- China

- /

- Semiconductors

- /

- SHSE:688153

Improved Revenues Required Before Vanchip (Tianjin) Technology Co., Ltd. (SHSE:688153) Stock's 26% Jump Looks Justified

Those holding Vanchip (Tianjin) Technology Co., Ltd. (SHSE:688153) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 36% in the last twelve months.

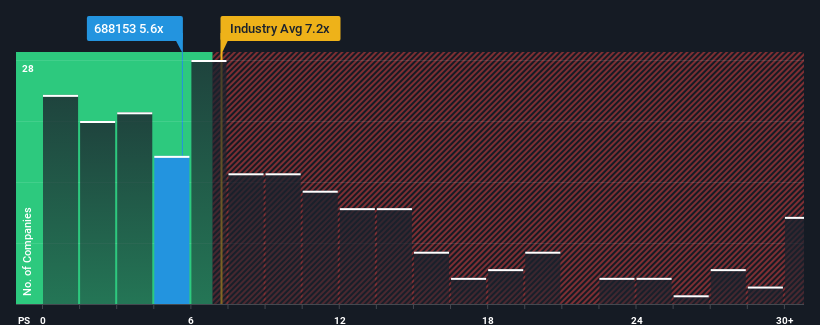

In spite of the firm bounce in price, Vanchip (Tianjin) Technology's price-to-sales (or "P/S") ratio of 5.6x might still make it look like a buy right now compared to the Semiconductor industry in China, where around half of the companies have P/S ratios above 7.2x and even P/S above 13x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Vanchip (Tianjin) Technology

How Has Vanchip (Tianjin) Technology Performed Recently?

Recent times have been advantageous for Vanchip (Tianjin) Technology as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Vanchip (Tianjin) Technology.How Is Vanchip (Tianjin) Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Vanchip (Tianjin) Technology would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 35%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 18% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 24% as estimated by the dual analysts watching the company. That's shaping up to be materially lower than the 49% growth forecast for the broader industry.

With this in consideration, its clear as to why Vanchip (Tianjin) Technology's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Vanchip (Tianjin) Technology's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Vanchip (Tianjin) Technology's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Vanchip (Tianjin) Technology, and understanding should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688153

Vanchip (Tianjin) Technology

Designs, manufactures, and sells radio frequency front end and high end analog chips in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives