- China

- /

- Communications

- /

- SZSE:300638

Global's Top Growth Companies With High Insider Ownership In November 2025

Reviewed by Simply Wall St

As global markets grapple with AI-related concerns and fluctuating economic indicators, investors are increasingly scrutinizing stock valuations and the potential returns on technological investments. Amidst this backdrop, growth companies with high insider ownership can offer a unique appeal; such alignment between management and shareholder interests often suggests confidence in the company's long-term prospects.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 32.6% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 109.1% |

| CD Projekt (WSE:CDR) | 29.7% | 50.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

BrightGene Bio-Medical Technology (SHSE:688166)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BrightGene Bio-Medical Technology Co., Ltd. is involved in the research, development, production, and sale of pharmaceutical products both in China and internationally, with a market cap of CN¥22.49 billion.

Operations: BrightGene Bio-Medical Technology Co., Ltd. generates revenue through its activities in the research, development, production, and sale of pharmaceutical products across domestic and international markets.

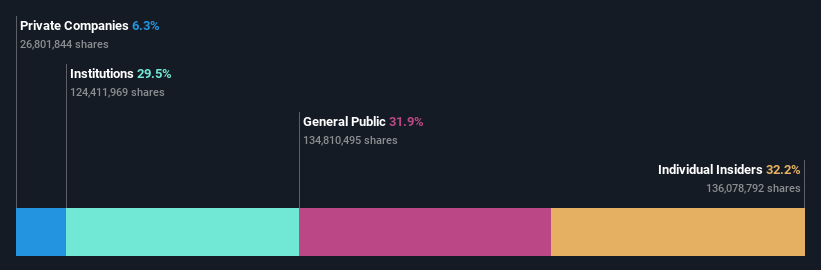

Insider Ownership: 32.2%

Revenue Growth Forecast: 18.3% p.a.

BrightGene Bio-Medical Technology demonstrates potential as a growth company with high insider ownership, despite recent challenges. The company reported declining sales and net income for the first nine months of 2025, with net income dropping to CNY 50.32 million from CNY 177.41 million year-on-year. However, earnings are forecast to grow significantly at 43.62% annually, outpacing the Chinese market's average growth rate of 27.6%. A share buyback program worth up to CNY 20 million highlights management's confidence in its future prospects amidst volatile share prices and current financial pressures.

- Take a closer look at BrightGene Bio-Medical Technology's potential here in our earnings growth report.

- Our expertly prepared valuation report BrightGene Bio-Medical Technology implies its share price may be too high.

Primarius Technologies (SHSE:688206)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Primarius Technologies Co., Ltd. researches, designs, and develops electronic design automation (EDA) tools in China and internationally, with a market cap of CN¥14.66 billion.

Operations: The company generates revenue primarily from its EDA Solutions segment, amounting to CN¥454.55 million.

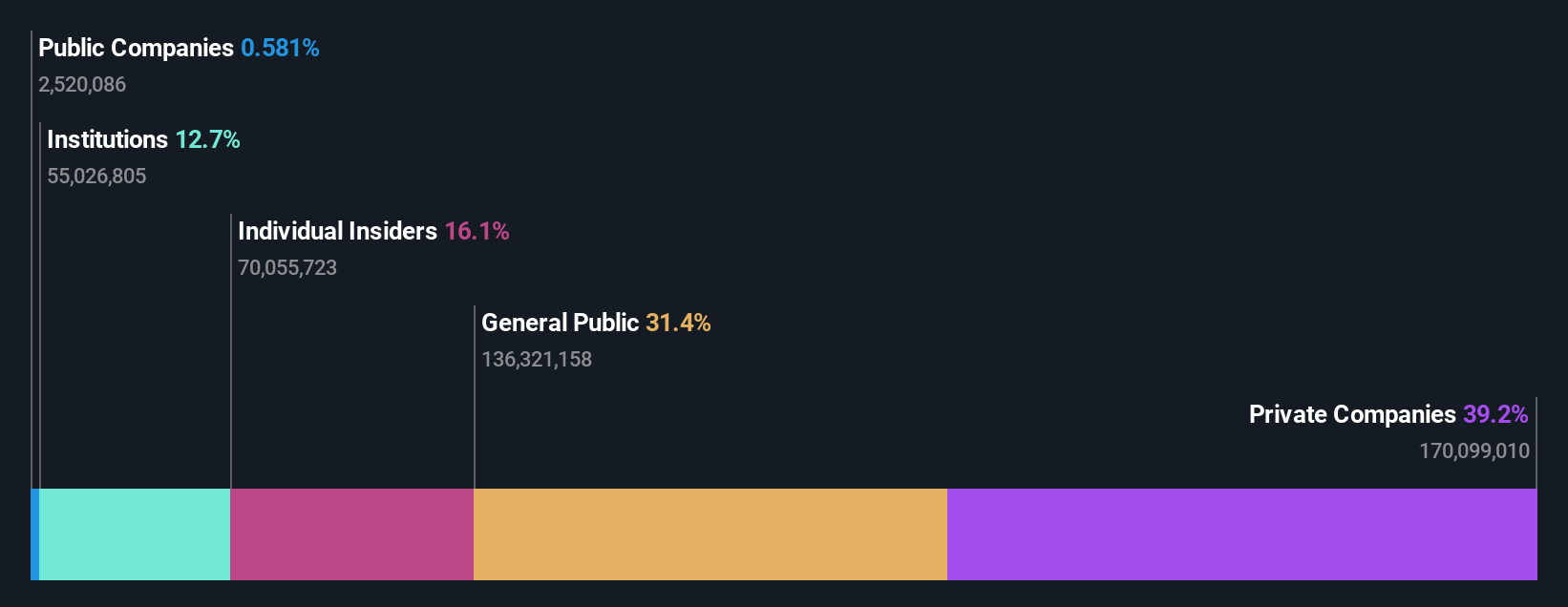

Insider Ownership: 16.1%

Revenue Growth Forecast: 22.8% p.a.

Primarius Technologies is experiencing rapid growth, with revenue expected to increase by 22.8% annually, surpassing the Chinese market's average. The company recently turned profitable, reporting a net income of CNY 41.99 million for the first nine months of 2025 compared to a loss last year. Despite high share price volatility and low forecasted return on equity (2.8%), its earnings are projected to grow significantly at over 121% per year, indicating strong potential amidst substantial insider ownership changes.

- Click here to discover the nuances of Primarius Technologies with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Primarius Technologies shares in the market.

Fibocom Wireless (SZSE:300638)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fibocom Wireless Inc. designs, develops, and sells wireless communication modules and solutions both in China and internationally, with a market cap of CN¥22.10 billion.

Operations: The company's revenue is primarily derived from the sale of wireless communication modules and solutions in both domestic and international markets.

Insider Ownership: 34.1%

Revenue Growth Forecast: 21.1% p.a.

Fibocom Wireless is positioned for significant growth, with revenue forecasted to expand by 21.1% annually, outpacing the broader Chinese market. Despite a decline in profit margins from 9.5% to 4.5%, earnings are expected to grow substantially at 39.6% per year over the next three years. Recent product innovations, such as AI Dongles and enhanced connectivity solutions showcased at Mobile World Congress Doha, highlight Fibocom's commitment to advancing intelligent connectivity across industries amidst high insider ownership levels.

- Unlock comprehensive insights into our analysis of Fibocom Wireless stock in this growth report.

- Upon reviewing our latest valuation report, Fibocom Wireless' share price might be too optimistic.

Seize The Opportunity

- Unlock our comprehensive list of 853 Fast Growing Global Companies With High Insider Ownership by clicking here.

- Contemplating Other Strategies? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300638

Fibocom Wireless

Designs, develops, and sells wireless communication modules and communication solutions in China and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success