Exploring Three Chinese Growth Companies With High Insider Ownership On The Shanghai Exchange

Reviewed by Simply Wall St

Amidst a backdrop of mixed global economic signals, Chinese equities have shown resilience with the Shanghai Composite Index remaining broadly stable. This steadiness comes despite challenges such as a contraction in manufacturing and ongoing pressures in the property sector. In such an environment, exploring growth companies with high insider ownership on the Shanghai Exchange could offer valuable insights into firms potentially well-positioned for navigating current market complexities.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 24.5% |

| Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.4% |

| Eoptolink Technology (SZSE:300502) | 26.7% | 39.4% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

| UTour Group (SZSE:002707) | 24% | 33.1% |

| Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

| Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

Underneath we present a selection of stocks filtered out by our screen.

JHT DesignLtd (SHSE:603061)

Simply Wall St Growth Rating: ★★★★★☆

Overview: JHT DesignLtd (ticker: SHSE:603061) specializes in the research, development, production, and sale of semiconductor chip testing equipment in China, with a market capitalization of CN¥3.87 billion.

Operations: The company generates its revenue primarily from the research, development, production, and sale of semiconductor chip testing equipment.

Insider Ownership: 23.1%

Earnings Growth Forecast: 46.9% p.a.

JHT DesignLtd, a Chinese growth company with high insider ownership, faces mixed financial dynamics. Despite a significant decline in net profit margins from 35.7% to 20.3% year-over-year and reduced Q1 earnings from CNY 31.9 million to CNY 14.89 million, the firm is poised for robust future growth with earnings expected to increase by 46.9% per year and revenue forecasted at an annual growth rate of 28.8%. These projections outpace the broader Chinese market's growth rates significantly, indicating potential despite current challenges.

- Dive into the specifics of JHT DesignLtd here with our thorough growth forecast report.

- Our valuation report unveils the possibility JHT DesignLtd's shares may be trading at a premium.

Qingdao Richen FoodLtd (SHSE:603755)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Qingdao Richen Food Co., Ltd. specializes in the research, development, production, and sale of compound seasonings and condiments for food processing and catering companies in China, with a market capitalization of approximately CN¥2.28 billion.

Operations: The company primarily generates its revenue through the production and sale of compound seasonings and condiments, serving food processing and catering sectors in China.

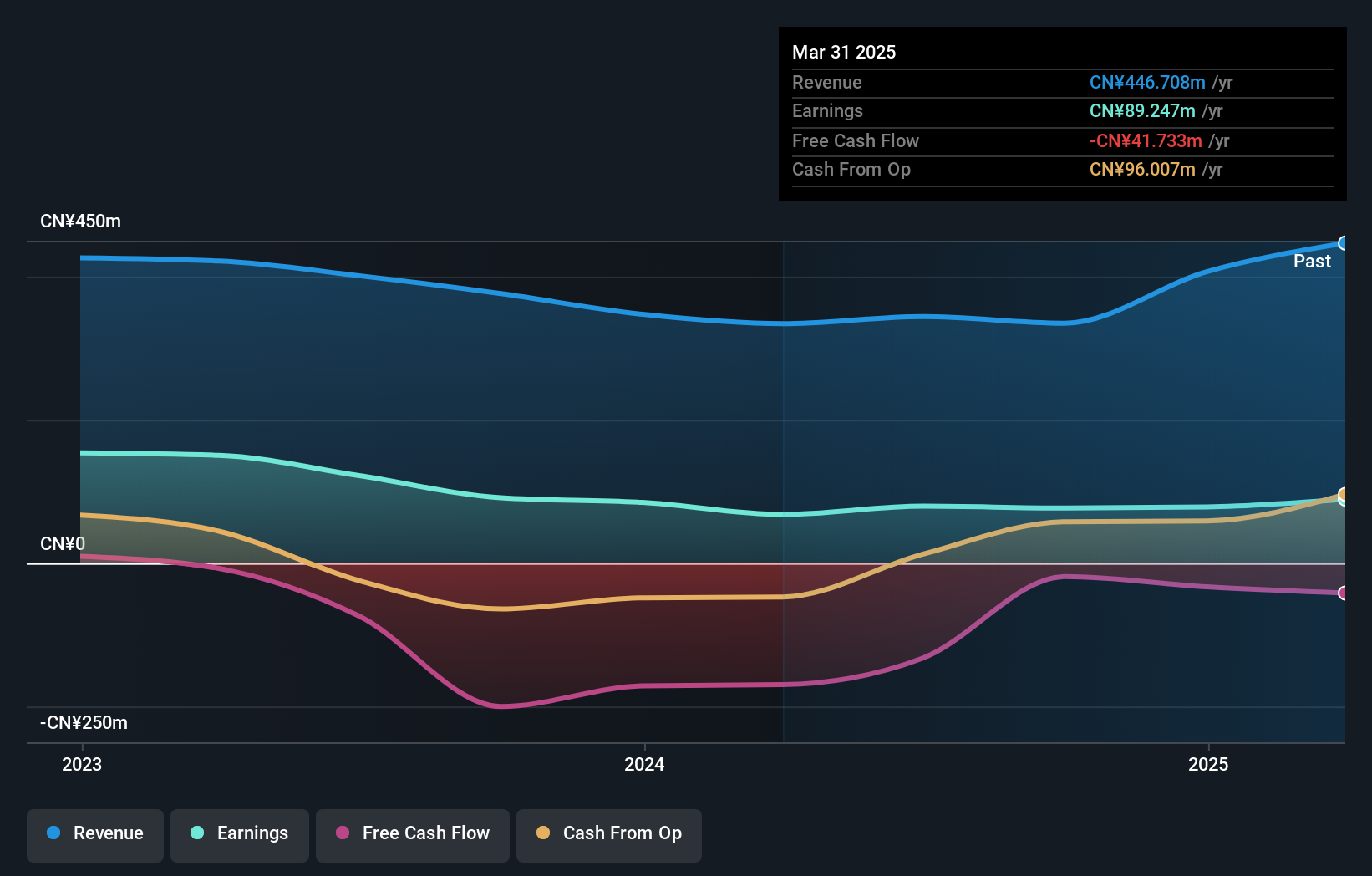

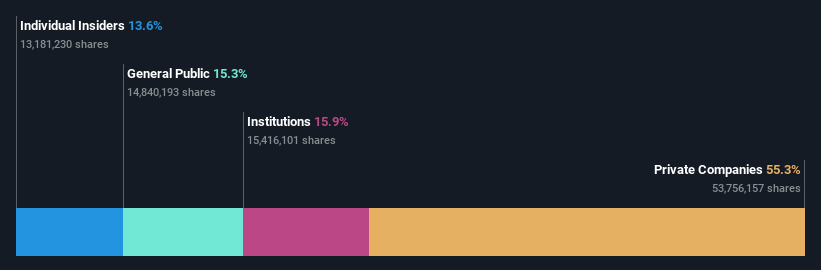

Insider Ownership: 13.6%

Earnings Growth Forecast: 23.7% p.a.

Qingdao Richen FoodLtd, a Chinese company with high insider ownership, demonstrates promising growth potential. Its revenue and earnings have shown robust increases, with revenue up to CNY 91.75 million and net income rising to CNY 12.9 million in Q1 2024 from the previous year. The company's annual earnings growth is expected at an impressive 23.7% per year, outpacing the broader Chinese market forecast of 23%. However, its low return on equity forecast of 11.7% suggests some efficiency challenges ahead.

- Click to explore a detailed breakdown of our findings in Qingdao Richen FoodLtd's earnings growth report.

- Our expertly prepared valuation report Qingdao Richen FoodLtd implies its share price may be too high.

Jiangxi Synergy Pharmaceutical (SZSE:300636)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangxi Synergy Pharmaceutical Co., Ltd. is a global manufacturer and seller of active pharmaceutical ingredients (APIs), with a market capitalization of approximately CN¥4.19 billion.

Operations: The company generates revenue primarily from pharmaceutical manufacturing, totaling approximately CN¥706.41 million.

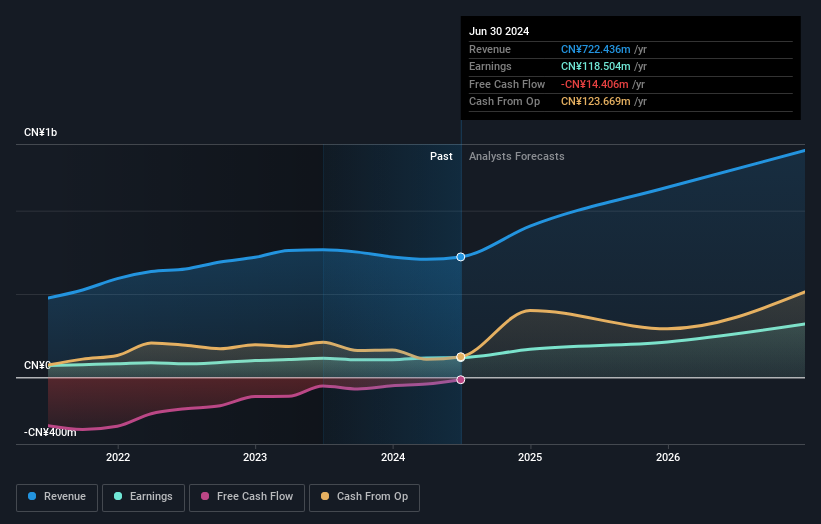

Insider Ownership: 33.9%

Earnings Growth Forecast: 28.8% p.a.

Jiangxi Synergy Pharmaceutical, a Chinese growth company with high insider ownership, reported a slight dip in dividends but showed robust financial performance with annual revenue reaching CNY 722.14 million and net income at CNY 105.98 million for the year ended December 31, 2023. Despite recent executive changes and dividend adjustments, the firm's earnings are expected to grow by approximately 28.84% annually over the next three years, outpacing both its past performance and broader market projections.

- Take a closer look at Jiangxi Synergy Pharmaceutical's potential here in our earnings growth report.

- Our valuation report here indicates Jiangxi Synergy Pharmaceutical may be overvalued.

Make It Happen

- Discover the full array of 398 Fast Growing Chinese Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Qingdao Richen FoodLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603755

Qingdao Richen FoodLtd

Engages in the research and development, production, and sale of compound seasoning and condiments for food processing and catering companies in China.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives