- China

- /

- Semiconductors

- /

- SHSE:688141

JoulWatt Technology Co., Ltd. (SHSE:688141) Stock Rockets 32% But Many Are Still Ignoring The Company

Those holding JoulWatt Technology Co., Ltd. (SHSE:688141) shares would be relieved that the share price has rebounded 32% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 57% share price drop in the last twelve months.

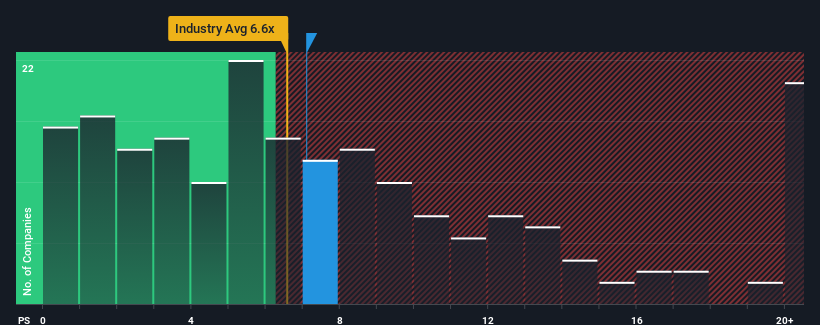

In spite of the firm bounce in price, there still wouldn't be many who think JoulWatt Technology's price-to-sales (or "P/S") ratio of 7.1x is worth a mention when the median P/S in China's Semiconductor industry is similar at about 6.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for JoulWatt Technology

What Does JoulWatt Technology's Recent Performance Look Like?

JoulWatt Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on JoulWatt Technology will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like JoulWatt Technology's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 8.0% decrease to the company's top line. Still, the latest three year period has seen an excellent 227% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 43% per year as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 31% per year, which is noticeably less attractive.

With this information, we find it interesting that JoulWatt Technology is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From JoulWatt Technology's P/S?

Its shares have lifted substantially and now JoulWatt Technology's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, JoulWatt Technology's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for JoulWatt Technology that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688141

JoulWatt Technology

An analog integrated circuit design company, engages in the research and development, and sale of integrated circuits in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives