- China

- /

- Semiconductors

- /

- SHSE:688261

Chinese Stocks Estimated To Be Trading Below Intrinsic Value In October 2024

Reviewed by Simply Wall St

In recent weeks, Chinese stocks have experienced a notable surge, buoyed by optimism surrounding Beijing's comprehensive support measures despite ongoing economic challenges. As the market navigates these complexities, identifying stocks trading below their intrinsic value can offer investors potential opportunities for growth and resilience in an uncertain environment.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen Lifotronic Technology (SHSE:688389) | CN¥16.39 | CN¥31.80 | 48.5% |

| JinGuan Electric (SHSE:688517) | CN¥15.20 | CN¥29.05 | 47.7% |

| YanKer shop FoodLtd (SZSE:002847) | CN¥51.30 | CN¥97.23 | 47.2% |

| Arctech Solar Holding (SHSE:688408) | CN¥82.27 | CN¥158.75 | 48.2% |

| Zhejiang Huahai Pharmaceutical (SHSE:600521) | CN¥19.20 | CN¥37.02 | 48.1% |

| Beijing Konruns PharmaceuticalLtd (SHSE:603590) | CN¥24.38 | CN¥46.03 | 47% |

| Topsec Technologies Group (SZSE:002212) | CN¥6.21 | CN¥12.13 | 48.8% |

| Seres GroupLtd (SHSE:601127) | CN¥89.02 | CN¥169.60 | 47.5% |

| Brilliance Technology (SZSE:300542) | CN¥21.25 | CN¥40.60 | 47.7% |

| Ningbo Jifeng Auto Parts (SHSE:603997) | CN¥13.70 | CN¥25.95 | 47.2% |

Let's take a closer look at a couple of our picks from the screened companies.

Suzhou Oriental Semiconductor (SHSE:688261)

Overview: Suzhou Oriental Semiconductor Company Limited is a semiconductor technology company operating in China with a market capitalization of CN¥6.67 billion.

Operations: The company generates revenue primarily from its Electric Equipment segment, amounting to CN¥859.31 million.

Estimated Discount To Fair Value: 10.1%

Suzhou Oriental Semiconductor's recent buyback completion and forecasted revenue growth of 24.2% annually highlight its potential despite a drop in net income to CNY 16.94 million for the half-year ending June 2024. Trading at CN¥54.6, it is approximately 10% below its estimated fair value of CN¥60.74, although profit margins have decreased significantly from last year. Earnings are expected to grow substantially, outpacing the broader Chinese market growth rates.

- In light of our recent growth report, it seems possible that Suzhou Oriental Semiconductor's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Suzhou Oriental Semiconductor.

M-Grass Ecology And Environment (Group) (SZSE:300355)

Overview: M-Grass Ecology And Environment (Group) Co., Ltd. operates in the ecological restoration and environmental protection sector, with a market cap of CN¥7.30 billion.

Operations: Unfortunately, the revenue segment data for M-Grass Ecology And Environment (Group) Co., Ltd. is not provided in the text you shared. If you can provide specific details about their revenue segments, I would be happy to help summarize them for you.

