- China

- /

- General Merchandise and Department Stores

- /

- SHSE:600857

Subdued Growth No Barrier To Ningbo Zhongbai Co., Ltd. (SHSE:600857) With Shares Advancing 30%

Despite an already strong run, Ningbo Zhongbai Co., Ltd. (SHSE:600857) shares have been powering on, with a gain of 30% in the last thirty days. Notwithstanding the latest gain, the annual share price return of 4.9% isn't as impressive.

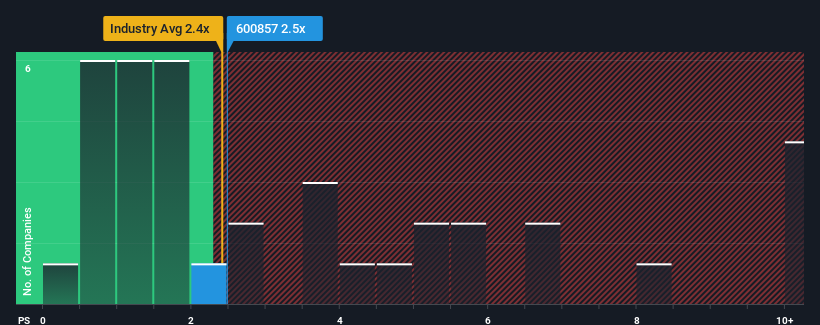

Although its price has surged higher, it's still not a stretch to say that Ningbo Zhongbai's price-to-sales (or "P/S") ratio of 2.5x right now seems quite "middle-of-the-road" compared to the Multiline Retail industry in China, where the median P/S ratio is around 2.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Ningbo Zhongbai

How Ningbo Zhongbai Has Been Performing

As an illustration, revenue has deteriorated at Ningbo Zhongbai over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Ningbo Zhongbai, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Ningbo Zhongbai?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Ningbo Zhongbai's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 25%. Regardless, revenue has managed to lift by a handy 12% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 14% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that Ningbo Zhongbai's P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Ningbo Zhongbai's P/S?

Ningbo Zhongbai appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Ningbo Zhongbai's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Ningbo Zhongbai, and understanding should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Ningbo Zhongbai, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ningbo Zhongbai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600857

Flawless balance sheet unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives