- China

- /

- Medical Equipment

- /

- SHSE:688050

3 High Growth Stocks Insiders Are Betting On

Reviewed by Simply Wall St

As global markets navigate a mixed landscape of rising stock indices and declining consumer confidence, investors are closely monitoring trends in major economies. While U.S. stocks have shown moderate gains, driven by large-cap growth stocks, concerns over consumer sentiment and economic indicators highlight the importance of strategic investment choices. In such an environment, identifying growth companies with high insider ownership can be crucial, as insider confidence often signals strong belief in a company's potential to thrive amidst market fluctuations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 25.6% |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We're going to check out a few of the best picks from our screener tool.

Medeze Group (SET:MEDEZE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Medeze Group Public Company Limited operates in the collection and storage of stem cells for medical use across Thailand, Vietnam, Cambodia, and internationally, with a market cap of approximately THB95.05 billion.

Operations: The company's revenue is primarily derived from the collection, sorting, and cultivation of stem cells from placenta (THB453.13 million), adipose tissue (THB137.52 million), cord blood (THB77.02 million), and hair follicle (THB7.14 million), along with Natural Killer (NK) testing services contributing THB132.50 million, and sales of products adding THB9.40 million.

Insider Ownership: 26.2%

Medeze Group exhibits strong growth potential with forecasted earnings growth of 24.4% annually, outpacing the Thai market. Despite a highly volatile share price recently, Medeze's revenue is set to grow faster than the market at 15.9% per year. The company's recent establishment of a new subsidiary focused on hair follicle stem cell services highlights its expansion strategy post-IPO, which raised THB 2.41 billion in capital, supporting future growth initiatives.

- Delve into the full analysis future growth report here for a deeper understanding of Medeze Group.

- The analysis detailed in our Medeze Group valuation report hints at an inflated share price compared to its estimated value.

Eyebright Medical Technology (Beijing) (SHSE:688050)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Eyebright Medical Technology (Beijing) Co., Ltd. operates in the medical technology sector, focusing on developing and manufacturing ophthalmic medical devices, with a market cap of approximately CN¥17.54 billion.

Operations: The company generates revenue primarily from its Medical Products segment, which amounts to CN¥1.36 billion.

