- China

- /

- General Merchandise and Department Stores

- /

- SHSE:600693

Do These 3 Checks Before Buying Fujian Dongbai (Group) Co.,Ltd. (SHSE:600693) For Its Upcoming Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Fujian Dongbai (Group) Co.,Ltd. (SHSE:600693) is about to go ex-dividend in just 2 days. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. In other words, investors can purchase Fujian Dongbai (Group)Ltd's shares before the 4th of July in order to be eligible for the dividend, which will be paid on the 4th of July.

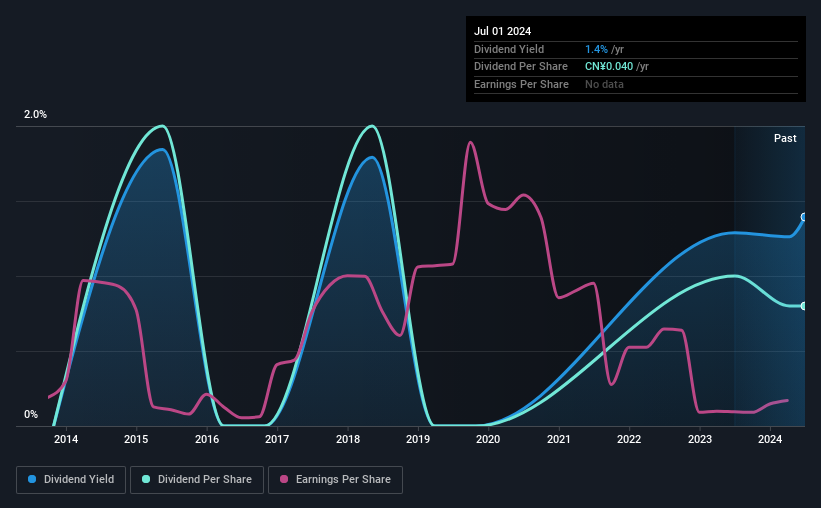

The company's upcoming dividend is CN¥0.04 a share, following on from the last 12 months, when the company distributed a total of CN¥0.04 per share to shareholders. Last year's total dividend payments show that Fujian Dongbai (Group)Ltd has a trailing yield of 1.4% on the current share price of CN¥2.87. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. As a result, readers should always check whether Fujian Dongbai (Group)Ltd has been able to grow its dividends, or if the dividend might be cut.

View our latest analysis for Fujian Dongbai (Group)Ltd

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Its dividend payout ratio is 86% of profit, which means the company is paying out a majority of its earnings. The relatively limited profit reinvestment could slow the rate of future earnings growth. It could become a concern if earnings started to decline. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It paid out 104% of its free cash flow in the form of dividends last year, which is outside the comfort zone for most businesses. Cash flows are usually much more volatile than earnings, so this could be a temporary effect - but we'd generally want to look more closely here.

Fujian Dongbai (Group)Ltd paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Were this to happen repeatedly, this would be a risk to Fujian Dongbai (Group)Ltd's ability to maintain its dividend.

Click here to see how much of its profit Fujian Dongbai (Group)Ltd paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. Fujian Dongbai (Group)Ltd's earnings per share have plummeted approximately 31% a year over the previous five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Fujian Dongbai (Group)Ltd has seen its dividend decline 9.7% per annum on average over the past nine years, which is not great to see. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

Final Takeaway

From a dividend perspective, should investors buy or avoid Fujian Dongbai (Group)Ltd? It's definitely not great to see earnings per share shrinking. The company paid out an acceptable percentage of its income, but an uncomfortably high percentage of its cash flow over the past year. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

With that being said, if you're still considering Fujian Dongbai (Group)Ltd as an investment, you'll find it beneficial to know what risks this stock is facing. For example, Fujian Dongbai (Group)Ltd has 3 warning signs (and 2 which make us uncomfortable) we think you should know about.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600693

Fujian Dongbai (Group)Ltd

Engages in the retail and warehousing and logistics business in China.

Slight unattractive dividend payer.