- China

- /

- Auto Components

- /

- SHSE:603210

Exploring Undiscovered Global Gems In April 2025

Reviewed by Simply Wall St

In the wake of recent tariff announcements by the Trump administration, global markets have experienced significant volatility, with small-cap stocks particularly affected as evidenced by a sharp decline in the Russell 2000 Index. Amidst this turbulent environment, investors are increasingly seeking opportunities in lesser-known stocks that may offer resilience and potential growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 9.41% | 15.39% | 13.20% | ★★★★★★ |

| Indofood Agri Resources | 30.05% | 2.36% | 41.87% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | 0.57% | 18.65% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.77% | -3.48% | -12.95% | ★★★★★★ |

| Tai Sin Electric | 28.69% | 9.56% | 4.66% | ★★★★★☆ |

| Time Interconnect Technology | 78.17% | 24.96% | 19.51% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Holly Futures | 2.30% | 18.13% | -25.64% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Dashang (SHSE:600694)

Simply Wall St Value Rating: ★★★★★★

Overview: Dashang Co., Ltd. operates a chain of department stores, supermarkets, and electrical appliance stores in China with a market cap of CN¥7.83 billion.

Operations: The company derives its revenue primarily from its chain of department stores, supermarkets, and electrical appliance stores. Its financial performance is influenced by various cost components associated with operating these retail outlets. The net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and market conditions.

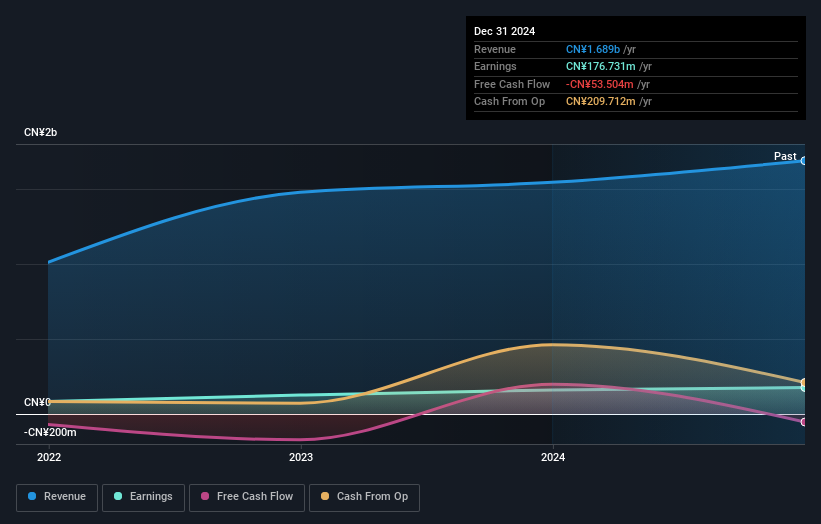

Dashang, a promising player in the retail sector, stands out with an 18.8% earnings growth over the past year, surpassing its industry peers who saw a -7.5% change. This debt-free company has reduced its debt to equity ratio from 11% five years ago to zero today, reflecting strong financial management. Trading at 3.3% below estimated fair value suggests potential for investors seeking undervalued opportunities. With high-quality earnings and positive free cash flow, Dashang appears poised for continued growth, supported by forecasts of an 8.49% annual increase in earnings and a recent shareholders meeting indicating active corporate governance engagement.

Zhejiang Tion Vanly Tech (SHSE:603210)