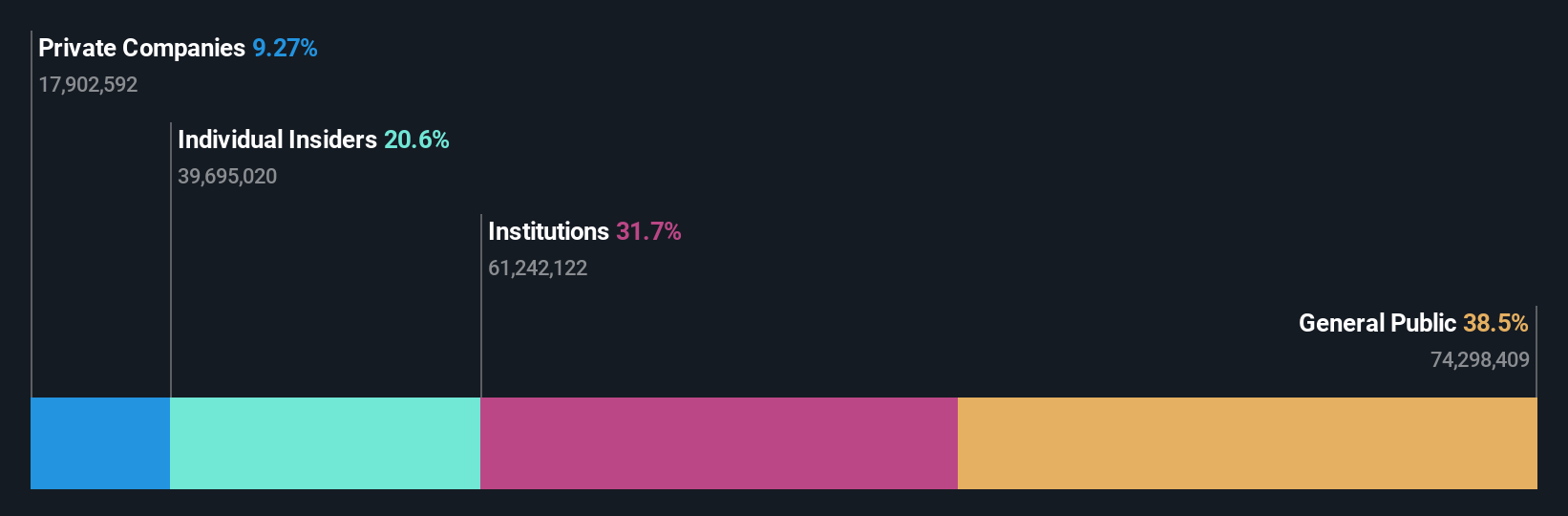

Insider Ownership: 21.5%

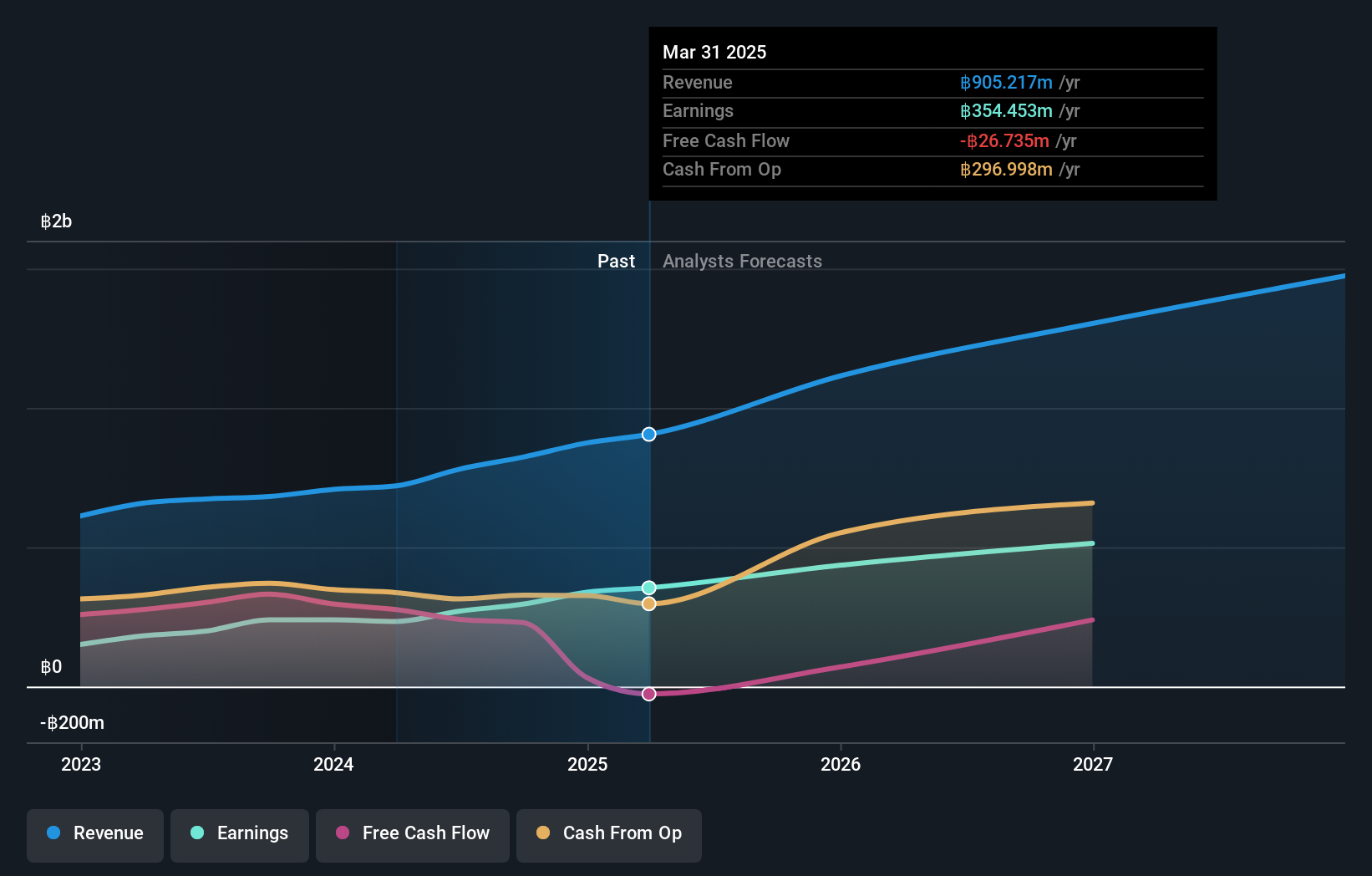

Eyebright Medical Technology (Beijing) demonstrates robust growth potential, with revenue and earnings forecasted to grow significantly above the market average. Recent earnings reports show a substantial increase in sales to CNY 1.08 billion and net income of CNY 317.59 million for the first nine months of 2024. Despite no recent insider trading activity, the company's strategic private placement aims to bolster its capital structure, supporting its aggressive expansion plans in the medical technology sector.

