- China

- /

- General Merchandise and Department Stores

- /

- SZSE:000715

Zhongxing Shenyang Commercial Building Group Co.,Ltd (SZSE:000715) Not Doing Enough For Some Investors As Its Shares Slump 30%

Zhongxing Shenyang Commercial Building Group Co.,Ltd (SZSE:000715) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 29% share price drop.

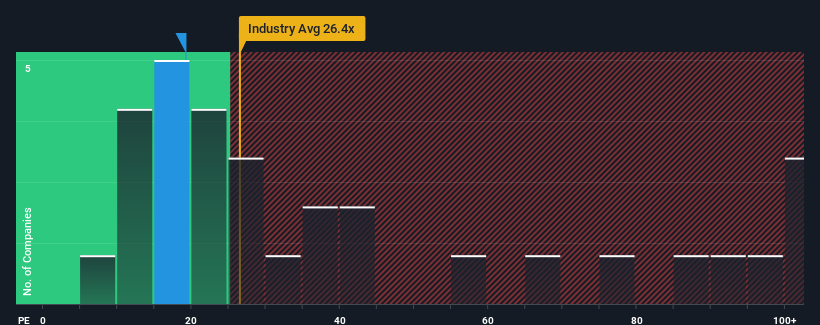

Even after such a large drop in price, Zhongxing Shenyang Commercial Building GroupLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 19.2x, since almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 55x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Zhongxing Shenyang Commercial Building GroupLtd as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Zhongxing Shenyang Commercial Building GroupLtd

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Zhongxing Shenyang Commercial Building GroupLtd's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 38% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 12% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 7.1% per year as estimated by the only analyst watching the company. That's not great when the rest of the market is expected to grow by 21% per annum.

With this information, we are not surprised that Zhongxing Shenyang Commercial Building GroupLtd is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Zhongxing Shenyang Commercial Building GroupLtd's P/E?

Zhongxing Shenyang Commercial Building GroupLtd's P/E has taken a tumble along with its share price. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Zhongxing Shenyang Commercial Building GroupLtd's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Zhongxing Shenyang Commercial Building GroupLtd (1 is a bit concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Zhongxing Shenyang Commercial Building GroupLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zhongxing Shenyang Commercial Building GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000715

Zhongxing Shenyang Commercial Building GroupLtd

Operates department stores, supermarkets, and online shopping platforms in China.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.