- China

- /

- Specialty Stores

- /

- SHSE:605136

Jiangxi Rimag Group And 2 Other Top Insider-Owned Growth Stocks

Reviewed by Simply Wall St

As global markets continue to experience mixed performances, with major indices like the S&P 500 and Nasdaq Composite hitting record highs while others such as the Russell 2000 decline, growth stocks have emerged as standout performers. In this environment, companies with high insider ownership often attract attention due to their potential for aligned interests between management and shareholders. This article explores Jiangxi Rimag Group and two other notable insider-owned growth stocks that may be of interest in today's market landscape.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| HANA Micron (KOSDAQ:A067310) | 18.4% | 110.9% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's uncover some gems from our specialized screener.

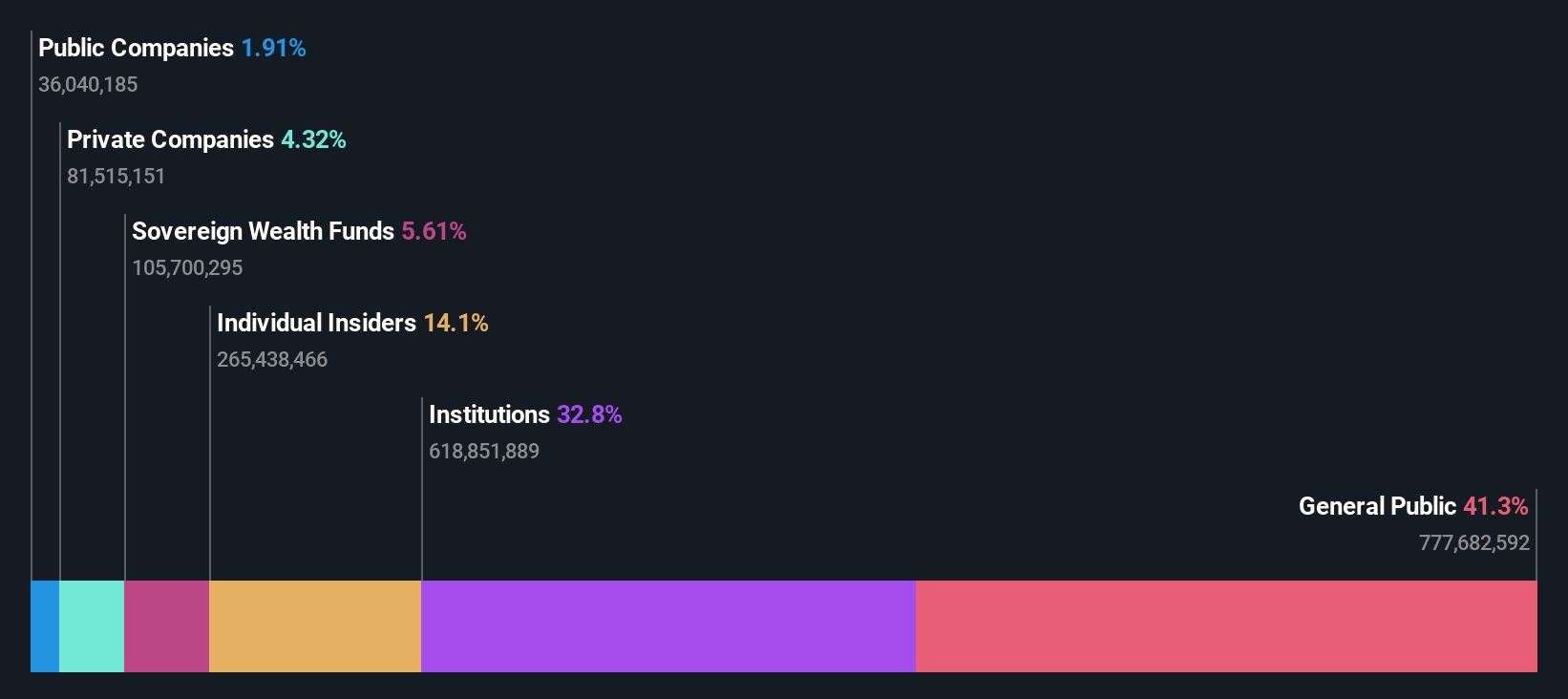

Jiangxi Rimag Group (SEHK:2522)

Simply Wall St Growth Rating: ★★★★★☆

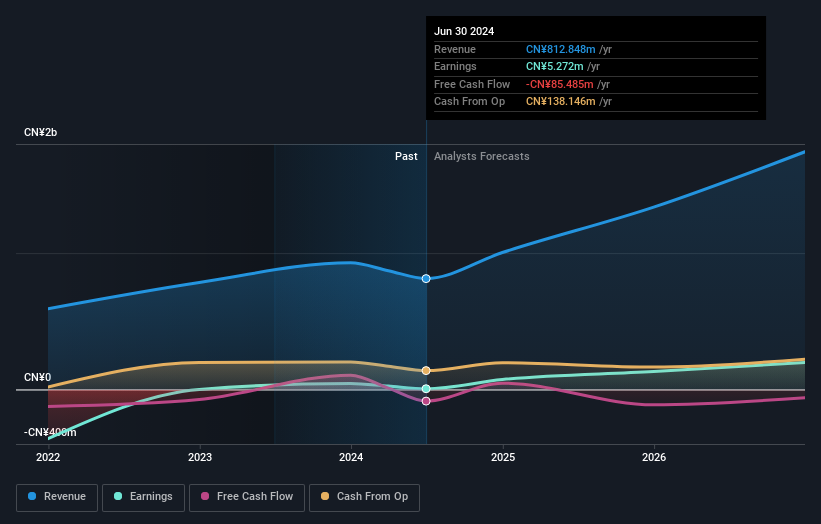

Overview: Jiangxi Rimag Group Co., Ltd. operates medical imaging centers in China and has a market cap of HK$20.38 billion.

Operations: The company generates revenue from its Medical Labs & Research segment, amounting to CN¥812.85 million.

Insider Ownership: 24.3%

Jiangxi Rimag Group is poised for significant growth, with earnings forecasted to rise 71.84% annually and revenue expected to grow by 30% per year, outpacing the Hong Kong market. Despite a low return on equity projection of 9.7%, no substantial insider trading activity has been reported recently. Recent board changes include the retirement of several directors and supervisors without any noted disagreements, ensuring stability in governance transitions.

- Dive into the specifics of Jiangxi Rimag Group here with our thorough growth forecast report.

- The analysis detailed in our Jiangxi Rimag Group valuation report hints at an inflated share price compared to its estimated value.

Chifeng Jilong Gold MiningLtd (SHSE:600988)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chifeng Jilong Gold Mining Co., Ltd. is a company engaged in the mining of gold and non-ferrous metals, with a market capitalization of CN¥28.49 billion.

Operations: Chifeng Jilong Gold Mining Co., Ltd. generates revenue primarily from its operations in gold and non-ferrous metal mining.

Insider Ownership: 16.1%

Chifeng Jilong Gold Mining Ltd. demonstrates strong growth potential with earnings projected to increase by 21.86% annually, though this is slightly below the broader CN market's growth rate. The company reported robust financial performance for the first nine months of 2024, with revenue reaching CNY 6.22 billion and net income doubling from the previous year to CNY 1.11 billion. Trading at a significant discount to estimated fair value, it offers good relative value compared to peers and industry standards.

- Click here to discover the nuances of Chifeng Jilong Gold MiningLtd with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Chifeng Jilong Gold MiningLtd's share price might be too pessimistic.

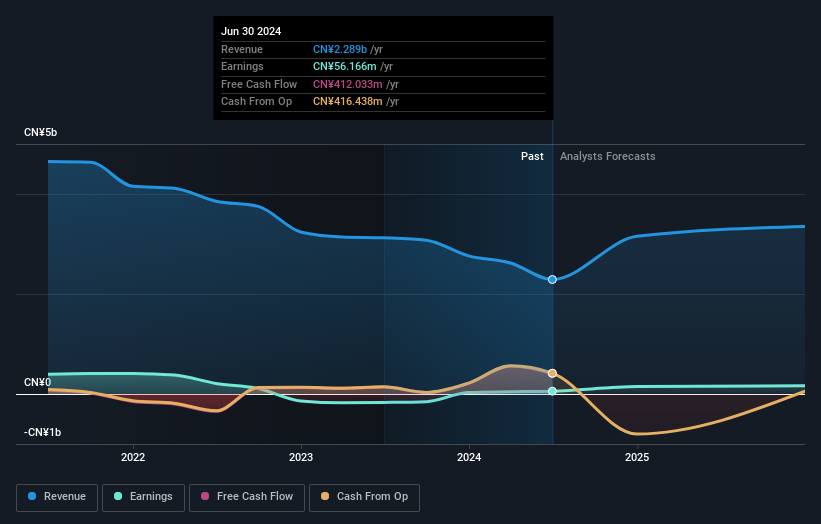

Shanghai Lily&Beauty CosmeticsLtd (SHSE:605136)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Lily&Beauty Cosmetics Co., Ltd. operates in China, offering online cosmetics marketing and retailing services with a market cap of CN¥3.92 billion.

Operations: Shanghai Lily&Beauty Cosmetics Co., Ltd.'s revenue primarily comes from its online cosmetics marketing and retailing services in China.

Insider Ownership: 32.5%

Shanghai Lily&Beauty Cosmetics Ltd. is expected to experience significant growth, with earnings projected to increase by 56.2% annually, outpacing the broader CN market. Despite reporting a net loss of CNY 27.8 million for the first nine months of 2024, this marks an improvement from the previous year. The stock trades at a substantial discount to its estimated fair value, suggesting potential undervaluation despite recent revenue declines from CNY 1.93 billion to CNY 1.23 billion year-over-year.

- Get an in-depth perspective on Shanghai Lily&Beauty CosmeticsLtd's performance by reading our analyst estimates report here.

- Our valuation report here indicates Shanghai Lily&Beauty CosmeticsLtd may be overvalued.

Summing It All Up

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1516 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605136

Shanghai Lily&Beauty CosmeticsLtd

Provides online cosmetics marketing and retailing services in China.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives