- China

- /

- Semiconductors

- /

- SHSE:600460

Improved Revenues Required Before Hangzhou Silan Microelectronics Co.,Ltd (SHSE:600460) Stock's 29% Jump Looks Justified

Those holding Hangzhou Silan Microelectronics Co.,Ltd (SHSE:600460) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 37% over that time.

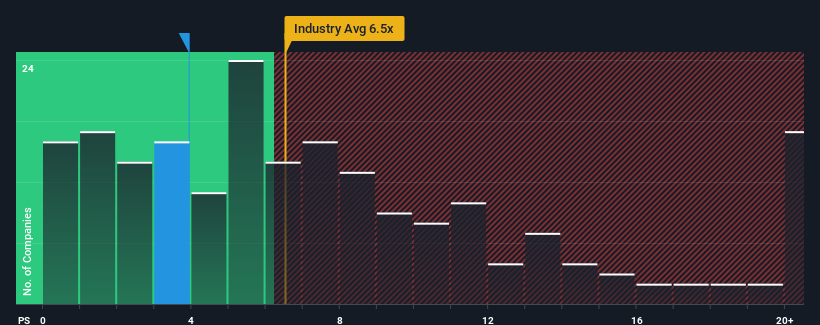

Even after such a large jump in price, Hangzhou Silan MicroelectronicsLtd's price-to-sales (or "P/S") ratio of 3.9x might still make it look like a buy right now compared to the Semiconductor industry in China, where around half of the companies have P/S ratios above 6.5x and even P/S above 12x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Hangzhou Silan MicroelectronicsLtd

How Has Hangzhou Silan MicroelectronicsLtd Performed Recently?

Recent times haven't been great for Hangzhou Silan MicroelectronicsLtd as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hangzhou Silan MicroelectronicsLtd.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Hangzhou Silan MicroelectronicsLtd would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 8.8% gain to the company's revenues. The latest three year period has also seen an excellent 132% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 23% per year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 31% each year, which is noticeably more attractive.

In light of this, it's understandable that Hangzhou Silan MicroelectronicsLtd's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Hangzhou Silan MicroelectronicsLtd's P/S Mean For Investors?

Hangzhou Silan MicroelectronicsLtd's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Hangzhou Silan MicroelectronicsLtd maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 4 warning signs for Hangzhou Silan MicroelectronicsLtd (1 is a bit concerning!) that we have uncovered.

If you're unsure about the strength of Hangzhou Silan MicroelectronicsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Silan MicroelectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600460

Hangzhou Silan MicroelectronicsLtd

Designs, manufactures, and sells integrated circuit (IC) chips and semiconductor microelectronics-related products in China.

Excellent balance sheet with proven track record.