- Get an in-depth perspective on Eyebright Medical Technology (Beijing)'s performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Eyebright Medical Technology (Beijing) is priced higher than what may be justified by its financials.

Suzhou Novosense Microelectronics (SHSE:688052)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Novosense Microelectronics Co., Ltd. operates in the microelectronics industry, focusing on the development and production of semiconductor products, with a market cap of CN¥18.79 billion.

Operations: The company generates revenue primarily through its semiconductor product development and production activities.

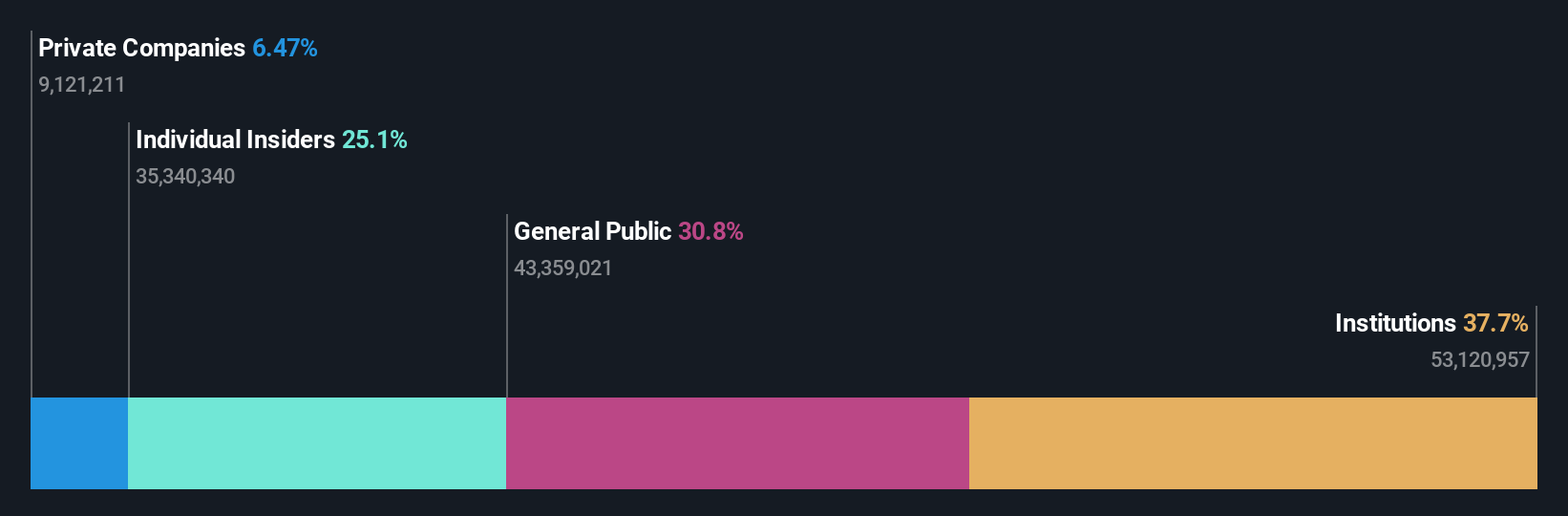

Insider Ownership: 25.1%

Suzhou Novosense Microelectronics is poised for substantial growth, with forecasted revenue and earnings expected to significantly outpace the market, growing at 30.3% and 121.52% per year respectively. Despite reporting a net loss of CNY 407.7 million for the first nine months of 2024, this aligns with expectations as the company transitions towards profitability over the next three years. No significant insider trading activity has been observed recently, maintaining stable insider ownership dynamics.

- Click here and access our complete growth analysis report to understand the dynamics of Suzhou Novosense Microelectronics.

- Our expertly prepared valuation report Suzhou Novosense Microelectronics implies its share price may be too high.

Make It Happen

- Dive into all 1512 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Eyebright Medical Technology (Beijing), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eyebright Medical Technology (Beijing) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688050

Eyebright Medical Technology (Beijing)

Eyebright Medical Technology (Beijing) Co., Ltd.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives