- China

- /

- Semiconductors

- /

- SHSE:600363

Here's Why Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd (SHSE:600363) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd (SHSE:600363). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd

How Fast Is Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Over the last three years, Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd has grown EPS by 5.6% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

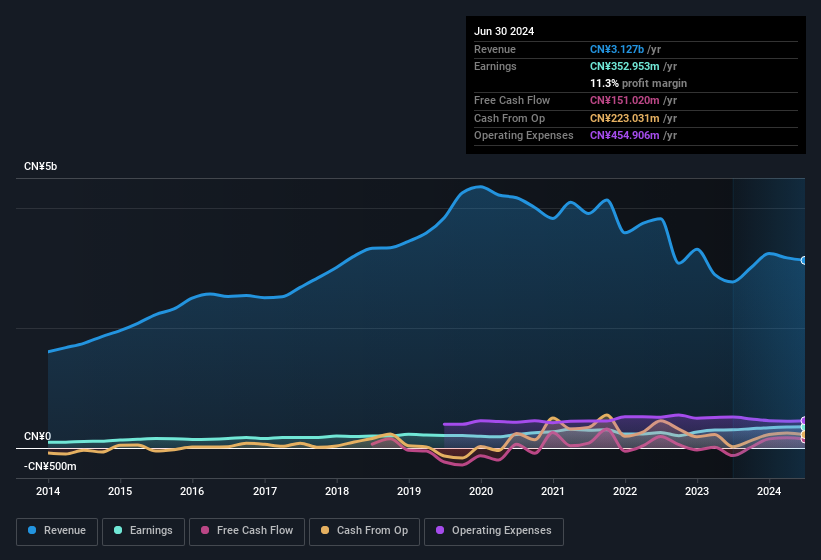

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd achieved similar EBIT margins to last year, revenue grew by a solid 13% to CN¥3.1b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd's forecast profits?

Are Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. So it is good to see that Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd insiders have a significant amount of capital invested in the stock. Given insiders own a significant chunk of shares, currently valued at CN¥483m, they have plenty of motivation to push the business to succeed. This would indicate that the goals of shareholders and management are one and the same.

Should You Add Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd To Your Watchlist?

One positive for Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd is that it is growing EPS. That's nice to see. To add an extra spark to the fire, significant insider ownership in the company is another highlight. These two factors are a huge highlight for the company which should be a strong contender your watchlists. Of course, just because Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600363

Jiangxi Lian Chuang Optoelectronic Science And TechnologylTd

Jiangxi Lian Chuang Optoelectronic Science And Technology Co.,lTd.

High growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026