- China

- /

- Semiconductors

- /

- SHSE:688216

Little Excitement Around China Chippacking Technology Co.,Ltd.'s (SHSE:688216) Revenues As Shares Take 25% Pounding

China Chippacking Technology Co.,Ltd. (SHSE:688216) shares have had a horrible month, losing 25% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 25% in that time.

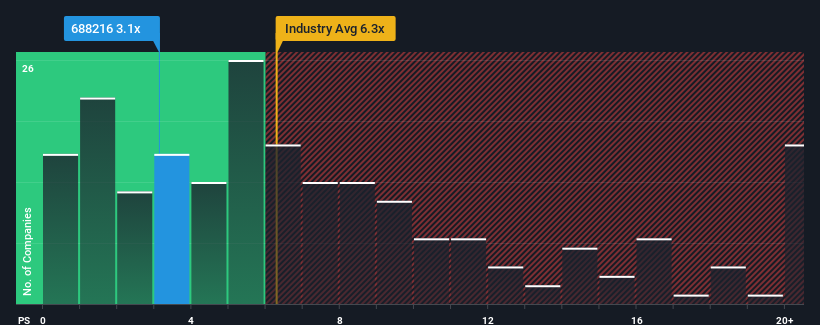

Since its price has dipped substantially, China Chippacking TechnologyLtd's price-to-sales (or "P/S") ratio of 3.1x might make it look like a strong buy right now compared to the wider Semiconductor industry in China, where around half of the companies have P/S ratios above 6.3x and even P/S above 11x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for China Chippacking TechnologyLtd

How China Chippacking TechnologyLtd Has Been Performing

There hasn't been much to differentiate China Chippacking TechnologyLtd's and the industry's revenue growth lately. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on China Chippacking TechnologyLtd will help you uncover what's on the horizon.How Is China Chippacking TechnologyLtd's Revenue Growth Trending?

China Chippacking TechnologyLtd's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. Still, revenue has fallen 15% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 8.8% during the coming year according to the sole analyst following the company. With the industry predicted to deliver 51% growth, the company is positioned for a weaker revenue result.

With this information, we can see why China Chippacking TechnologyLtd is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Shares in China Chippacking TechnologyLtd have plummeted and its P/S has followed suit. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of China Chippacking TechnologyLtd's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 2 warning signs we've spotted with China Chippacking TechnologyLtd (including 1 which is a bit concerning).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688216

China Chippacking TechnologyLtd

Engages in the integrated circuit packaging and testing business in China.

Low risk and slightly overvalued.

Market Insights

Community Narratives