- China

- /

- Retail Distributors

- /

- SHSE:601801

Anhui Xinhua Media Co., Ltd.'s (SHSE:601801) Earnings Are Not Doing Enough For Some Investors

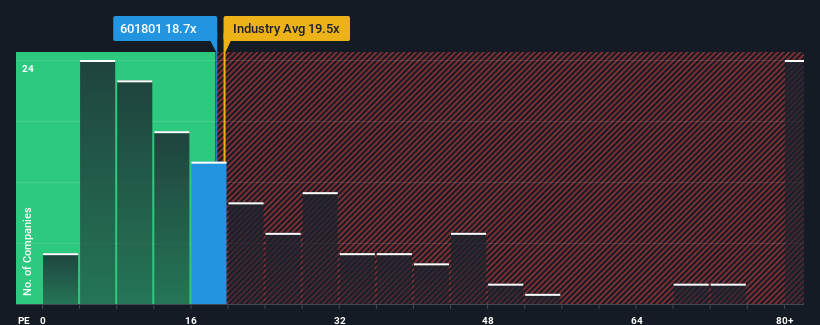

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 37x, you may consider Anhui Xinhua Media Co., Ltd. (SHSE:601801) as an attractive investment with its 18.7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Anhui Xinhua Media has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Anhui Xinhua Media

How Is Anhui Xinhua Media's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Anhui Xinhua Media's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's bottom line. Regardless, EPS has managed to lift by a handy 8.1% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Looking ahead now, EPS is anticipated to climb by 20% during the coming year according to the five analysts following the company. With the market predicted to deliver 38% growth , the company is positioned for a weaker earnings result.

In light of this, it's understandable that Anhui Xinhua Media's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Anhui Xinhua Media maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for Anhui Xinhua Media that we have uncovered.

Of course, you might also be able to find a better stock than Anhui Xinhua Media. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601801

Anhui Xinhua Media

Engages in the cultural services, education services, supply chain management, and other culture-related businesses in China.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.