- China

- /

- Semiconductors

- /

- SHSE:605358

Earnings Tell The Story For Hangzhou Lion Electronics Co.,Ltd (SHSE:605358) As Its Stock Soars 27%

Those holding Hangzhou Lion Electronics Co.,Ltd (SHSE:605358) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 46% in the last twelve months.

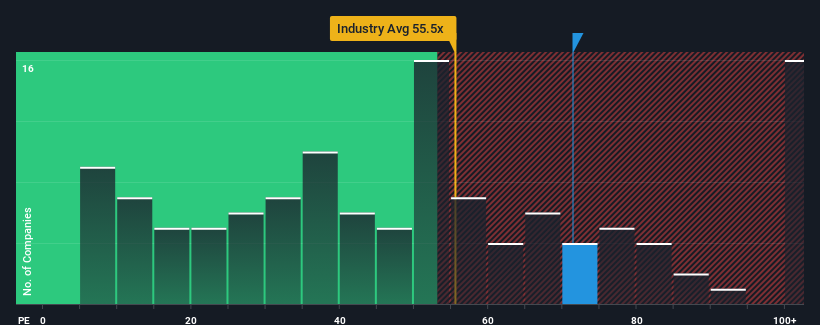

After such a large jump in price, Hangzhou Lion ElectronicsLtd's price-to-earnings (or "P/E") ratio of 71.4x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 30x and even P/E's below 18x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Hangzhou Lion ElectronicsLtd as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for Hangzhou Lion ElectronicsLtd

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Hangzhou Lion ElectronicsLtd's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 73%. Regardless, EPS has managed to lift by a handy 16% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 123% over the next year. With the market only predicted to deliver 41%, the company is positioned for a stronger earnings result.

With this information, we can see why Hangzhou Lion ElectronicsLtd is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Hangzhou Lion ElectronicsLtd's P/E?

The strong share price surge has got Hangzhou Lion ElectronicsLtd's P/E rushing to great heights as well. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Hangzhou Lion ElectronicsLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Hangzhou Lion ElectronicsLtd (at least 1 which is concerning), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Lion ElectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605358

Hangzhou Lion ElectronicsLtd

Engages in the research and development, production, and sale of semiconductor silicon wafers and power devices, and compound semiconductor radio frequency chips in China.

High growth potential and slightly overvalued.