- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A089030

February 2025's Top Insider-Owned Growth Stocks

Reviewed by Simply Wall St

As global markets edge towards record highs, driven by strong performances in U.S. stock indexes and a cautious approach to interest rates amid rising inflation, investors are increasingly focused on growth stocks that demonstrate robust insider ownership. In this dynamic environment, companies with high insider stakes often signal confidence in their long-term potential, making them attractive considerations for those seeking to navigate the current economic landscape effectively.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 30.2% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

We'll examine a selection from our screener results.

Techwing (KOSDAQ:A089030)

Simply Wall St Growth Rating: ★★★★★★

Overview: Techwing, Inc. develops, manufactures, sells, and services semiconductor inspection equipment both in South Korea and internationally with a market cap of ₩1.56 trillion.

Operations: Techwing's revenue is primarily derived from the development, manufacturing, sales, and servicing of semiconductor inspection equipment in both domestic and international markets.

Insider Ownership: 18.8%

Earnings Growth Forecast: 64.3% p.a.

Techwing's earnings are expected to grow significantly at 64.3% annually, outpacing the KR market. Revenue growth is also strong, forecasted at 47.3% per year. Despite high volatility in its share price recently and debt not being well-covered by operating cash flow, Techwing's return on equity is projected to be very high at 43.4% in three years. Recent discussions focus on improving the Cube Prober business and exploring new ventures for future growth.

- Click here and access our complete growth analysis report to understand the dynamics of Techwing.

- Our valuation report here indicates Techwing may be overvalued.

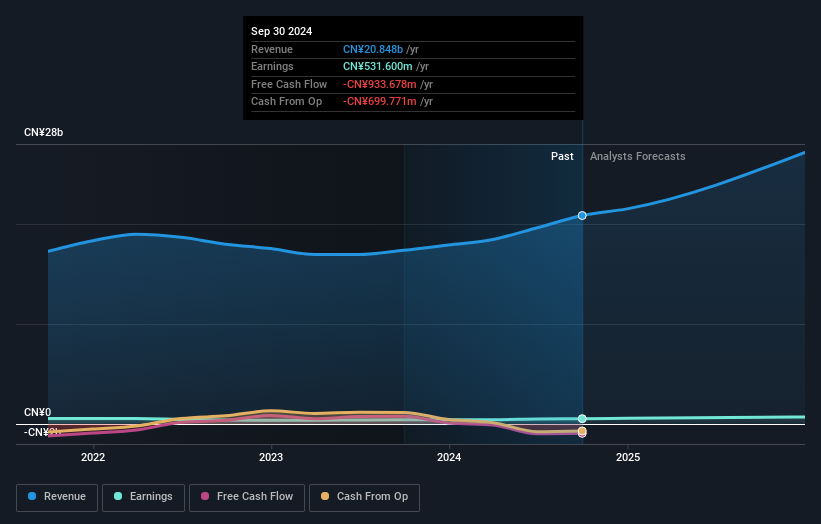

Tongling Jingda Special Magnet Wire (SHSE:600577)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tongling Jingda Special Magnet Wire Co., Ltd. operates in the manufacturing of special magnet wire products and has a market cap of CN¥15.21 billion.

Operations: Tongling Jingda generates its revenue primarily from the manufacturing of special magnet wire products.

Insider Ownership: 11.8%

Earnings Growth Forecast: 22.8% p.a.

Tongling Jingda Special Magnet Wire is poised for growth, with earnings forecasted to rise 22.8% annually, although this lags behind the CN market's 25.3%. Revenue growth is strong at 22.5%, surpassing the market average of 13.4%. Despite a volatile share price and debt not well-covered by operating cash flow, its P/E ratio of 29.3x suggests it is undervalued compared to the CN market's average of 37.9x.

- Click to explore a detailed breakdown of our findings in Tongling Jingda Special Magnet Wire's earnings growth report.

- In light of our recent valuation report, it seems possible that Tongling Jingda Special Magnet Wire is trading beyond its estimated value.

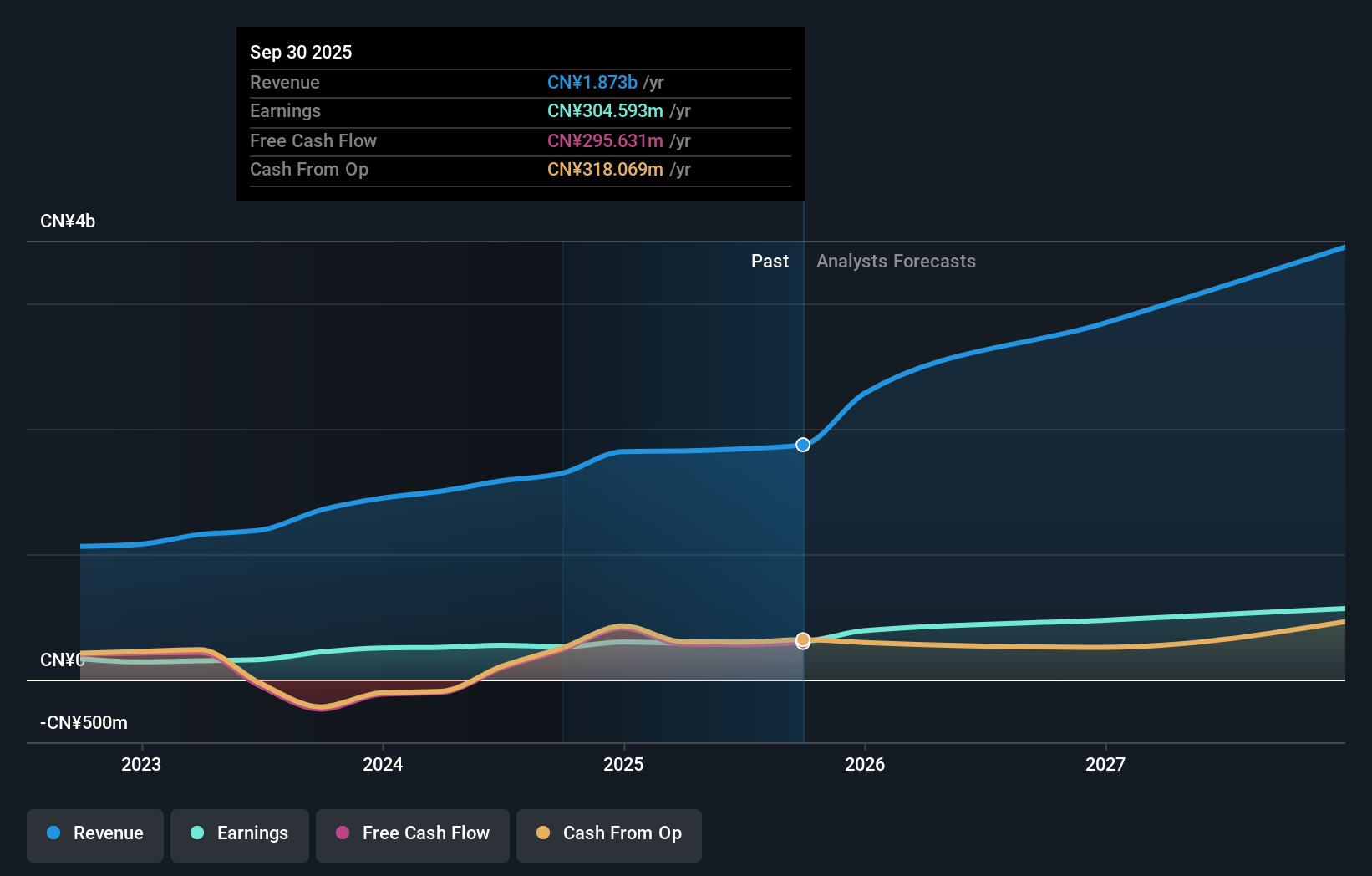

Shenzhen Bluetrum Technology (SHSE:688332)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Bluetrum Technology Co., Ltd. focuses on the research, development, design, and sale of wireless audio SOC chips in China and has a market cap of approximately CN¥14.71 billion.

Operations: Shenzhen Bluetrum Technology Co., Ltd. generates revenue primarily through its research, development, design, and sale of wireless audio SOC chips in China.

Insider Ownership: 26.3%

Earnings Growth Forecast: 25.8% p.a.

Shenzhen Bluetrum Technology is set for robust growth, with revenue anticipated to rise 24.2% annually, outpacing the CN market's 13.4%. Earnings are projected to grow significantly at 25.8% per year, exceeding market expectations. While the share price has been highly volatile recently and Return on Equity is forecasted low at 9.8%, its P/E ratio of 57.9x remains attractive compared to the industry average of 67.4x.

- Take a closer look at Shenzhen Bluetrum Technology's potential here in our earnings growth report.

- Our valuation report unveils the possibility Shenzhen Bluetrum Technology's shares may be trading at a premium.

Next Steps

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1457 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Techwing, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Techwing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A089030

Techwing

Develops, manufactures, sells, and services semiconductor inspection equipment in South Korea and internationally.

Exceptional growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives