- China

- /

- Semiconductors

- /

- SHSE:688303

Xinjiang Daqo New Energy Co.,Ltd.'s (SHSE:688303) Low P/S No Reason For Excitement

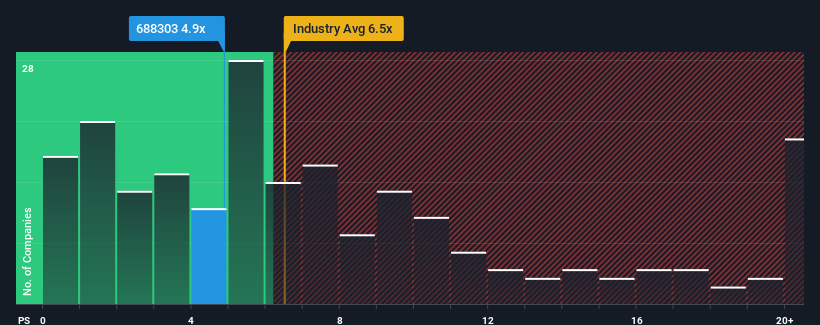

Xinjiang Daqo New Energy Co.,Ltd.'s (SHSE:688303) price-to-sales (or "P/S") ratio of 4.9x might make it look like a buy right now compared to the Semiconductor industry in China, where around half of the companies have P/S ratios above 6.5x and even P/S above 11x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Xinjiang Daqo New EnergyLtd

What Does Xinjiang Daqo New EnergyLtd's P/S Mean For Shareholders?

Xinjiang Daqo New EnergyLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Xinjiang Daqo New EnergyLtd.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Xinjiang Daqo New EnergyLtd's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 51%. This means it has also seen a slide in revenue over the longer-term as revenue is down 5.2% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 32% over the next year. With the industry predicted to deliver 54% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Xinjiang Daqo New EnergyLtd's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Xinjiang Daqo New EnergyLtd's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Xinjiang Daqo New EnergyLtd's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Xinjiang Daqo New EnergyLtd (1 is concerning!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688303

Xinjiang Daqo New EnergyLtd

Xinjiang Daquan New Energy Co., Ltd. engages in the research, development, production, and sale of polysilicon and silicon-based materials primarily for the photovoltaic and semiconductor industries.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives