- China

- /

- Retail Distributors

- /

- SHSE:600415

Here's Why We Think Zhejiang China Commodities City Group (SHSE:600415) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Zhejiang China Commodities City Group (SHSE:600415). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Zhejiang China Commodities City Group

How Quickly Is Zhejiang China Commodities City Group Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Zhejiang China Commodities City Group's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 37%. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Zhejiang China Commodities City Group's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Zhejiang China Commodities City Group shareholders can take confidence from the fact that EBIT margins are up from 9.0% to 23%, and revenue is growing. Both of which are great metrics to check off for potential growth.

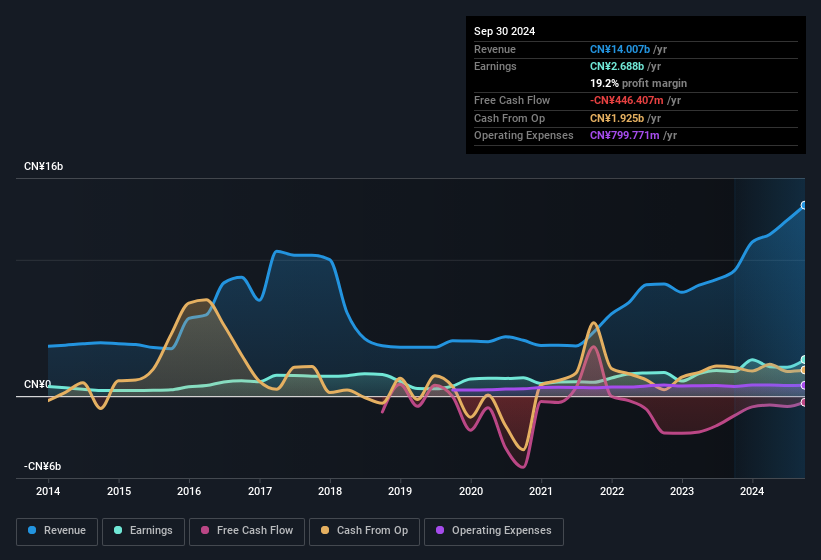

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Zhejiang China Commodities City Group.

Are Zhejiang China Commodities City Group Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalisations between CN¥29b and CN¥87b, like Zhejiang China Commodities City Group, the median CEO pay is around CN¥1.9m.

The CEO of Zhejiang China Commodities City Group only received CN¥508k in total compensation for the year ending December 2023. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Zhejiang China Commodities City Group Worth Keeping An Eye On?

Zhejiang China Commodities City Group's earnings have taken off in quite an impressive fashion. With increasing profits, its seems likely the business has a rosy future; and it may have hit an inflection point. At the same time the reasonable CEO compensation reflects well on the board of directors. It will definitely require further research to be sure, but it does seem that Zhejiang China Commodities City Group has the hallmarks of a quality business; and that would make it well worth watching. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Zhejiang China Commodities City Group that you should be aware of.

Although Zhejiang China Commodities City Group certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang China Commodities City Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600415

Zhejiang China Commodities City Group

Through its subsidiaries, engages in the development, management, operation, and service of an online trading platform in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives