- China

- /

- Semiconductors

- /

- SHSE:688037

KINGSEMI's (SHSE:688037) earnings growth rate lags the 12% CAGR delivered to shareholders

It might be of some concern to shareholders to see the KINGSEMI Co., Ltd. (SHSE:688037) share price down 18% in the last month. On the bright side the returns have been quite good over the last half decade. It has returned a market beating 76% in that time.

In light of the stock dropping 4.7% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

See our latest analysis for KINGSEMI

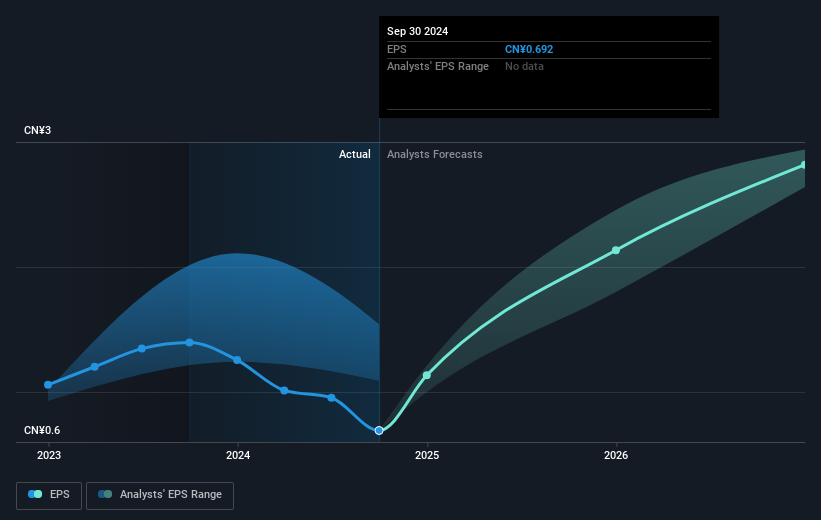

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, KINGSEMI achieved compound earnings per share (EPS) growth of 27% per year. This EPS growth is higher than the 12% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company. Having said that, the market is still optimistic, given the P/E ratio of 112.06.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on KINGSEMI's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 9.2% in the last year, KINGSEMI shareholders lost 3.5% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 12% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand KINGSEMI better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with KINGSEMI , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if KINGSEMI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688037

KINGSEMI

Engages in the research, development, production, and sale of semiconductor-specific equipment, integrated circuit production equipment, testing equipment, and other electronic equipment in China.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives