- China

- /

- Semiconductors

- /

- SHSE:688262

C*Core Technology Co., Ltd. (SHSE:688262) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

C*Core Technology Co., Ltd. (SHSE:688262) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 44% in the last twelve months.

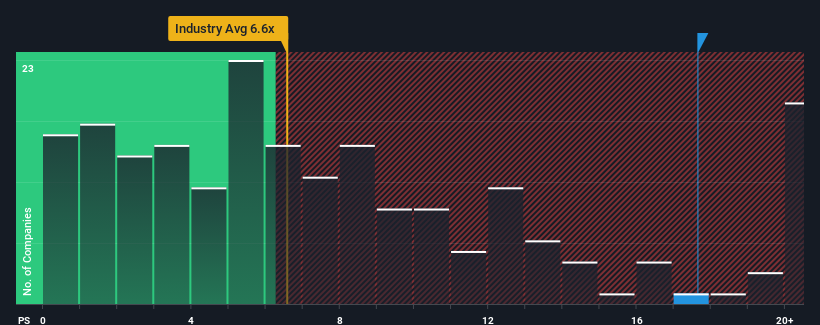

Following the firm bounce in price, C*Core Technology may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 17.6x, when you consider almost half of the companies in the Semiconductor industry in China have P/S ratios under 6.6x and even P/S lower than 3x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for C*Core Technology

What Does C*Core Technology's Recent Performance Look Like?

C*Core Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on C*Core Technology.What Are Revenue Growth Metrics Telling Us About The High P/S?

C*Core Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's top line. Still, the latest three year period has seen an excellent 65% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 150% as estimated by the one analyst watching the company. With the industry predicted to deliver 20,706% growth, the company is positioned for a weaker revenue result.

With this information, we find it concerning that C*Core Technology is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

The strong share price surge has lead to C*Core Technology's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've concluded that C*Core Technology currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware C*Core Technology is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on C*Core Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688262

C*Core Technology

A chip design company, offers IP authorization, chip customization, and independent chip and module products in China.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives