- China

- /

- Semiconductors

- /

- SHSE:688123

Undiscovered Gems with Promising Potential for January 2025

Reviewed by Simply Wall St

As we enter 2025, global markets are navigating a complex landscape marked by mixed performances in major indices and shifting economic indicators. With the S&P 500 closing out a strong two-year stretch despite recent volatility and small-cap indices like the Russell 2000 showing resilience, investors are increasingly looking towards undiscovered gems that may offer promising potential amidst these dynamic conditions. Identifying such stocks often involves seeking companies with robust fundamentals and growth prospects that can weather economic fluctuations and capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Bailong Chuangyuan Bio-Tech Co., Ltd. operates in the biotechnology sector and has a market capitalization of CN¥5.83 billion.

Operations: The company generates revenue primarily from its biotechnology operations, with a focus on specific product lines that contribute significantly to its financial performance. The net profit margin has shown variations over recent periods, reflecting changes in cost management and operational efficiency.

Earnings for Shandong Bailong Chuangyuan Bio-Tech surged by 34.5% over the past year, outpacing the broader food industry, which saw a -5.8% change. The company is trading at a good value, estimated to be 45.6% below its fair market value. With more cash than total debt and a reduced debt-to-equity ratio from 9.5% to 4.3% over five years, financial stability seems robust despite negative free cash flow trends recently observed in levered free cash flow figures like CNY -65 million as of September 2024. Future earnings are projected to grow annually by about 30%, suggesting potential upside ahead.

Giantec Semiconductor (SHSE:688123)

Simply Wall St Value Rating: ★★★★★★

Overview: Giantec Semiconductor Corporation is engaged in the manufacturing and sale of integrated circuits both in China and internationally, with a market capitalization of CN¥10.45 billion.

Operations: The company generates revenue primarily from the integrated circuit design industry, amounting to CN¥970.87 million. The focus on this segment indicates a specialized revenue stream within the semiconductor market.

