- China

- /

- Semiconductors

- /

- SHSE:688216

China Chippacking Technology Co.,Ltd. (SHSE:688216) Held Back By Insufficient Growth Even After Shares Climb 54%

China Chippacking Technology Co.,Ltd. (SHSE:688216) shares have had a really impressive month, gaining 54% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 6.0% in the last twelve months.

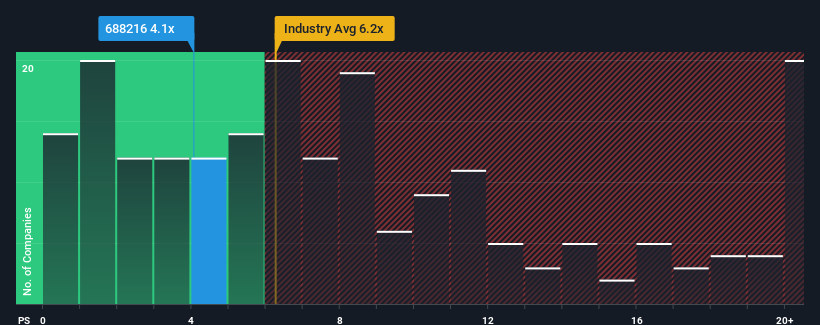

In spite of the firm bounce in price, China Chippacking TechnologyLtd may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 4.1x, since almost half of all companies in the Semiconductor industry in China have P/S ratios greater than 6.2x and even P/S higher than 11x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for China Chippacking TechnologyLtd

How Has China Chippacking TechnologyLtd Performed Recently?

With revenue growth that's superior to most other companies of late, China Chippacking TechnologyLtd has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think China Chippacking TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

China Chippacking TechnologyLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 11% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 8.1% during the coming year according to the sole analyst following the company. That's shaping up to be materially lower than the 36% growth forecast for the broader industry.

In light of this, it's understandable that China Chippacking TechnologyLtd's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On China Chippacking TechnologyLtd's P/S

The latest share price surge wasn't enough to lift China Chippacking TechnologyLtd's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that China Chippacking TechnologyLtd maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Having said that, be aware China Chippacking TechnologyLtd is showing 2 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of China Chippacking TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688216

China Chippacking TechnologyLtd

Engages in the integrated circuit packaging and testing business in China.

Low risk and slightly overvalued.

Market Insights

Community Narratives