- South Korea

- /

- Electrical

- /

- KOSE:A001440

Undiscovered Gems On None Exchange For November 2024

Reviewed by Simply Wall St

In a global market landscape marked by a busy earnings season and mixed economic signals, small-cap stocks have shown resilience, holding up better than their large-cap counterparts despite broader market declines. As investors navigate these turbulent times, the search for undiscovered gems becomes more pertinent, with opportunities arising from companies that demonstrate strong fundamentals and potential for growth amidst cautious macroeconomic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Thai Energy Storage Technology | 11.21% | -1.12% | 0.18% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Piccadily Agro Industries | 50.57% | 13.86% | 42.85% | ★★★★★☆ |

| Nibe | 39.26% | 80.75% | 84.69% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Petchsrivichai Enterprise | 31.46% | -14.18% | nan | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Taihan Cable & Solution (KOSE:A001440)

Simply Wall St Value Rating: ★★★★★☆

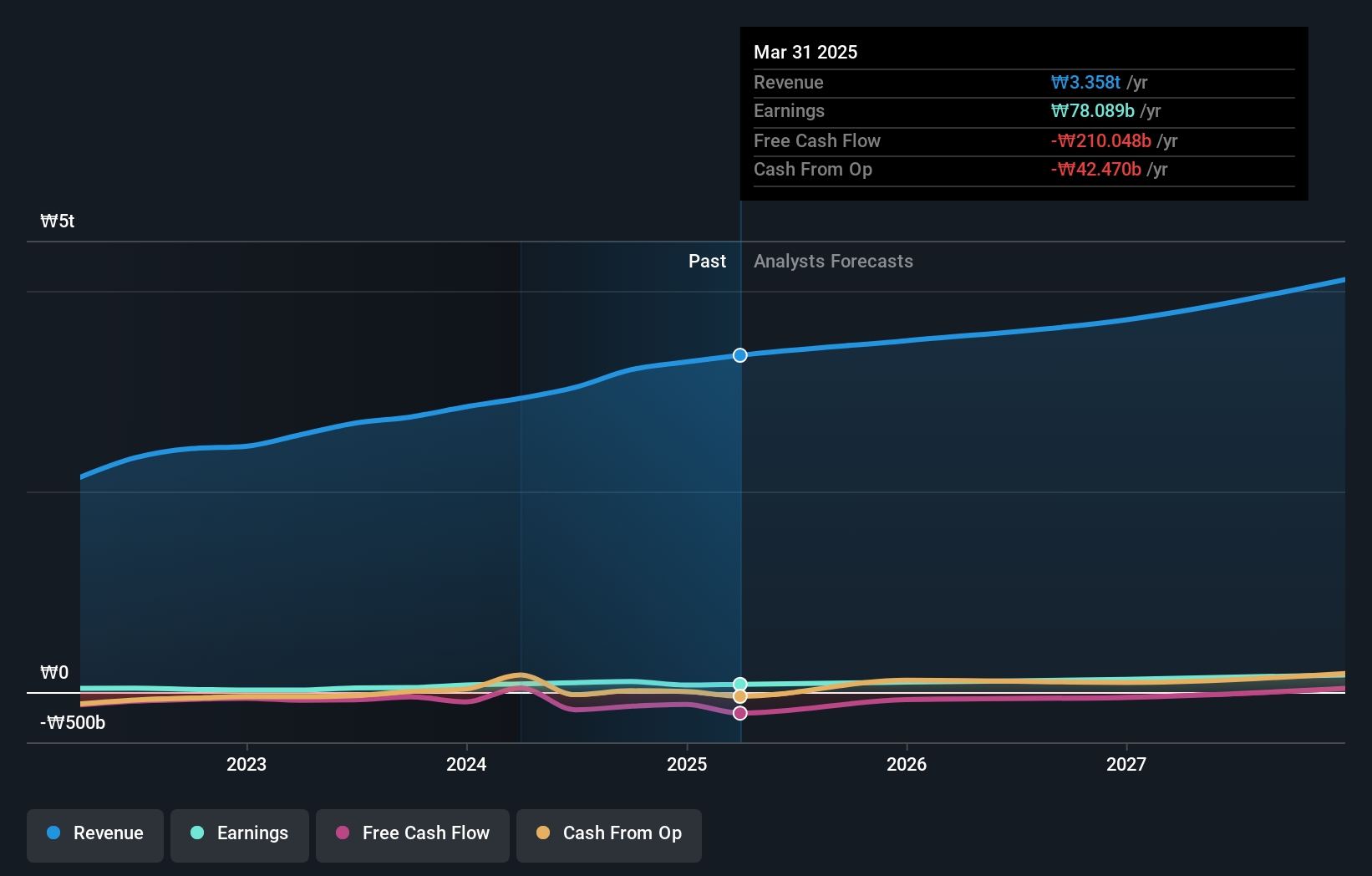

Overview: Taihan Cable & Solution Co., Ltd. manufactures, processes, and sells electric wires, cables, and related products worldwide with a market capitalization of ₩2.25 trillion.

Operations: The primary revenue stream for Taihan Cable & Solution comes from its wire segment, generating ₩3.42 billion. The company also records sales between divisions amounting to -₩380.13 million, impacting overall revenue figures.

Taihan Cable & Solution, a smaller player in the electrical industry, has shown impressive financial resilience and growth. Over the past year, earnings surged by 127%, outpacing the industry's 11.6% growth rate. The company's debt to equity ratio significantly improved from 203.6% to 30.2% over five years, indicating better leverage management. Despite this progress, shareholders faced substantial dilution recently. In recent reports for Q2 2024, net income rose sharply to KRW 24,879 million from KRW 12,816 million last year while sales dipped slightly to KRW 8,823 million from KRW 9,748 million a year ago.

- Take a closer look at Taihan Cable & Solution's potential here in our health report.

Evaluate Taihan Cable & Solution's historical performance by accessing our past performance report.

Dashang (SHSE:600694)

Simply Wall St Value Rating: ★★★★★★

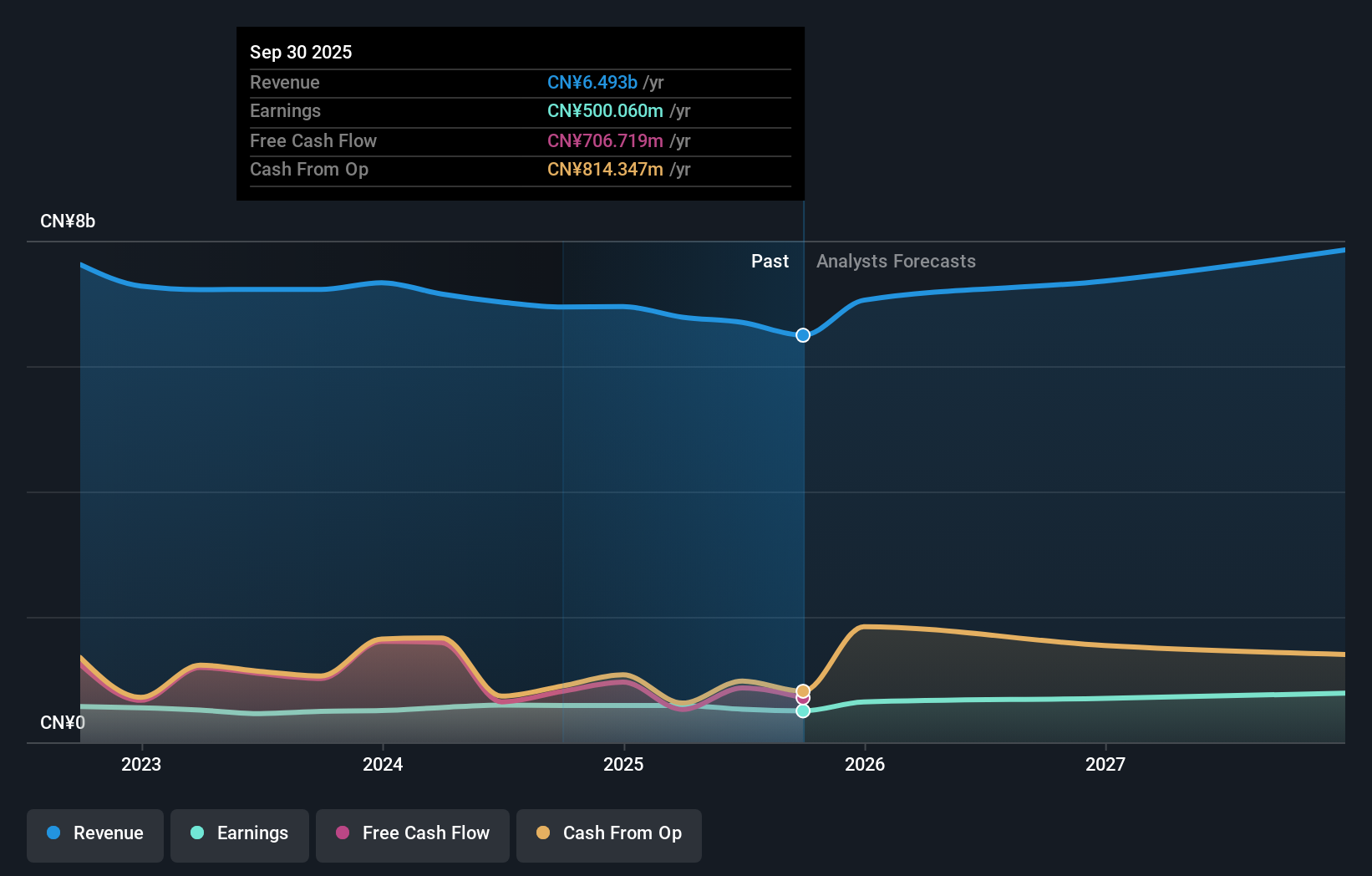

Overview: Dashang Co., Ltd. operates a chain of department stores, supermarkets, and electrical appliance stores in China with a market cap of CN¥5.96 billion.

Operations: Dashang generates revenue primarily through its department stores, supermarkets, and electrical appliance stores in China. The company's cost structure includes expenses related to retail operations and inventory management. Net profit margin trends indicate fluctuations over recent periods.

Dashang, a relatively compact player in the retail scene, shows promising financial health with no debt and earnings growth of 18.8% over the past year, surpassing its industry peers who saw a -5.9% change. The company trades at 32.5% below its estimated fair value, suggesting potential for investment upside. For the nine months ending September 2024, Dashang reported net income of CNY 531 million compared to CNY 450 million in the previous year, reflecting solid profitability despite sales dipping from CNY 5,675 million to CNY 5,288 million. This performance is bolstered by high-quality earnings and positive free cash flow trends.

- Navigate through the intricacies of Dashang with our comprehensive health report here.

Explore historical data to track Dashang's performance over time in our Past section.

Suzhou Anjie Technology (SZSE:002635)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou Anjie Technology Co., Ltd. focuses on the research, development, production, and sale of intelligent terminal components both in China and internationally, with a market cap of CN¥10.34 billion.

Operations: Suzhou Anjie Technology generates revenue primarily from the sale of intelligent terminal components. The company has a market capitalization of CN¥10.34 billion.

Anjie Technology is making waves with its earnings growth, surpassing the Electrical industry by a significant margin of 20% over the past year. Despite a rise in its debt to equity ratio from 0.7% to 11% over five years, it remains financially stable with more cash than total debt and no issues covering interest payments. Recent reports show sales climbing to CNY 3.59 billion for nine months ending September 2024, up from CNY 3.07 billion last year, though net income dipped slightly to CNY 221 million from CNY 237 million. Earnings per share stayed steady at CNY 0.34 compared to last year’s figures.

- Click to explore a detailed breakdown of our findings in Suzhou Anjie Technology's health report.

Assess Suzhou Anjie Technology's past performance with our detailed historical performance reports.

Summing It All Up

- Click through to start exploring the rest of the 4699 Undiscovered Gems With Strong Fundamentals now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taihan Cable & Solution might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A001440

Taihan Cable & Solution

Manufactures, processes, and sells electric wires, cables, and related products worldwide.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives