- China

- /

- Electrical

- /

- SZSE:301031

Asian Growth Companies With High Insider Ownership For October 2025

Reviewed by Simply Wall St

As of October 2025, Asian markets have shown resilience, with Chinese stocks gaining momentum despite economic challenges and Japan's markets reacting positively to political stability. In such a landscape, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business, potentially aligning well with investors seeking robust opportunities in this evolving market environment.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Techwing (KOSDAQ:A089030) | 19% | 84.7% |

| Suzhou Sunmun Technology (SZSE:300522) | 33.2% | 84.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

We'll examine a selection from our screener results.

Shanghai Aiko Solar EnergyLtd (SHSE:600732)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shanghai Aiko Solar Energy Co., Ltd. is involved in the research, manufacture, and sale of crystalline silicon solar cells, with a market cap of CN¥34.41 billion.

Operations: The company generates revenue through the research, production, and distribution of crystalline silicon solar cells.

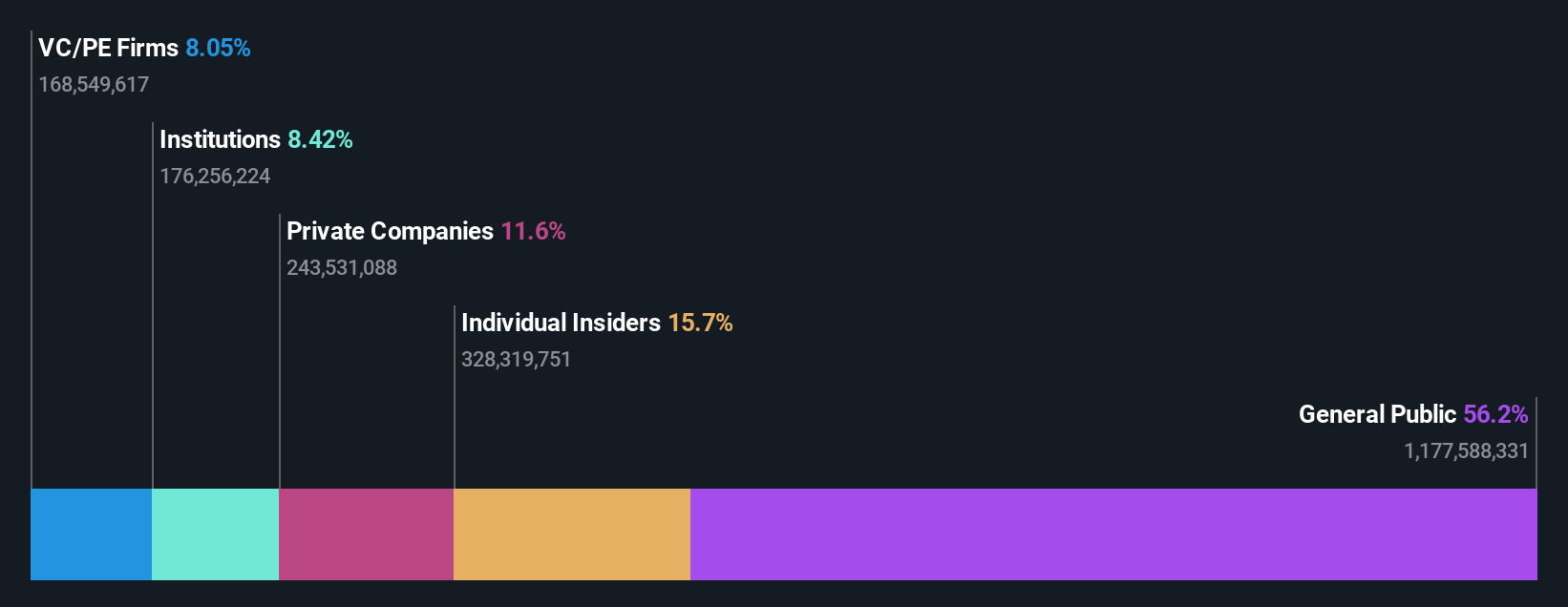

Insider Ownership: 15.7%

Earnings Growth Forecast: 113.4% p.a.

Shanghai Aiko Solar Energy Ltd. demonstrates strong growth potential, with revenue forecasted to increase by 29.3% annually, outpacing the Chinese market's average of 14.2%. Despite a past year of shareholder dilution and high share price volatility, the company is expected to achieve profitability within three years and has reported significant improvements in financial performance, reducing net losses substantially. Recent private placements indicate confidence in its strategic direction amidst substantial insider ownership.

- Dive into the specifics of Shanghai Aiko Solar EnergyLtd here with our thorough growth forecast report.

- Our expertly prepared valuation report Shanghai Aiko Solar EnergyLtd implies its share price may be lower than expected.

Inner Mongolia Furui Medical Science (SZSE:300049)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Inner Mongolia Furui Medical Science Co., Ltd. operates in the medical science industry and has a market capitalization of approximately CN¥19.74 billion.

Operations: I'm sorry, but the provided text for revenue segments does not contain any specific information on the company's revenue breakdown.

Insider Ownership: 15.9%

Earnings Growth Forecast: 41.3% p.a.

Inner Mongolia Furui Medical Science shows promising growth potential, with earnings expected to increase significantly at 41.3% annually, surpassing the Chinese market average. Revenue is also projected to grow faster than the market at 22.7% per year. Recent earnings results for the nine months ended September 2025 indicate improved sales and net income compared to last year. However, high share price volatility and a forecasted low return on equity remain concerns amidst no recent insider trading activity.

- Delve into the full analysis future growth report here for a deeper understanding of Inner Mongolia Furui Medical Science.

- In light of our recent valuation report, it seems possible that Inner Mongolia Furui Medical Science is trading beyond its estimated value.

Xi'an Sinofuse Electric (SZSE:301031)

Simply Wall St Growth Rating: ★★★★★★

Overview: Xi'an Sinofuse Electric Co., Ltd. focuses on the research, development, production, and sale of fuses and related accessories in China, with a market cap of CN¥12.21 billion.

Operations: Xi'an Sinofuse Electric Co., Ltd. generates revenue primarily through its activities in the research, development, production, and sale of fuses and related accessories within China.

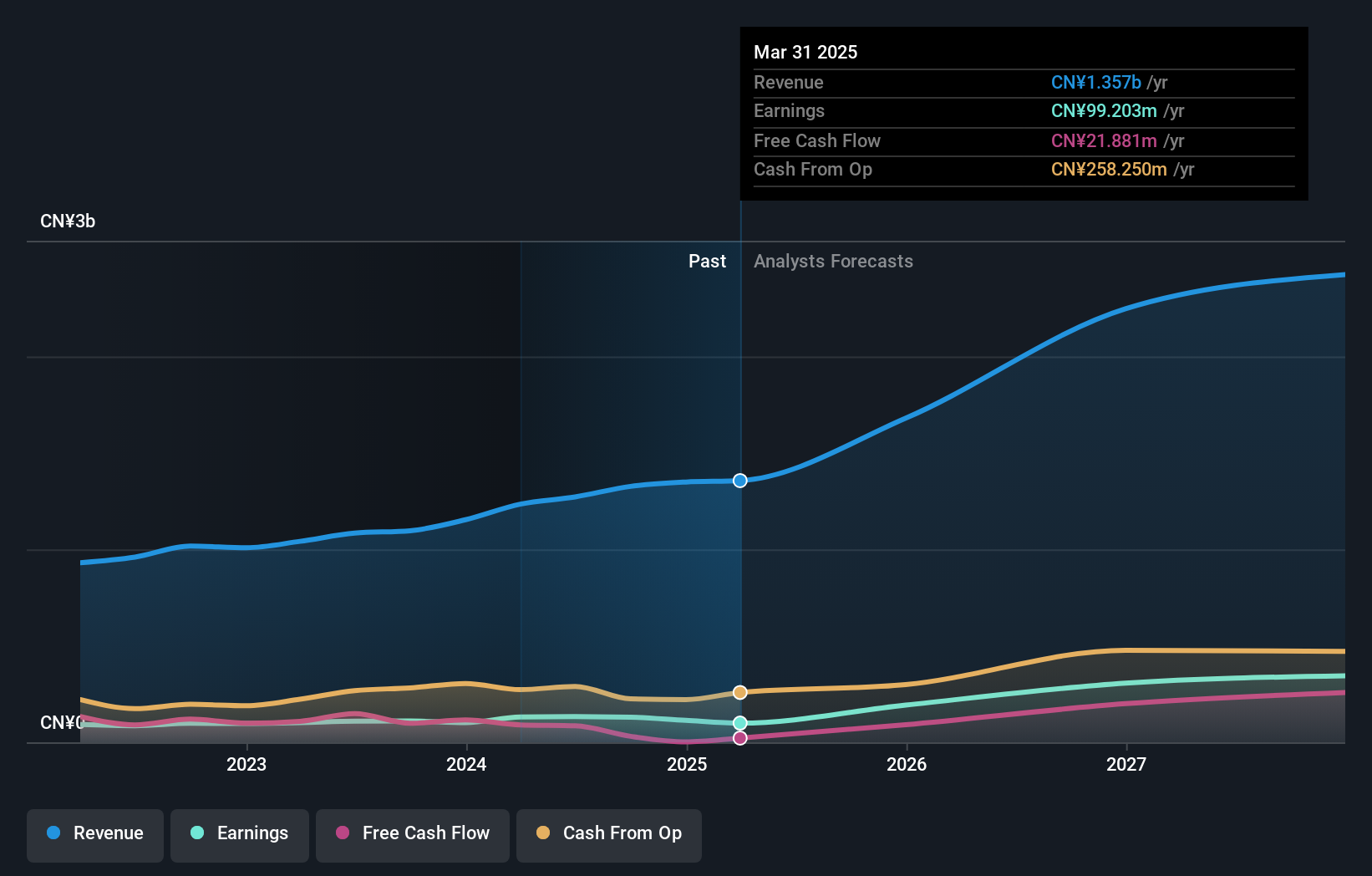

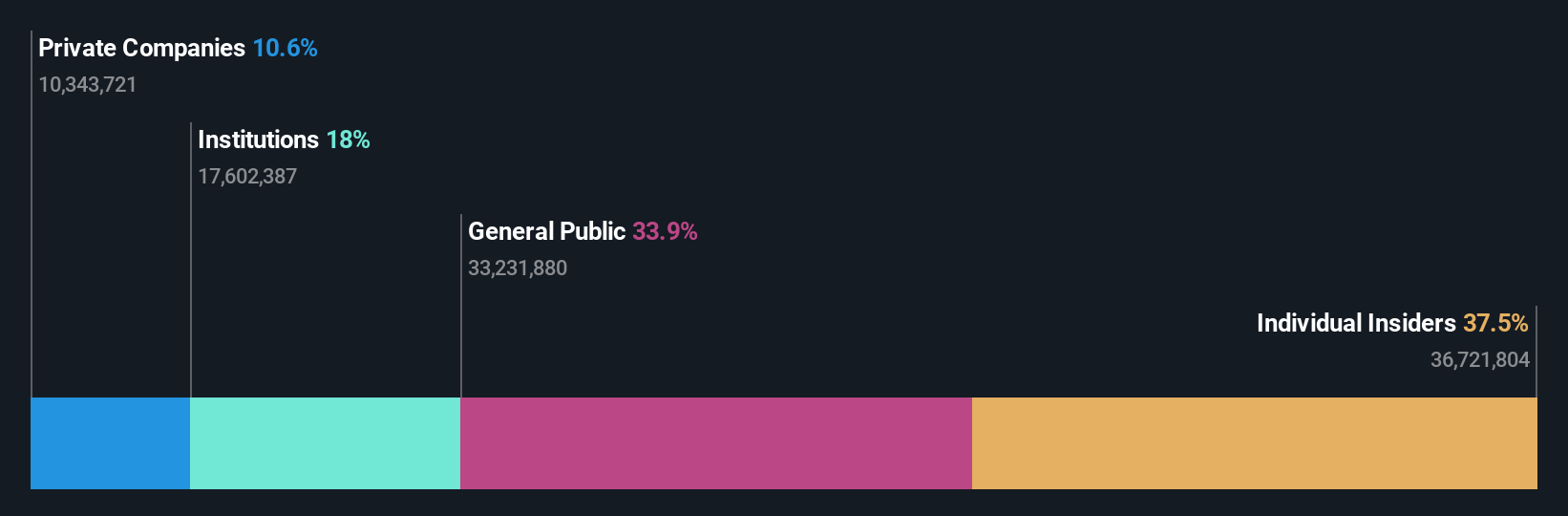

Insider Ownership: 34%

Earnings Growth Forecast: 28.0% p.a.

Xi'an Sinofuse Electric demonstrates strong growth potential with earnings expected to rise significantly at 28% annually, outpacing the Chinese market. Revenue is also forecasted to grow faster than the market at 24.4% per year. Recent earnings for nine months ending September 2025 show substantial increases in sales and net income compared to last year. Despite high share price volatility and no recent insider trading activity, its price-to-earnings ratio remains attractive relative to the market average.

- Get an in-depth perspective on Xi'an Sinofuse Electric's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Xi'an Sinofuse Electric's shares may be trading at a premium.

Make It Happen

- Gain an insight into the universe of 622 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Ready For A Different Approach? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301031

Xi'an Sinofuse Electric

Engages in the research, development, production, and sale of fuses and related accessories in China.

Exceptional growth potential with outstanding track record.

Market Insights

Community Narratives