- China

- /

- Semiconductors

- /

- SHSE:688409

Further Upside For Shenyang Fortune Precision Equipment Co., Ltd. (SHSE:688409) Shares Could Introduce Price Risks After 28% Bounce

Those holding Shenyang Fortune Precision Equipment Co., Ltd. (SHSE:688409) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 48% in the last twelve months.

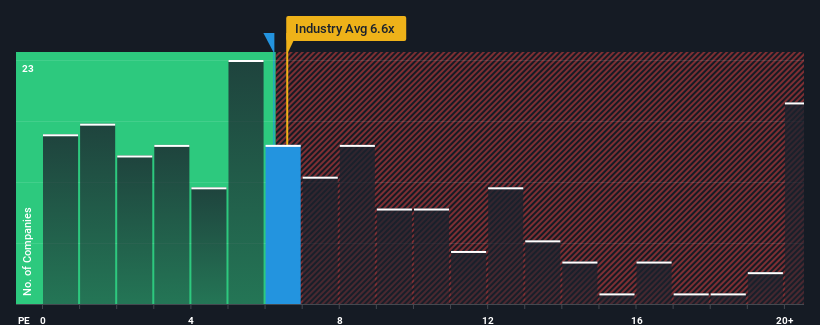

In spite of the firm bounce in price, there still wouldn't be many who think Shenyang Fortune Precision Equipment's price-to-sales (or "P/S") ratio of 6.2x is worth a mention when the median P/S in China's Semiconductor industry is similar at about 6.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Shenyang Fortune Precision Equipment

How Shenyang Fortune Precision Equipment Has Been Performing

Shenyang Fortune Precision Equipment certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shenyang Fortune Precision Equipment.What Are Revenue Growth Metrics Telling Us About The P/S?

Shenyang Fortune Precision Equipment's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 34%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 36% per annum as estimated by the five analysts watching the company. With the industry only predicted to deliver 31% per annum, the company is positioned for a stronger revenue result.

In light of this, it's curious that Shenyang Fortune Precision Equipment's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Shenyang Fortune Precision Equipment appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Shenyang Fortune Precision Equipment currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Plus, you should also learn about these 2 warning signs we've spotted with Shenyang Fortune Precision Equipment.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Shenyang Fortune Precision Equipment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688409

Shenyang Fortune Precision Equipment

Shenyang Fortune Precision Equipment Co., Ltd.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives