As global markets react to the Federal Reserve's first rate cut in over four years, U.S. stocks have surged to new highs, with small-cap indexes showing notable resilience despite remaining below their historical peaks. This optimistic sentiment creates a favorable backdrop for high-growth tech stocks, which often thrive in environments of lower borrowing costs and robust consumer confidence. In this context, selecting a good stock involves identifying companies that not only exhibit strong growth potential but also demonstrate the ability to capitalize on current economic conditions and market trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.80% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 1297 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Lens Technology (SZSE:300433)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lens Technology Co., Ltd. engages in the production and sale of electronic components in China and has a market cap of CN¥79.35 billion.

Operations: Lens Technology generates revenue primarily from the production and sale of electronic components, totaling CN¥63.18 billion. The company's operations are focused on this singular segment, reflecting its core business model.

Lens Technology has demonstrated a robust pattern in its financial performance, notably with a 23% annual earnings growth forecast, outpacing the broader Chinese market's 22.9%. This growth is supported by significant R&D investments, which have been crucial for maintaining technological leadership and driving innovation. In the first half of 2024 alone, Lens Technology reported substantial revenue growth to CNY 28.87 billion from CNY 20.18 billion in the previous year, underscoring a strong market demand for their products. Moreover, recent events such as their presentation at the Macquarie Asia TMT Conference highlight their active engagement with industry stakeholders and potential investors. The company's strategic focus on expanding its tech capabilities through increased R&D expenses — which are not just sustaining but enhancing product offerings — positions it well for future opportunities despite forecasts of relatively lower return on equity at 10.2% in three years' time compared to current standards.

- Navigate through the intricacies of Lens Technology with our comprehensive health report here.

Examine Lens Technology's past performance report to understand how it has performed in the past.

