- China

- /

- Semiconductors

- /

- SHSE:688535

Top Insider-Owned Growth Stocks For October 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by escalating Middle East tensions and robust U.S. job gains, investors are keenly observing the interplay between geopolitical events and economic indicators. The recent surge in oil prices and unexpected employment growth have fueled both opportunities and uncertainties across various sectors, highlighting the importance of strategic investment choices. In this environment, companies with high insider ownership often stand out as potential growth leaders due to their alignment of interests between management and shareholders, making them noteworthy considerations for those seeking resilient investment options amidst market volatility.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's review some notable picks from our screened stocks.

Suzhou Oriental Semiconductor (SHSE:688261)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Oriental Semiconductor Company Limited is a semiconductor technology company operating in China with a market capitalization of approximately CN¥5.99 billion.

Operations: The company's revenue primarily comes from its Electric Equipment segment, which generated approximately CN¥859.31 million.

Insider Ownership: 33.4%

Earnings Growth Forecast: 54.3% p.a.

Suzhou Oriental Semiconductor shows potential as a growth company with high insider ownership, despite recent challenges. The company's revenue is forecast to grow 24.2% annually, outpacing the market's 13.2%. Earnings are expected to rise significantly at 54.3% per year, although current profit margins have dropped from 22.6% to 6.6%. Recent buybacks totaling CNY 26.02 million may indicate confidence in future prospects despite volatile share prices and lower returns on equity forecasts.

- Click to explore a detailed breakdown of our findings in Suzhou Oriental Semiconductor's earnings growth report.

- Upon reviewing our latest valuation report, Suzhou Oriental Semiconductor's share price might be too optimistic.

Jiangsu HHCK Advanced MaterialsLtd (SHSE:688535)

Simply Wall St Growth Rating: ★★★★★☆

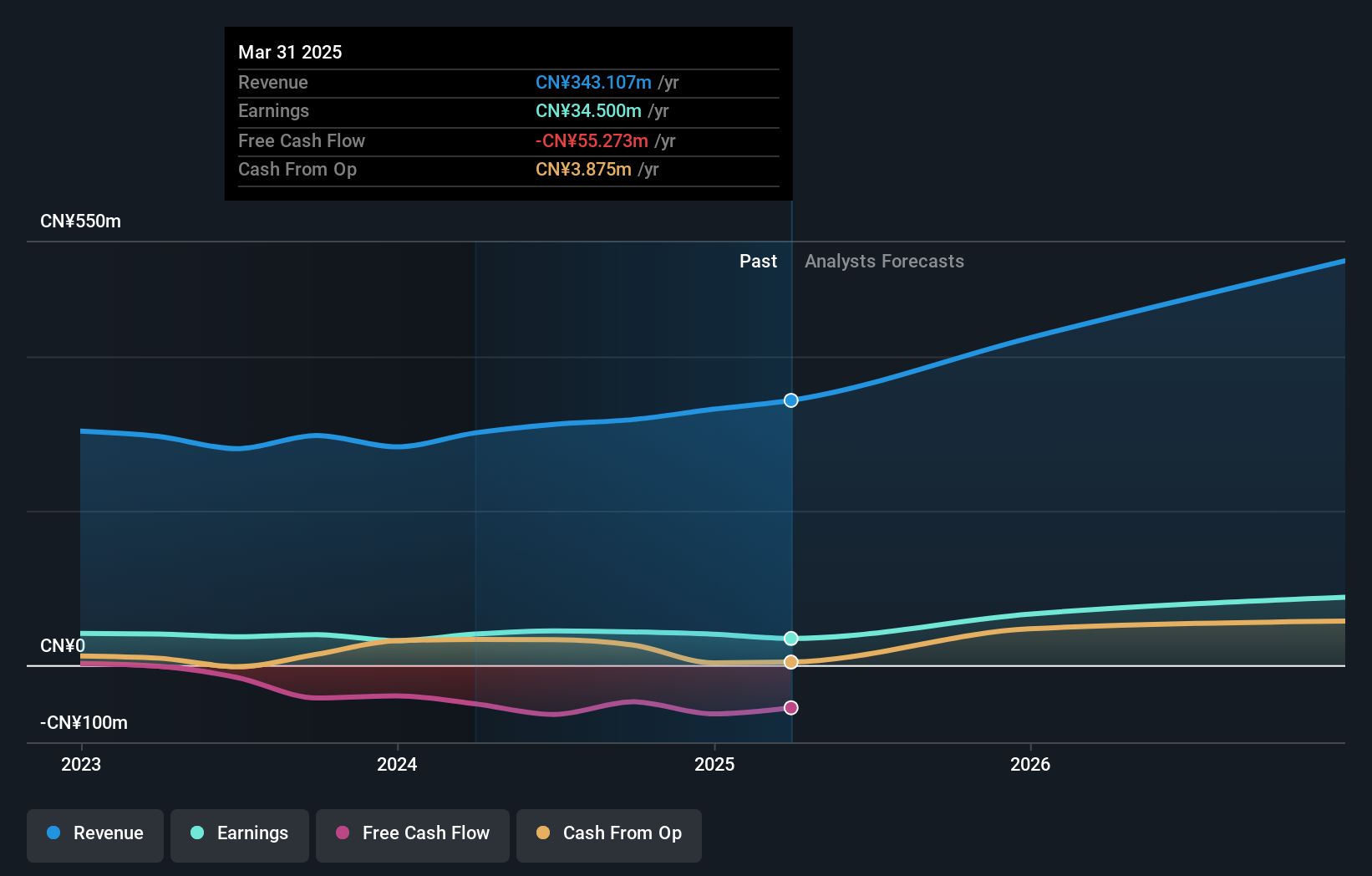

Overview: Jiangsu HHCK Advanced Materials Co., Ltd. focuses on the research, development, production, and sale of electronic packaging materials in China, with a market capitalization of approximately CN¥6.55 billion.

Operations: The company generates revenue primarily from its Specialty Chemicals segment, amounting to CN¥311.98 million.

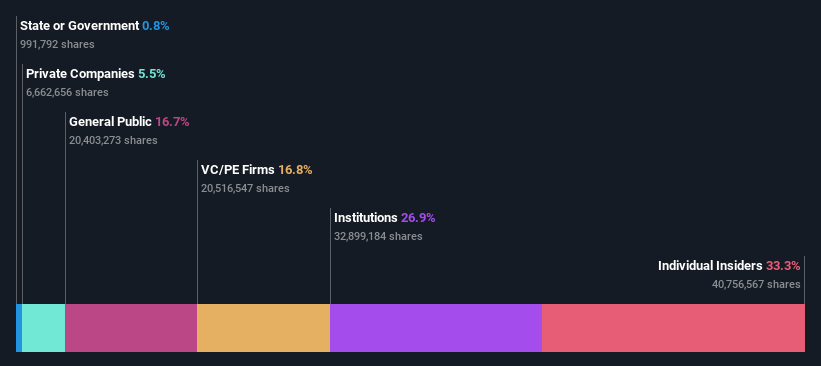

Insider Ownership: 34.4%

Earnings Growth Forecast: 28.1% p.a.

Jiangsu HHCK Advanced Materials has shown strong growth, with earnings rising 20.9% over the past year and revenue expected to grow at 21.1% annually, surpassing market averages. Despite a highly volatile share price recently, its inclusion in the S&P Global BMI Index highlights its increasing prominence. However, the company's return on equity is forecasted to remain low at 6.8%, and there has been no substantial insider trading activity in recent months.

- Click here and access our complete growth analysis report to understand the dynamics of Jiangsu HHCK Advanced MaterialsLtd.

- Our valuation report here indicates Jiangsu HHCK Advanced MaterialsLtd may be overvalued.

Chipsea Technologies (shenzhen) (SHSE:688595)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chipsea Technologies (shenzhen) Corp. is a chip design company specializing in ADCs, MCUs, measurement algorithms, and IoT solutions in China with a market cap of CN¥5.52 billion.

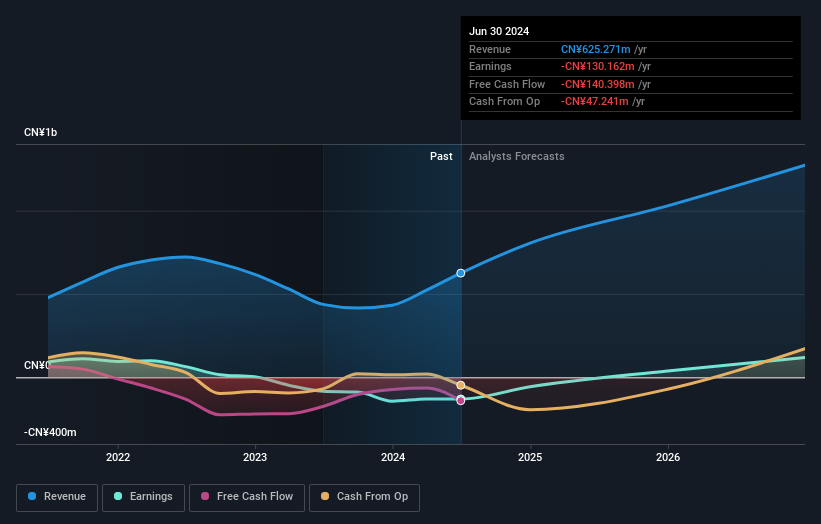

Operations: The company's revenue primarily comes from its Integrated Circuit segment, which generated CN¥625.27 million.

Insider Ownership: 28.4%

Earnings Growth Forecast: 113.5% p.a.

Chipsea Technologies (Shenzhen) has demonstrated significant revenue growth, with sales increasing to CNY 350.11 million for the half year ended June 30, 2024. Despite a net loss of CNY 56.82 million, the company is expected to achieve profitability within three years, outpacing average market growth rates. Revenue is forecasted to grow at an impressive rate of 27% annually, though its share price remains highly volatile and return on equity is projected to be modest at 7.9%.

- Unlock comprehensive insights into our analysis of Chipsea Technologies (shenzhen) stock in this growth report.

- The valuation report we've compiled suggests that Chipsea Technologies (shenzhen)'s current price could be inflated.

Seize The Opportunity

- Click this link to deep-dive into the 1477 companies within our Fast Growing Companies With High Insider Ownership screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688535

Jiangsu HHCK Advanced MaterialsLtd

Engages in the research, development, production, and sale of electronic packaging materials in China.

Flawless balance sheet with high growth potential.