Liuzhou Chemical Industry Leads This Trio Of Noteworthy Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer confidence and mixed economic signals, investors continue to seek opportunities for growth. Despite their vintage connotation, penny stocks remain a compelling area of interest due to their affordability and potential for significant returns. This article will explore several noteworthy penny stocks that stand out for their financial strength and potential in today's market conditions.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$140.36M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.05 | £772.37M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.88 | HK$42.73B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.948 | £149.54M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.355 | £172.56M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.62 | £69.04M | ★★★★☆☆ |

Click here to see the full list of 5,814 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Liuzhou Chemical Industry (SHSE:600423)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Liuzhou Chemical Industry Co., Ltd. is a company that produces and sells chemical fertilizers in China, with a market cap of CN¥2.35 billion.

Operations: The company generates revenue of CN¥178.44 million from its chemical industry segment.

Market Cap: CN¥2.35B

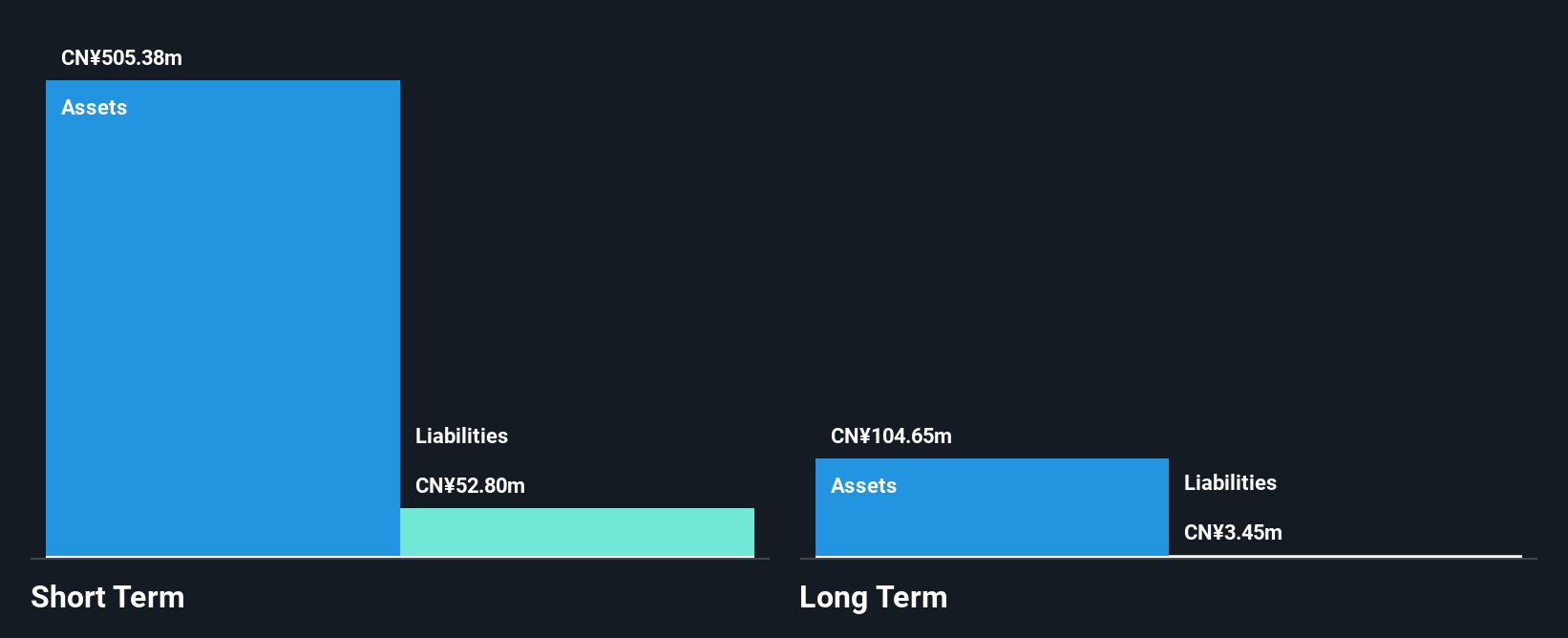

Liuzhou Chemical Industry has shown impressive financial performance with earnings growing by 381.3% over the past year, significantly outpacing the chemicals industry average. The company is debt-free, ensuring that interest coverage is not a concern, and its short-term assets comfortably exceed both short and long-term liabilities. Despite a low return on equity of 16.9%, Liuzhou's net profit margins have improved substantially from last year. The management team and board are experienced, contributing to stable operations without shareholder dilution in the past year. Additionally, its price-to-earnings ratio of 25.2x suggests it may be valued attractively compared to the broader Chinese market.

- Jump into the full analysis health report here for a deeper understanding of Liuzhou Chemical Industry.

- Evaluate Liuzhou Chemical Industry's historical performance by accessing our past performance report.

Lanzhou Lishang Guochao Industrial GroupLtd (SHSE:600738)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lanzhou Lishang Guochao Industrial Group Co., Ltd operates department stores in China and internationally, with a market cap of CN¥3.65 billion.

Operations: The company generates CN¥701.90 million in revenue from its operations in China.

Market Cap: CN¥3.65B

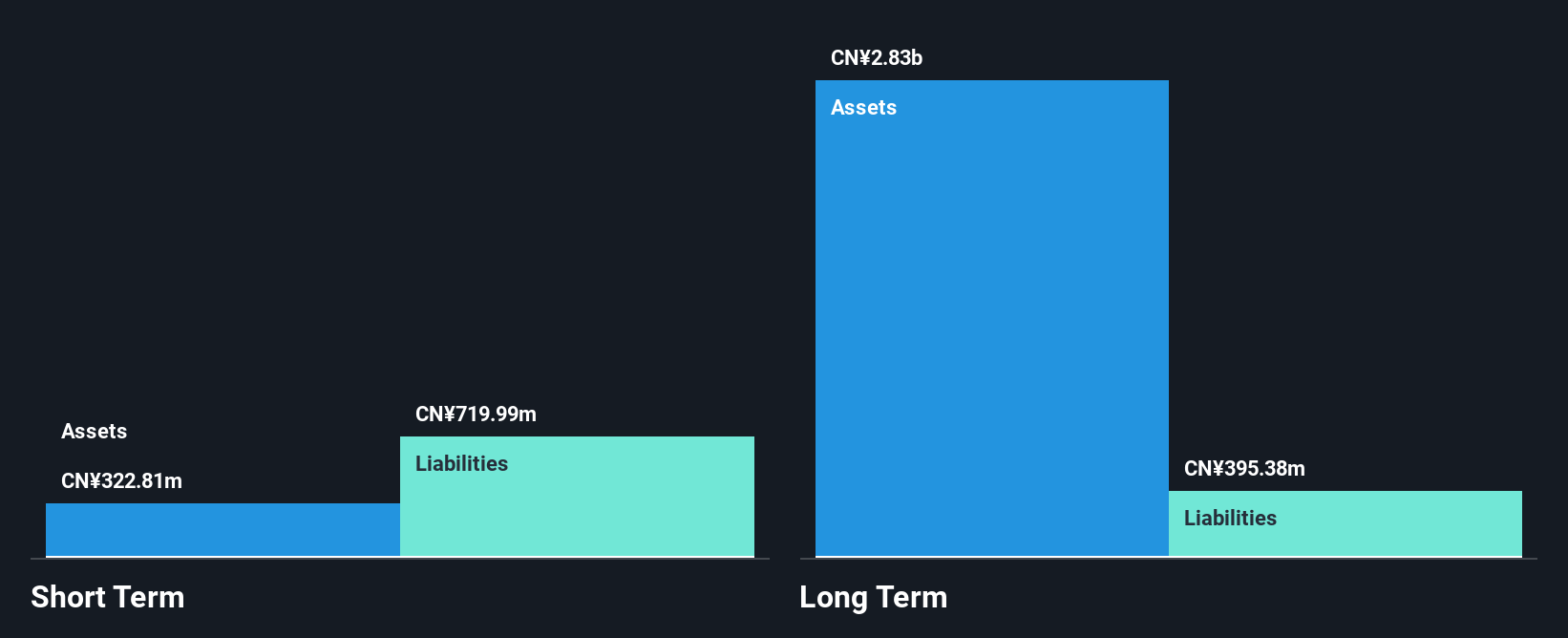

Lanzhou Lishang Guochao Industrial Group Co., Ltd has experienced a significant earnings growth of 166.5% over the past year, despite a decline in revenue from CN¥694.67 million to CN¥516.2 million for the nine months ending September 2024. The company's net income increased to CN¥107.48 million, reflecting improved profit margins from last year. While its debt level is satisfactory with a net debt to equity ratio of 22.9%, short-term assets do not cover liabilities, posing potential liquidity concerns. The management team is relatively inexperienced with an average tenure of 1.8 years, but the board remains seasoned and stable over time.

- Navigate through the intricacies of Lanzhou Lishang Guochao Industrial GroupLtd with our comprehensive balance sheet health report here.

- Understand Lanzhou Lishang Guochao Industrial GroupLtd's track record by examining our performance history report.

Shandong Polymer Biochemicals (SZSE:002476)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shandong Polymer Biochemicals Co., Ltd. produces and sells special chemicals for oil and gas exploitation both in China and internationally, with a market cap of CN¥2.58 billion.

Operations: No revenue segments have been reported for Shandong Polymer Biochemicals Co., Ltd.

Market Cap: CN¥2.58B

Shandong Polymer Biochemicals Co., Ltd. has shown a positive shift in profitability, reporting net income of CN¥23.37 million for the nine months ending September 2024, compared to a loss in the previous year. This improvement is partly due to a significant one-off gain of CN¥27.2 million impacting results. The company's financial health appears stable with short-term assets exceeding both short and long-term liabilities, and more cash than total debt, although its return on equity remains low at 3.2%. Recent transactions include Chengdu Dingsheng Tengda's acquisition of a 5.58% stake for approximately CN¥140 million, indicating investor interest despite an inexperienced board averaging just 0.7 years tenure.

- Click to explore a detailed breakdown of our findings in Shandong Polymer Biochemicals' financial health report.

- Gain insights into Shandong Polymer Biochemicals' past trends and performance with our report on the company's historical track record.

Next Steps

- Explore the 5,814 names from our Penny Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002476

Shandong Polymer Biochemicals

Produces and sells special chemicals for oil and gas exploitation in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives