- China

- /

- Semiconductors

- /

- SHSE:600537

A Piece Of The Puzzle Missing From EGing Photovoltaic Technology Co.,Ltd.'s (SHSE:600537) 28% Share Price Climb

EGing Photovoltaic Technology Co.,Ltd. (SHSE:600537) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 43% over that time.

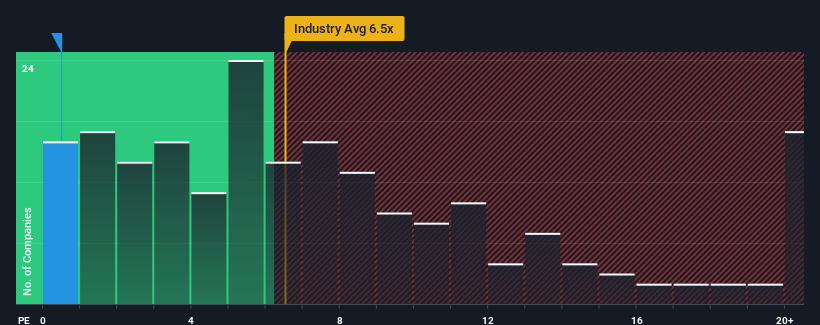

Even after such a large jump in price, EGing Photovoltaic TechnologyLtd's price-to-sales (or "P/S") ratio of 0.5x might still make it look like a strong buy right now compared to the wider Semiconductor industry in China, where around half of the companies have P/S ratios above 6.5x and even P/S above 12x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for EGing Photovoltaic TechnologyLtd

What Does EGing Photovoltaic TechnologyLtd's P/S Mean For Shareholders?

Recent times have been quite advantageous for EGing Photovoltaic TechnologyLtd as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on EGing Photovoltaic TechnologyLtd will help you shine a light on its historical performance.How Is EGing Photovoltaic TechnologyLtd's Revenue Growth Trending?

EGing Photovoltaic TechnologyLtd's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered an exceptional 55% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 153% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

It's interesting to note that the rest of the industry is similarly expected to grow by 37% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this in consideration, we find it intriguing that EGing Photovoltaic TechnologyLtd's P/S falls short of its industry peers. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

EGing Photovoltaic TechnologyLtd's recent share price jump still sees fails to bring its P/S alongside the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of EGing Photovoltaic TechnologyLtd revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. medium-term

It is also worth noting that we have found 1 warning sign for EGing Photovoltaic TechnologyLtd that you need to take into consideration.

If these risks are making you reconsider your opinion on EGing Photovoltaic TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if EGing Photovoltaic TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600537

EGing Photovoltaic TechnologyLtd

Researches, develops, manufactures, and sells photovoltaic products in China and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026