Simply Wall St Value Rating: ★★★★☆☆

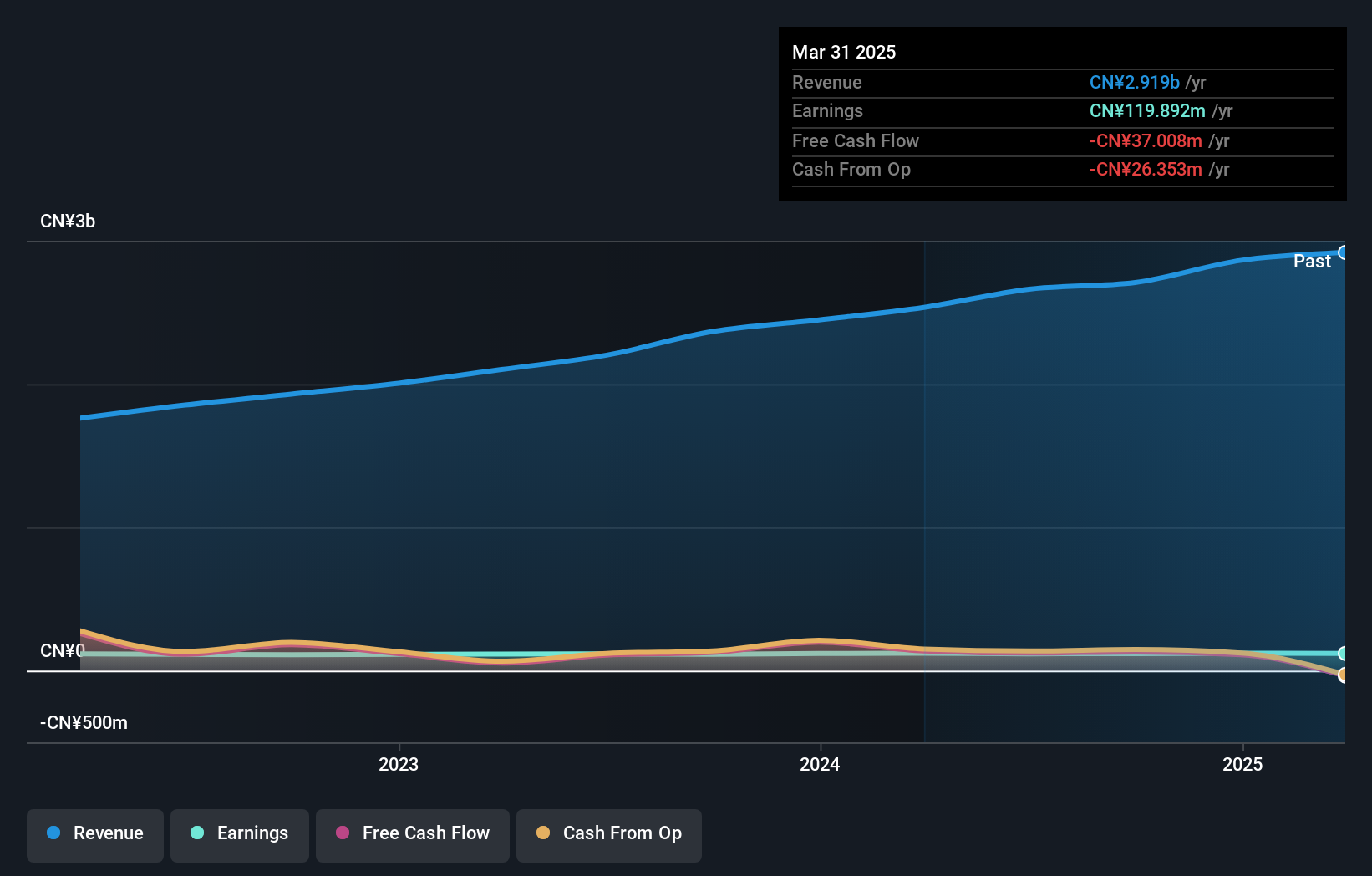

Overview: Zhejiang Tion Vanly Tech. Co., Ltd. focuses on the research, development, production, sales, and service of automotive stamping and welded structural parts and small assembly functional parts for vehicle manufacturers in China with a market capitalization of CN¥2.93 billion.

Operations: Tion Vanly Tech generates revenue primarily from the sale of automotive stamping and welded structural parts, along with small assembly functional parts for vehicle manufacturers. The company's financial performance is reflected in its market capitalization of CN¥2.93 billion.

Zhejiang Tion Vanly Tech recently made waves with its IPO, raising CNY 731.86 million. The company is trading at a notable 48.3% below its estimated fair value, presenting potential upside for investors. With earnings growth of 27.1% over the past year, it has outpaced the Auto Components industry average of 10.2%. Its net debt to equity ratio stands at a satisfactory 33%, and interest payments are well-covered by EBIT at a multiple of 12 times. Despite these strengths, shares remain highly illiquid, which could pose challenges for some investors seeking liquidity in their investments.

- Dive into the specifics of Zhejiang Tion Vanly Tech here with our thorough health report.

Evaluate Zhejiang Tion Vanly Tech's historical performance by accessing our past performance report.

Shenzhen SDG ServiceLtd (SZSE:300917)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen SDG Service Co., Ltd. offers property management services in China and has a market capitalization of CN¥6.93 billion.

Operations: The company generates revenue primarily from property management services in China. It has a market capitalization of CN¥6.93 billion.

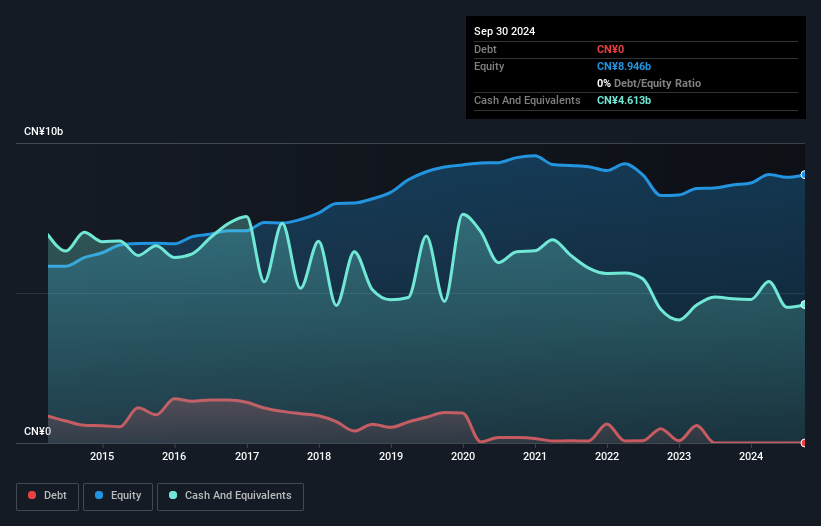

Shenzhen SDG Service Ltd. showcases resilience with a notable 3.3% earnings growth over the past year, outpacing the broader Real Estate sector's -40.1%. The company enjoys a debt-free status, highlighting its financial health and eliminating concerns over interest coverage. Free cash flow remains positive, reaching A$130.69 million as of September 2024, indicating effective cash management despite capital expenditures of A$16.19 million in the same period. However, investors should be cautious of its highly volatile share price in recent months which might impact short-term confidence but long-term prospects appear promising given its high-quality earnings profile.

Make It Happen

- Click this link to deep-dive into the 3190 companies within our Global Undiscovered Gems With Strong Fundamentals screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Tion Vanly Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603210

Zhejiang Tion Vanly Tech

Engages in the research, development, production, sells, and service of automotive stamping and welded structural parts and small assembly functional parts for vehicle manufacturers in China.

Excellent balance sheet with questionable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)