- China

- /

- Electrical

- /

- SZSE:300617

Undiscovered Gems Highlight 3 Top Small Cap Stocks with Strong Metrics

Reviewed by Simply Wall St

In the current economic landscape, cooling inflation in the U.S. and strong bank earnings have propelled major stock indexes higher, while small-cap stocks, as evidenced by the S&P MidCap 400's notable gains, are also capturing attention amidst this positive momentum. With these dynamics in play, identifying small-cap stocks with robust financial metrics can be a strategic move for investors looking to capitalize on potential growth opportunities within this segment of the market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Consun Pharmaceutical Group (SEHK:1681)

Simply Wall St Value Rating: ★★★★★★

Overview: Consun Pharmaceutical Group Limited focuses on the research, development, manufacturing, and sale of Chinese medicines and medical contrast medium products in China, with a market capitalization of HK$6.44 billion.

Operations: The company generates revenue primarily from the Consun Pharmaceutical Segment, contributing CN¥2.33 billion, and the Yulin Pharmaceutical Segment, adding CN¥410 million.

Consun Pharma, a nimble player in the pharmaceuticals sector, has been trading at nearly 60% below its estimated fair value, suggesting potential undervaluation. Over the past year, earnings grew by 13.9%, surpassing the industry average of 9.4%, indicating robust performance. The company's debt-to-equity ratio has improved significantly from 27.7% to 12.7% over five years, reflecting effective financial management and reduced leverage risks. Recent changes in company bylaws aim to align with regulatory requirements and streamline governance structures, potentially enhancing operational efficiency moving forward while maintaining high-quality earnings and positive free cash flow.

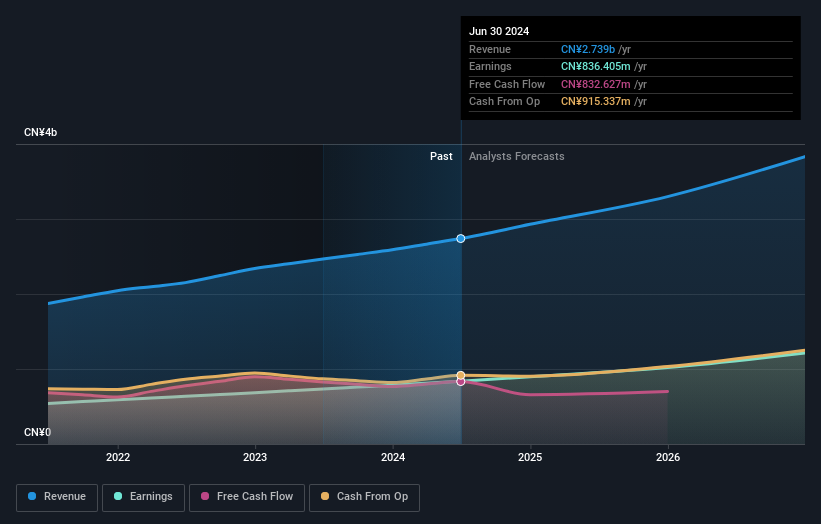

Fujian Raynen Technology (SHSE:603933)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fujian Raynen Technology Co., Ltd. operates in the IC distribution sector both within China and globally, with a market capitalization of CN¥3.38 billion.

Operations: Raynen Technology's revenue primarily stems from its IC distribution business. The company has a market capitalization of CN¥3.38 billion.

Fujian Raynen Technology, a burgeoning player in the semiconductor sector, has shown impressive earnings growth of 53.7% over the past year, outstripping the industry's 12.1%. The company’s price-to-earnings ratio of 46x is notably below the industry average of 65.9x, suggesting potential value for investors. Despite an increase in its debt to equity ratio from 15.4% to 27.7% over five years, its interest payments are well-covered by EBIT at a multiple of 7.3x. Recent results revealed net income climbing to CN¥60.58 million from CN¥46.18 million year-on-year for nine months ending September 2024.

- Take a closer look at Fujian Raynen Technology's potential here in our health report.

Assess Fujian Raynen Technology's past performance with our detailed historical performance reports.

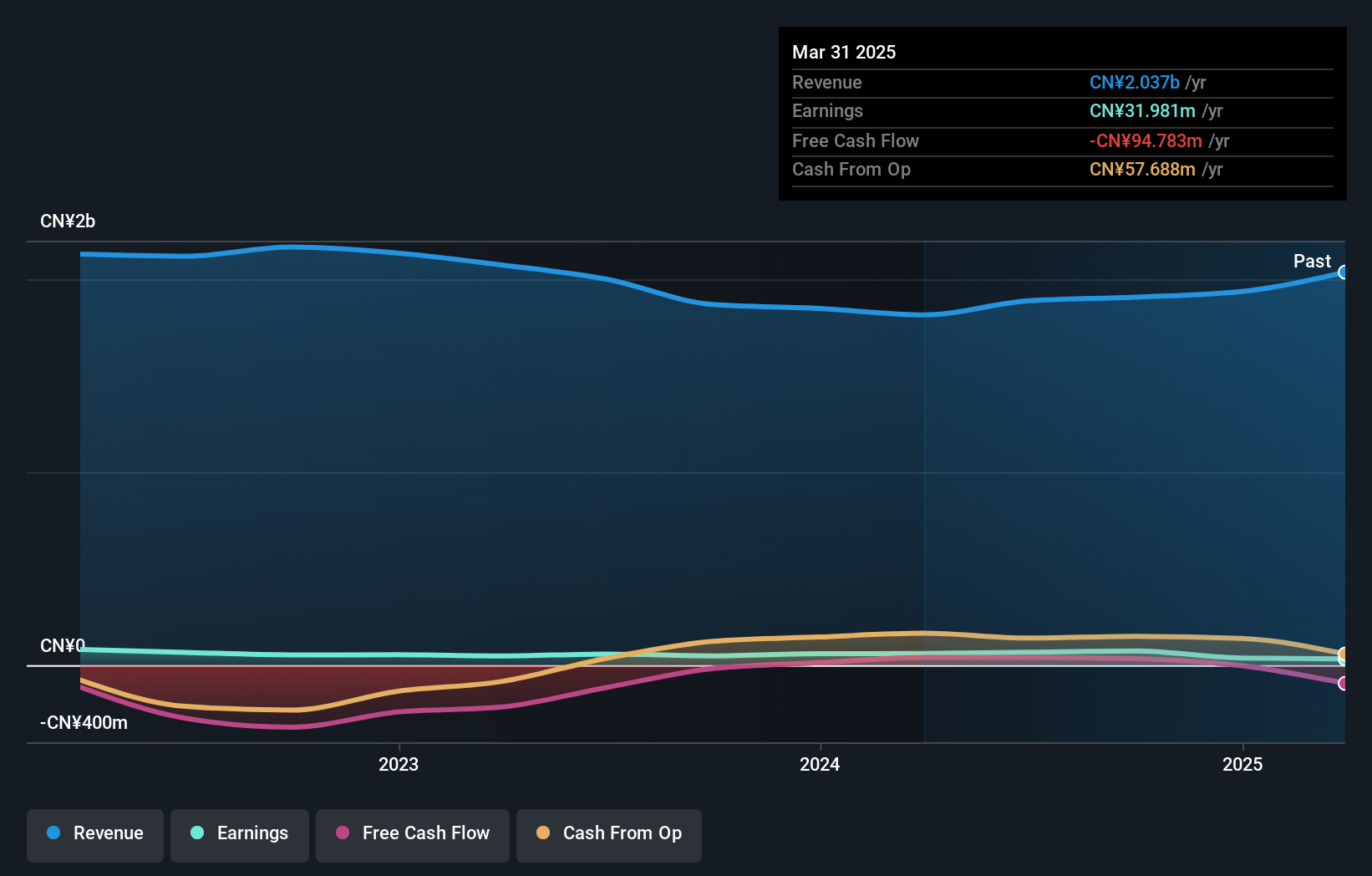

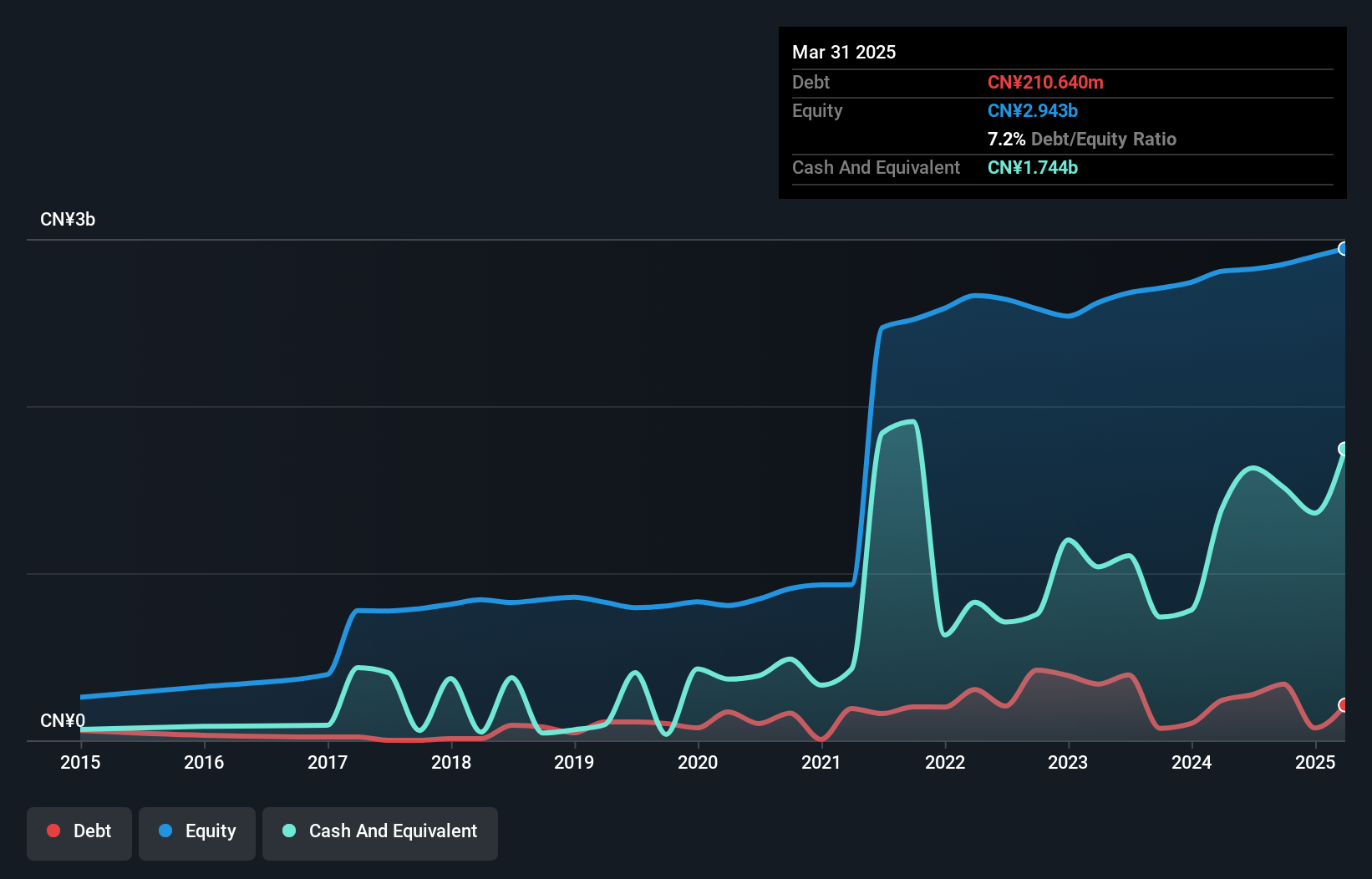

Jiangsu Ankura Intelligent Power (SZSE:300617)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Ankura Intelligent Power Co., Ltd. operates in the electric equipment industry and has a market capitalization of CN¥4.93 billion.

Operations: Ankura Intelligent Power generates revenue primarily from its electric equipment segment, amounting to CN¥948.17 million. The company has a market capitalization of CN¥4.93 billion.

Jiangsu Ankura Intelligent Power is carving out a niche with earnings growth of 5.7% over the past year, outpacing the Electrical industry’s 1.1%. Its price-to-earnings ratio stands attractively at 28x, below the CN market average of 34.9x, indicating potential value. Despite recent challenges with net income dipping to CNY 135.99 million from CNY 160.98 million last year, it maintains high-quality earnings and has reduced its debt-to-equity ratio from 12.4% to 11.8% over five years, suggesting prudent financial management amidst fluctuating sales figures around CNY 669 million this period compared to last year's CNY 679 million.

Taking Advantage

- Get an in-depth perspective on all 4658 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300617

Jiangsu Ankura Intelligent Electric

Jiangsu Ankura Intelligent Electric Co., Ltd.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)