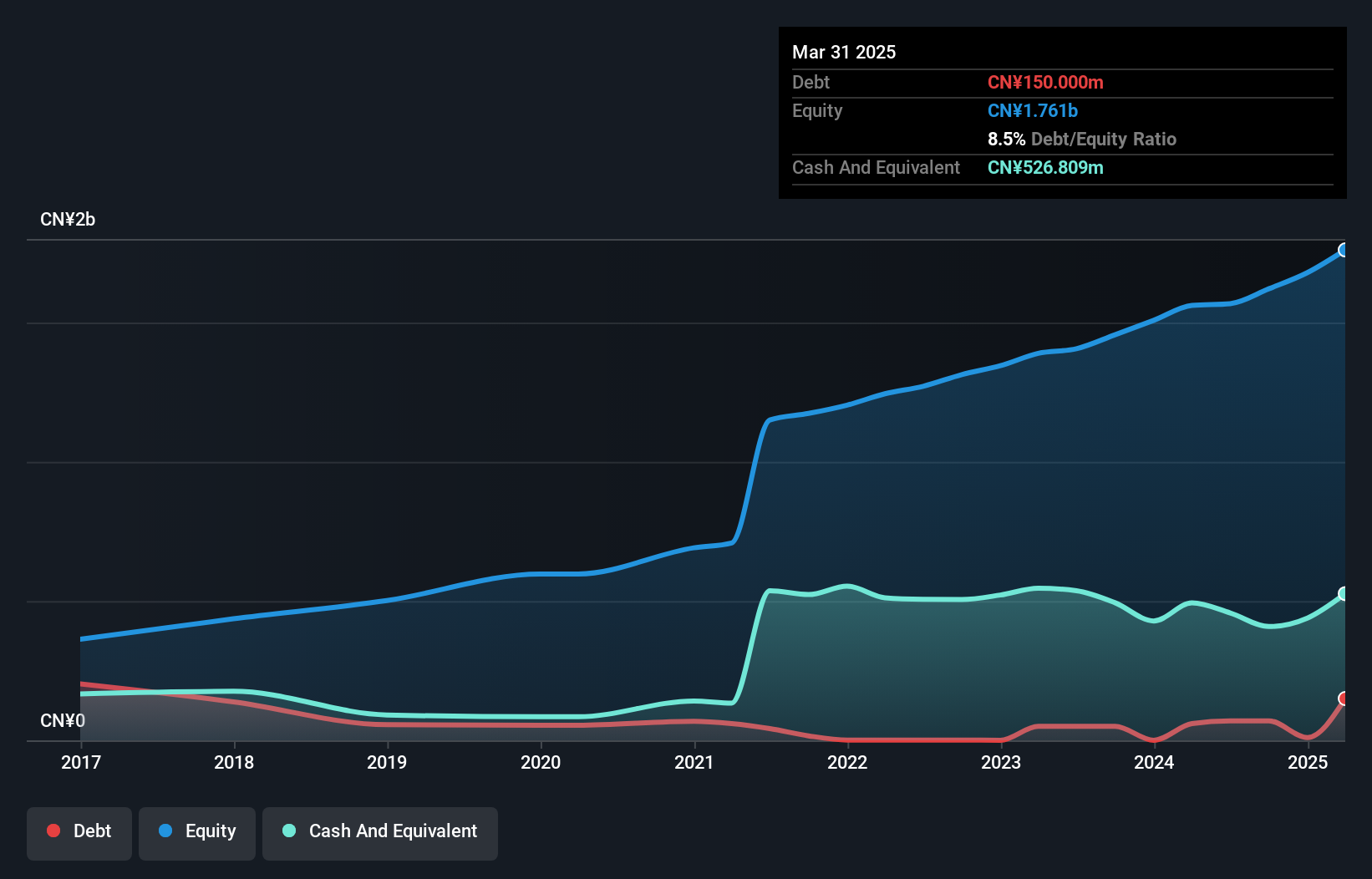

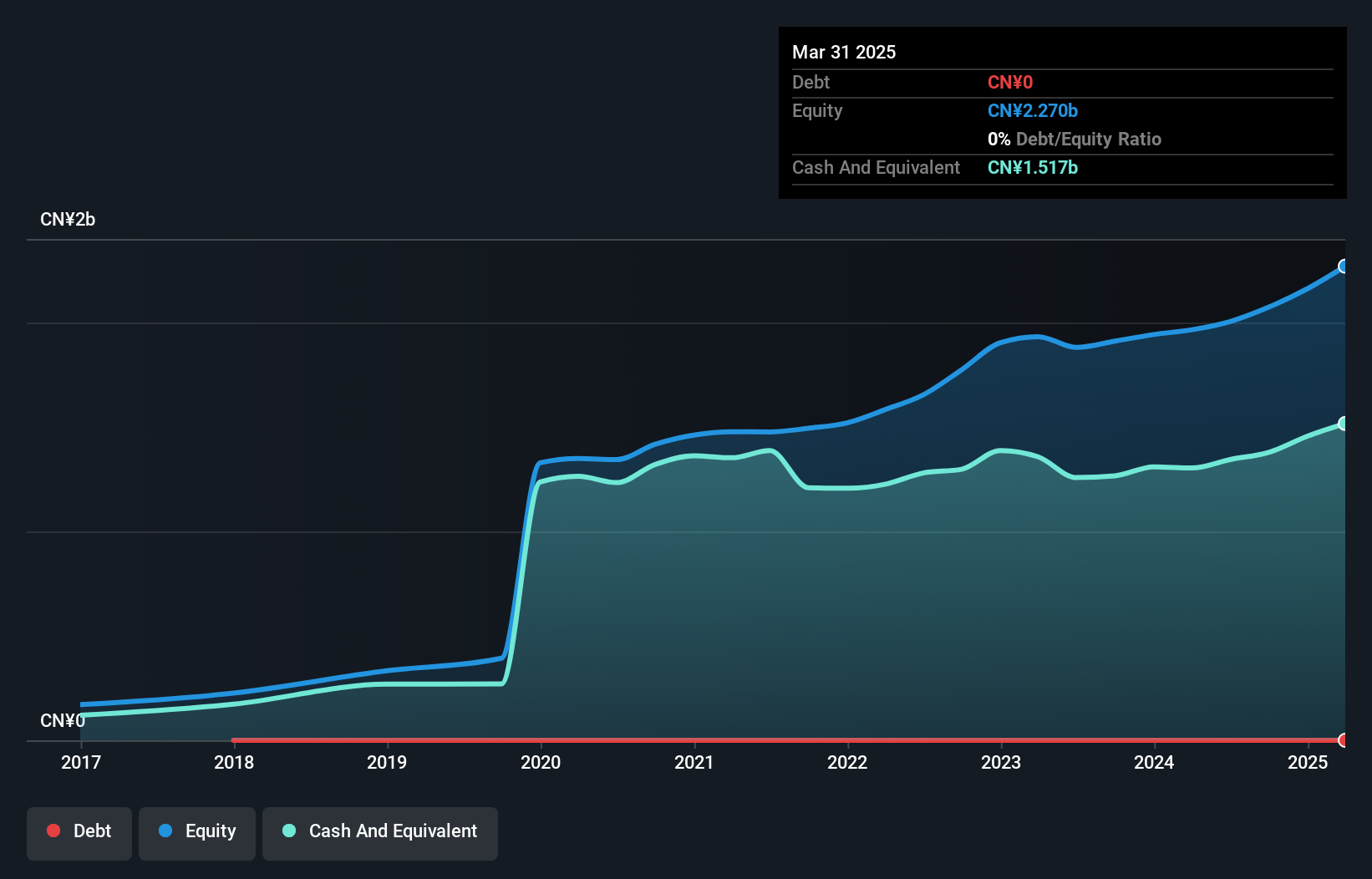

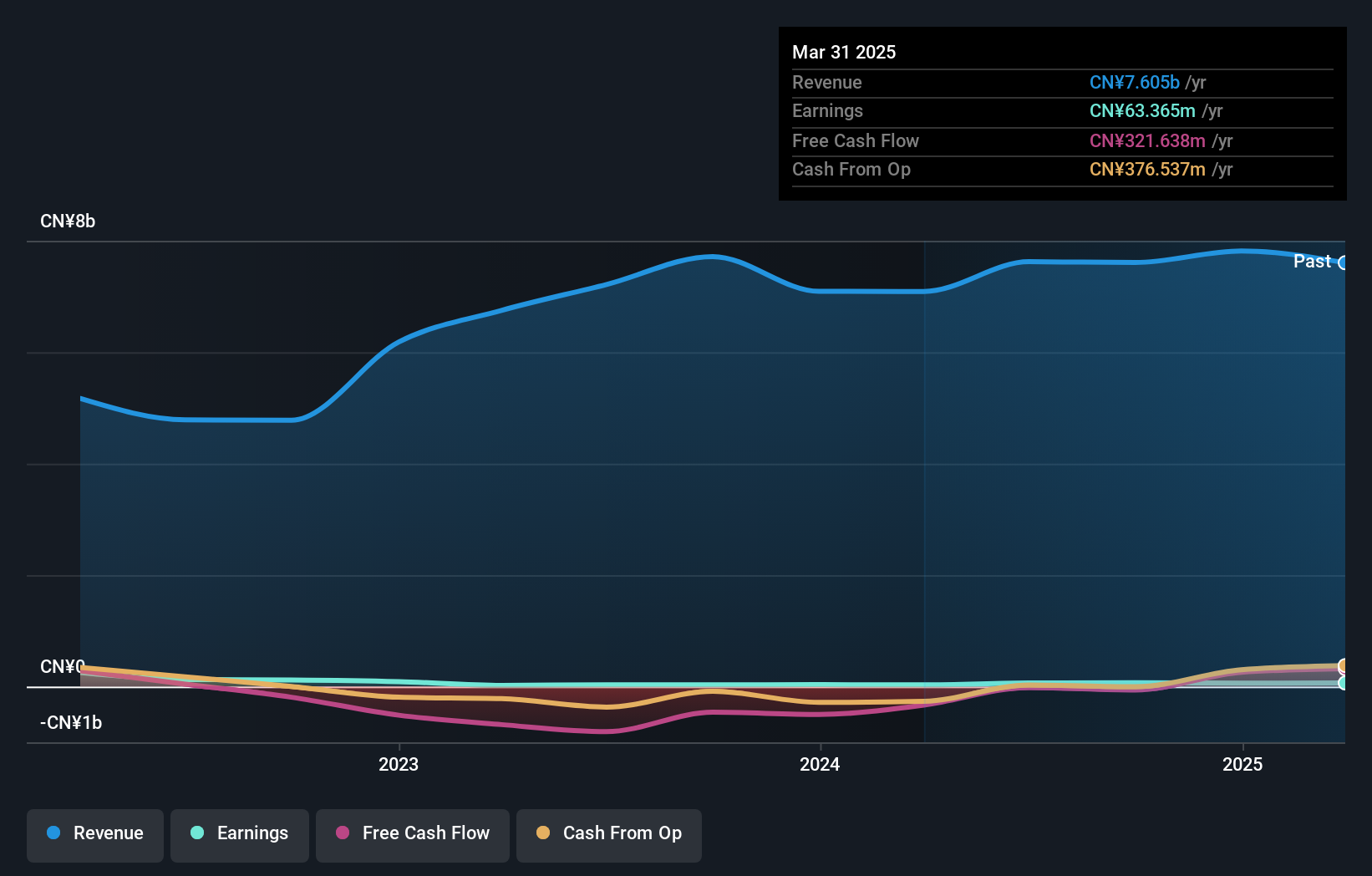

Giantec Semiconductor, a nimble player in the semiconductor space, boasts a Price-To-Earnings ratio of 45.6x, which is comfortably below the industry average of 60.4x. The company's earnings growth over the past year hit an impressive 29%, outpacing the industry's 12.9%. With no debt on its books for five years, Giantec's financial health seems robust and interest coverage isn't a concern. Recent results show sales climbing to CNY 769.08 million from CNY 501.69 million last year, while net income soared to CNY 211.36 million from CNY 82.42 million, showcasing strong operational performance and potential for future growth in this competitive sector.

- Unlock comprehensive insights into our analysis of Giantec Semiconductor stock in this health report.

