- China

- /

- Semiconductors

- /

- SHSE:688216

China Chippacking Technology Co.,Ltd.'s (SHSE:688216) Shares Bounce 37% But Its Business Still Trails The Industry

Those holding China Chippacking Technology Co.,Ltd. (SHSE:688216) shares would be relieved that the share price has rebounded 37% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 45% in the last twelve months.

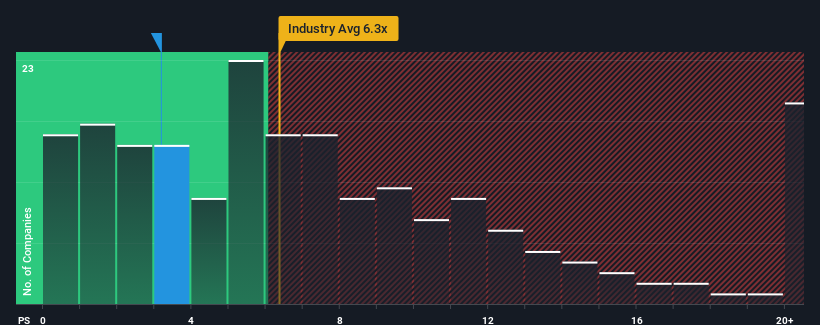

In spite of the firm bounce in price, China Chippacking TechnologyLtd's price-to-sales (or "P/S") ratio of 3.2x might still make it look like a buy right now compared to the Semiconductor industry in China, where around half of the companies have P/S ratios above 6.3x and even P/S above 11x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for China Chippacking TechnologyLtd

What Does China Chippacking TechnologyLtd's P/S Mean For Shareholders?

Recent times haven't been great for China Chippacking TechnologyLtd as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on China Chippacking TechnologyLtd.Is There Any Revenue Growth Forecasted For China Chippacking TechnologyLtd?

The only time you'd be truly comfortable seeing a P/S as low as China Chippacking TechnologyLtd's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 2.6% gain to the company's revenues. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 29% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 37%, which is noticeably more attractive.

With this information, we can see why China Chippacking TechnologyLtd is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From China Chippacking TechnologyLtd's P/S?

China Chippacking TechnologyLtd's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of China Chippacking TechnologyLtd's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for China Chippacking TechnologyLtd you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688216

China Chippacking TechnologyLtd

Engages in the integrated circuit packaging and testing business in China.

Low risk and slightly overvalued.

Market Insights

Community Narratives