- China

- /

- Semiconductors

- /

- SHSE:688261

Investors Still Aren't Entirely Convinced By Suzhou Oriental Semiconductor Company Limited's (SHSE:688261) Revenues Despite 30% Price Jump

Suzhou Oriental Semiconductor Company Limited (SHSE:688261) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 42% over that time.

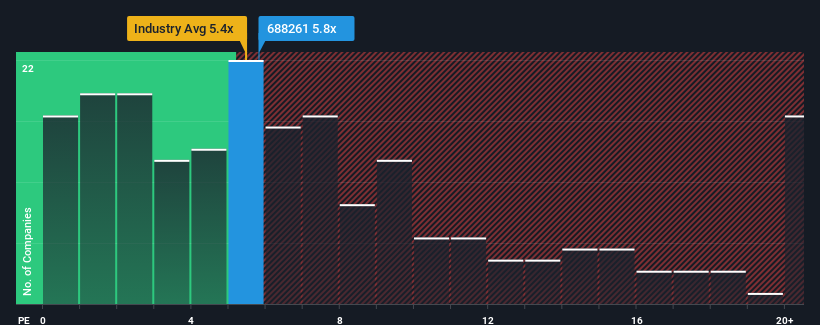

Although its price has surged higher, there still wouldn't be many who think Suzhou Oriental Semiconductor's price-to-sales (or "P/S") ratio of 5.8x is worth a mention when the median P/S in China's Semiconductor industry is similar at about 5.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Suzhou Oriental Semiconductor

What Does Suzhou Oriental Semiconductor's Recent Performance Look Like?

Suzhou Oriental Semiconductor hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Suzhou Oriental Semiconductor will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Suzhou Oriental Semiconductor's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 27%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 28% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 41% during the coming year according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 36%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Suzhou Oriental Semiconductor's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Suzhou Oriental Semiconductor's P/S

Its shares have lifted substantially and now Suzhou Oriental Semiconductor's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Suzhou Oriental Semiconductor currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 3 warning signs we've spotted with Suzhou Oriental Semiconductor (including 1 which makes us a bit uncomfortable).

If these risks are making you reconsider your opinion on Suzhou Oriental Semiconductor, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688261

Suzhou Oriental Semiconductor

Operates as a semiconductor technology company in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives