- China

- /

- Semiconductors

- /

- SHSE:688012

Advanced Micro-Fabrication Equipment Inc. China's (SHSE:688012) Price Is Out Of Tune With Earnings

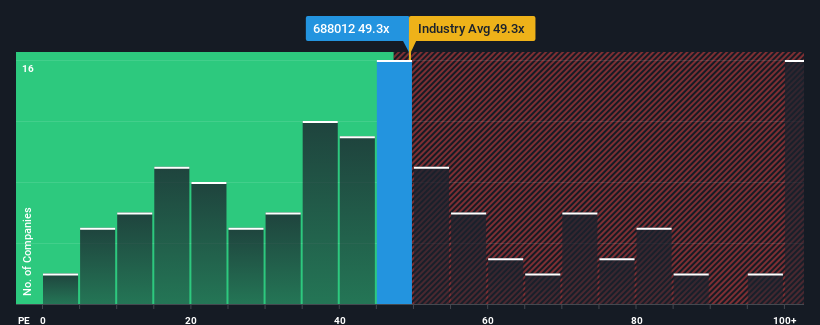

When close to half the companies in China have price-to-earnings ratios (or "P/E's") below 28x, you may consider Advanced Micro-Fabrication Equipment Inc. China (SHSE:688012) as a stock to avoid entirely with its 49.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been advantageous for Advanced Micro-Fabrication Equipment China as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Advanced Micro-Fabrication Equipment China

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Advanced Micro-Fabrication Equipment China would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 31% gain to the company's bottom line. Pleasingly, EPS has also lifted 152% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 26% per annum during the coming three years according to the analysts following the company. That's shaping up to be similar to the 25% per year growth forecast for the broader market.

With this information, we find it interesting that Advanced Micro-Fabrication Equipment China is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Advanced Micro-Fabrication Equipment China's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Advanced Micro-Fabrication Equipment China currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 1 warning sign for Advanced Micro-Fabrication Equipment China that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688012

Advanced Micro-Fabrication Equipment China

Advanced Micro-Fabrication Equipment Inc.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives