- China

- /

- Semiconductors

- /

- SHSE:600363

Revenues Not Telling The Story For Jiangxi Lian Chuang Optoelectronic Science And Technology Co.,lTd. (SHSE:600363) After Shares Rise 28%

Despite an already strong run, Jiangxi Lian Chuang Optoelectronic Science And Technology Co.,lTd. (SHSE:600363) shares have been powering on, with a gain of 28% in the last thirty days. The annual gain comes to 108% following the latest surge, making investors sit up and take notice.

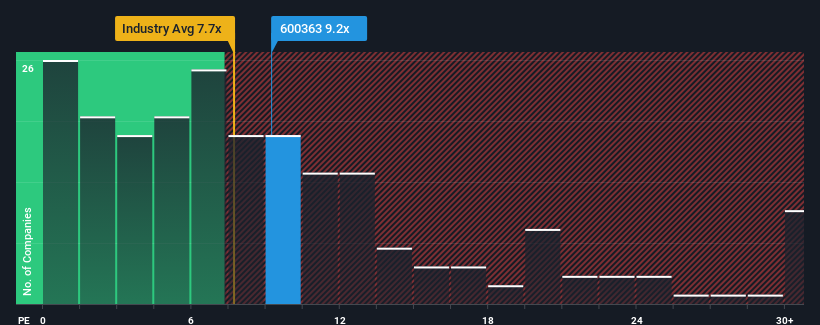

Since its price has surged higher, Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd's price-to-sales (or "P/S") ratio of 9.2x might make it look like a sell right now compared to the wider Semiconductor industry in China, where around half of the companies have P/S ratios below 7.7x and even P/S below 3x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd

How Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd Has Been Performing

With revenue growth that's inferior to most other companies of late, Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 6.0%. However, this wasn't enough as the latest three year period has seen an unpleasant 22% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 14% as estimated by the two analysts watching the company. That's shaping up to be materially lower than the 45% growth forecast for the broader industry.

With this information, we find it concerning that Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600363

Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd

Jiangxi Lian Chuang Optoelectronic Science And Technology Co.,lTd.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.