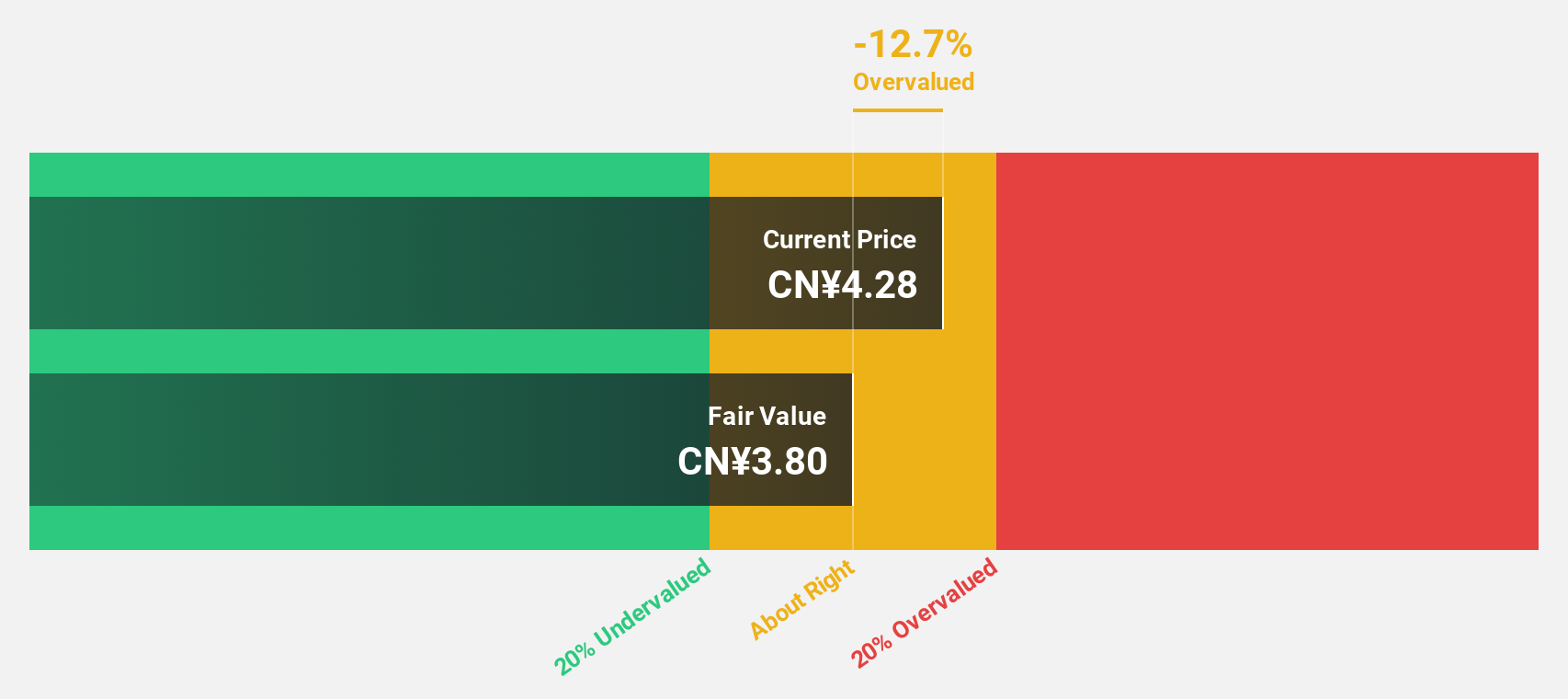

Estimated Discount To Fair Value: 12.4%

M-Grass Ecology And Environment (Group) shows potential as an undervalued stock based on its cash flows, trading at CN¥4.55, slightly below the estimated fair value of CN¥5.19. Despite a volatile share price and declining profit margins from 7.2% to 2.3%, earnings are expected to grow significantly at 95.42% annually, outpacing market averages. Recent half-year results show decreased revenue (CN¥689.52 million) and net income (CN¥25.28 million), reflecting current financial challenges.

- Our earnings growth report unveils the potential for significant increases in M-Grass Ecology And Environment (Group)'s future results.

- Take a closer look at M-Grass Ecology And Environment (Group)'s balance sheet health here in our report.

Jiangsu Gian Technology (SZSE:300709)

Overview: Jiangsu Gian Technology Co., Ltd. manufactures and sells metal injection molding products both in China and internationally, with a market cap of CN¥8.79 billion.

Operations: The company's revenue is primarily derived from its MIM Products and Other Divisions at CN¥2.02 billion, followed by the Precision Plastic Products Division at CN¥260.68 million, and the End Products Division at CN¥77.85 million.

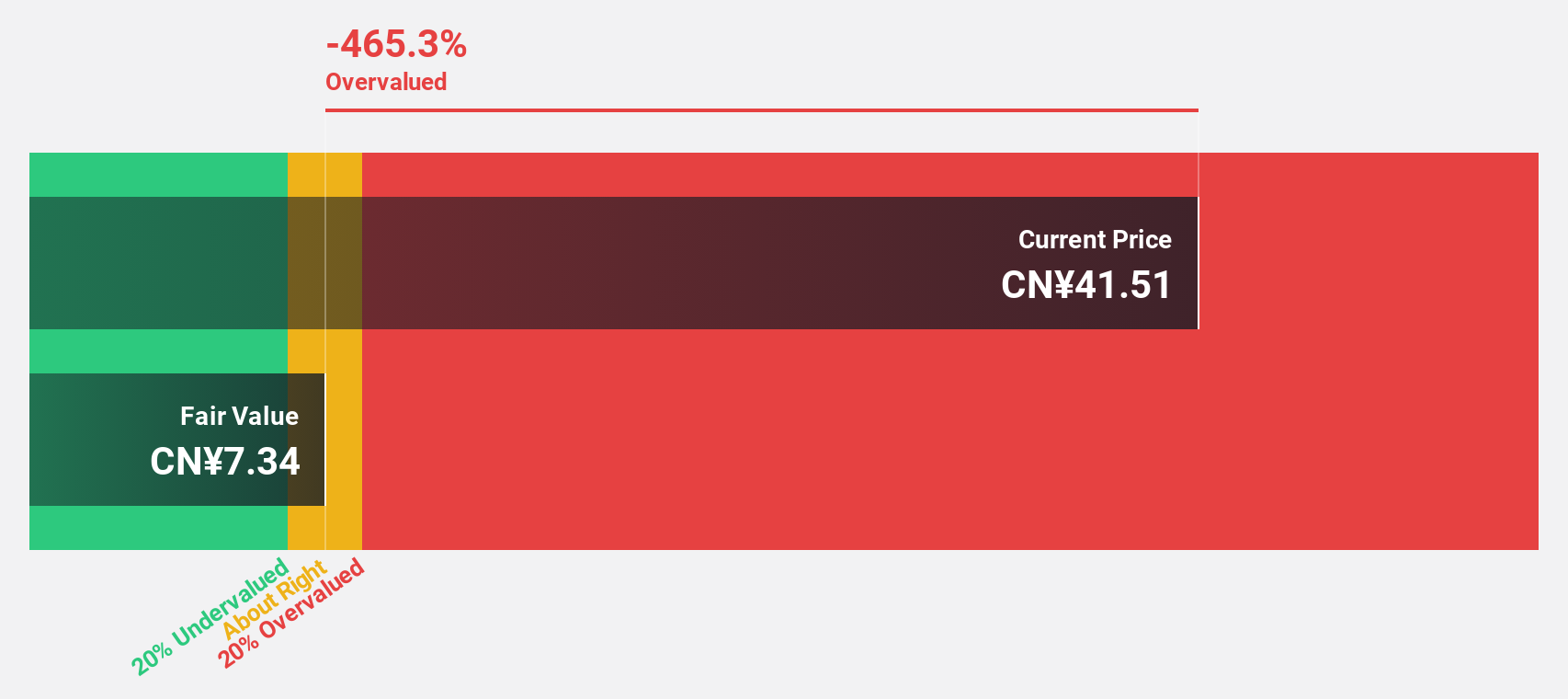

Estimated Discount To Fair Value: 14.8%

Jiangsu Gian Technology appears undervalued based on cash flows, trading at CN¥47.25, below the estimated fair value of CN¥55.48. Recent earnings show a turnaround with net income of CNY 59.21 million compared to a loss last year and revenue growth outpacing market expectations at 25.3% annually. However, the share price remains volatile and return on equity is projected to be low at 13.4% in three years, suggesting some caution is warranted.

- Our comprehensive growth report raises the possibility that Jiangsu Gian Technology is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Jiangsu Gian Technology stock in this financial health report.

Taking Advantage

- Navigate through the entire inventory of 110 Undervalued Chinese Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688261

Suzhou Oriental Semiconductor

Operates as a semiconductor technology company in China.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives