- China

- /

- General Merchandise and Department Stores

- /

- SZSE:301110

Qingmu Tec Co., Ltd. (SZSE:301110) Stocks Shoot Up 26% But Its P/E Still Looks Reasonable

Despite an already strong run, Qingmu Tec Co., Ltd. (SZSE:301110) shares have been powering on, with a gain of 26% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 52% in the last year.

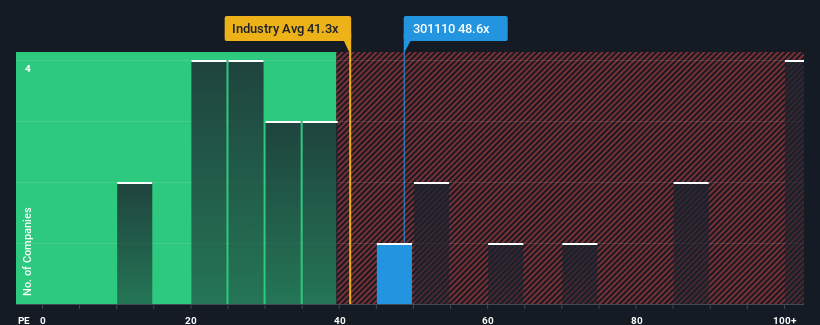

Since its price has surged higher, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 35x, you may consider Qingmu Tec as a stock to potentially avoid with its 48.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times have been pleasing for Qingmu Tec as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Qingmu Tec

Does Growth Match The High P/E?

In order to justify its P/E ratio, Qingmu Tec would need to produce impressive growth in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 79%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 41% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 118% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the market is forecast to only expand by 39%, which is noticeably less attractive.

In light of this, it's understandable that Qingmu Tec's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The large bounce in Qingmu Tec's shares has lifted the company's P/E to a fairly high level. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Qingmu Tec maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 3 warning signs for Qingmu Tec (1 is significant!) that we have uncovered.

Of course, you might also be able to find a better stock than Qingmu Tec. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Qingmu Tec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301110

Flawless balance sheet with low risk.

Market Insights

Community Narratives