Evaluate Giantec Semiconductor's historical performance by accessing our past performance report.

Xilong Scientific (SZSE:002584)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xilong Scientific Co., Ltd. is engaged in the research, development, manufacturing, and sale of chemical reagents in China with a market cap of CN¥4.50 billion.

Operations: Xilong Scientific generates revenue primarily through the sale of chemical reagents. The company's net profit margin has shown variability, reflecting changes in cost management and pricing strategies.

Xilong Scientific, a promising player in the chemicals industry, has shown robust earnings growth of 124.5% over the past year, significantly outpacing the industry's -4.7%. The company's net debt to equity ratio stands at a satisfactory 32.7%, indicating sound financial health. Xilong's interest payments are well covered by EBIT at 3.4 times, reinforcing its solid footing in managing debt obligations. Recent developments include a notable acquisition by Jingge Win-Win Exclusive No. 11 Private Equity Fund of a 5.98% stake for approximately CNY 230 million and an approved cash dividend of CNY 0.33 per share for Q3 2024 shareholders.

- Get an in-depth perspective on Xilong Scientific's performance by reading our health report here.

Explore historical data to track Xilong Scientific's performance over time in our Past section.

Taking Advantage

- Unlock our comprehensive list of 4659 Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688123

Giantec Semiconductor

Manufactures and sells integrated circuits in China and internationally.

Flawless balance sheet with high growth potential.