- China

- /

- Retail Distributors

- /

- SHSE:600981

Investors Don't See Light At End Of Jiangsu High Hope International Group Corporation's (SHSE:600981) Tunnel And Push Stock Down 25%

Jiangsu High Hope International Group Corporation (SHSE:600981) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 18% in that time.

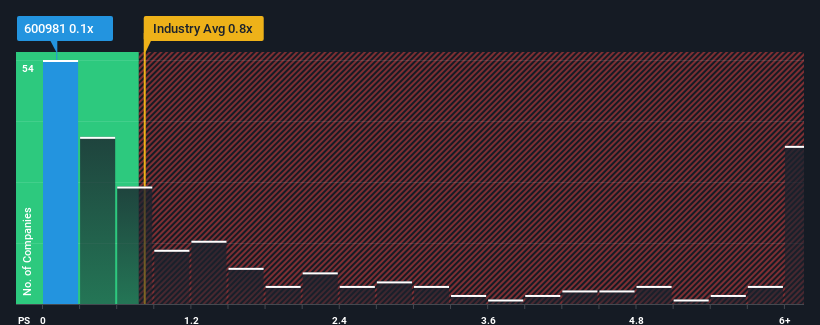

After such a large drop in price, Jiangsu High Hope International Group may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Retail Distributors industry in China have P/S ratios greater than 0.6x and even P/S higher than 3x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Jiangsu High Hope International Group

What Does Jiangsu High Hope International Group's P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for Jiangsu High Hope International Group, which is generally not a bad outcome. It might be that many expect the respectable revenue performance to degrade, which has repressed the P/S. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Jiangsu High Hope International Group will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Jiangsu High Hope International Group?

In order to justify its P/S ratio, Jiangsu High Hope International Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 5.3% gain to the company's revenues. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing that to the industry, which is predicted to deliver 22% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we can see why Jiangsu High Hope International Group is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

What Does Jiangsu High Hope International Group's P/S Mean For Investors?

Jiangsu High Hope International Group's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Jiangsu High Hope International Group revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

It is also worth noting that we have found 2 warning signs for Jiangsu High Hope International Group that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600981

Jiangsu High Hope International Group

Engages in trade, real estate, investment, logistics, manufacturing, services, etc.

Low and slightly overvalued.

Market Insights

Community Narratives