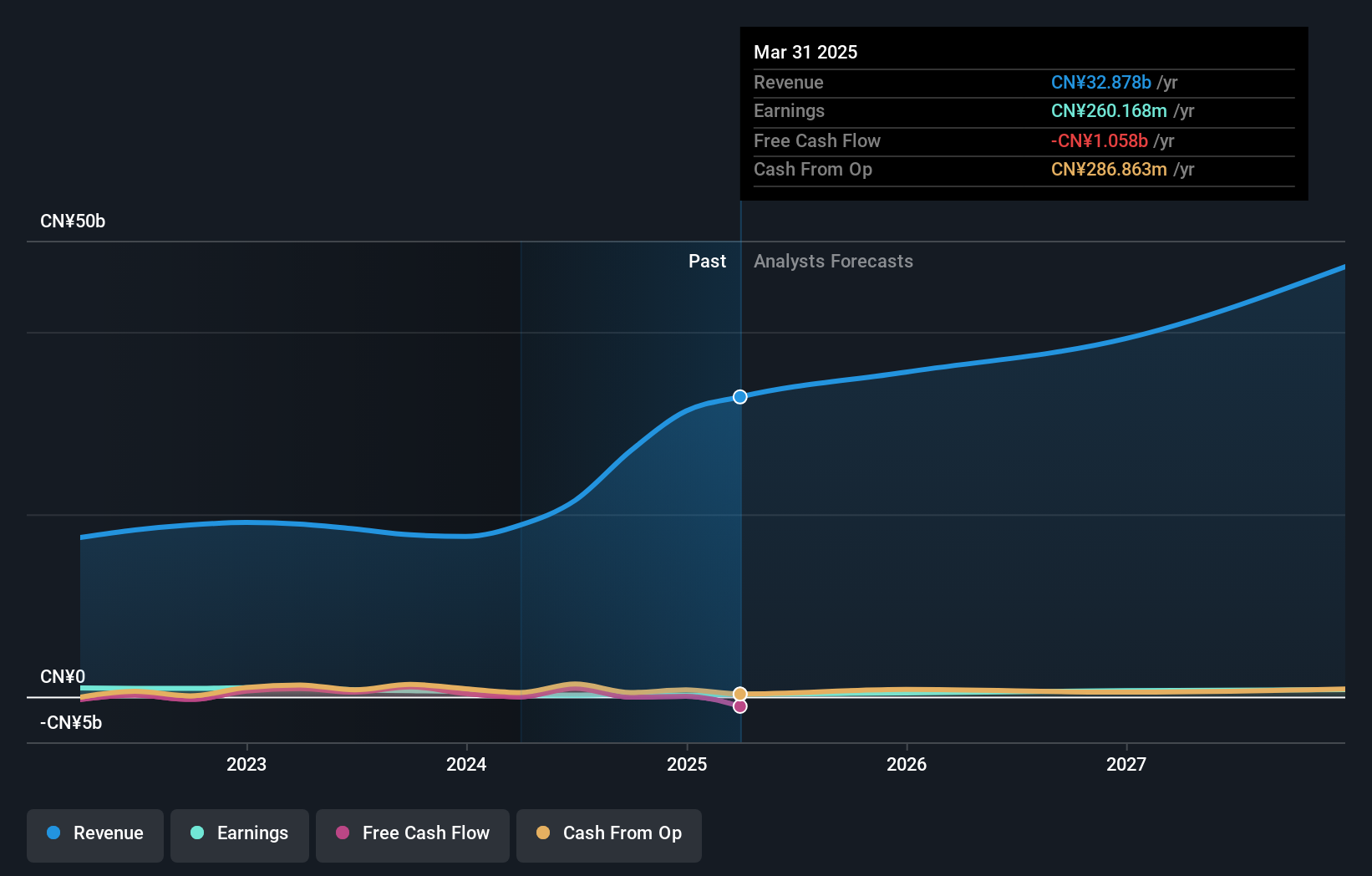

iSoftStone Information Technology (Group) (SZSE:301236)

Simply Wall St Growth Rating: ★★★★★☆

Overview: iSoftStone Information Technology (Group) Co., Ltd. (SZSE:301236) specializes in providing IT services and solutions, with a market cap of CN¥34.91 billion.

Operations: iSoftStone generates revenue primarily from its IT services and solutions. The company operates with a market cap of CN¥34.91 billion.

iSoftStone Information Technology (Group) has navigated a challenging landscape with its recent financial performance reflecting a shift. Despite a substantial increase in revenue, up to CNY 12.53 billion from CNY 8.58 billion year-over-year, the company faced a net loss of CNY 154.33 million compared to a profit previously, highlighting volatility in its earnings trajectory. This contrast underscores the importance of their strategic R&D investments which have surged by 22.3%, aligning with an industry trend towards bolstering technological capabilities to foster innovation and maintain competitive edges in rapidly evolving markets. Moreover, the company's aggressive focus on expanding its tech footprint is evident from its expected annual earnings growth rate of 47%, signaling robust future prospects despite current financial discrepancies.

- Unlock comprehensive insights into our analysis of iSoftStone Information Technology (Group) stock in this health report.

Understand iSoftStone Information Technology (Group)'s track record by examining our Past report.

International Games SystemLtd (TPEX:3293)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Games System Co., Ltd. engages in planning, designing, researching, developing, manufacturing, marketing, servicing, and licensing arcade, online, and mobile games primarily in Taiwan, the United Kingdom, and China with a market cap of NT$239.53 billion.

Operations: The company generates revenue primarily from its Online Games Division (NT$8.99 billion) and Business Game Division (NT$7.13 billion). Its operations span planning, designing, researching, developing, manufacturing, marketing, servicing, and licensing games across multiple platforms in Taiwan, the UK, and China.

International Games SystemLtd. has demonstrated robust financial performance, with a significant uptick in sales reaching TWD 8.75 billion, up from TWD 6.80 billion year-over-year, and net income surging to TWD 4.31 billion from TWD 3.11 billion in the same period. This growth trajectory is underscored by its strategic R&D investments which have effectively supported its expansion within the tech sector, aligning with broader industry trends that prioritize innovation through substantial R&D efforts to stay competitive in fast-evolving markets like gaming and digital entertainment. Moreover, the company's recent inclusion in the FTSE All-World Index underscores its rising prominence on a global scale, enhancing its visibility among international investors and potentially bolstering future growth prospects as it continues to outpace average market revenue growth projections by nearly double at an expected rate of 20.6% annually.

Taking Advantage

- Navigate through the entire inventory of 1297 High Growth Tech and AI Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iSoftStone Information Technology (Group) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301236

iSoftStone Information Technology (Group)

iSoftStone Information Technology (Group) Co., Ltd.

High growth potential with excellent balance sheet.