- South Korea

- /

- Machinery

- /

- KOSE:A064350

Global Market Insights On 3 Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

In the midst of escalating trade tensions and volatile market conditions, global indices have experienced significant fluctuations, with U.S. stocks rebounding after a tumultuous week marked by tariff announcements. Amidst this uncertainty, identifying stocks that are trading below their fair value can offer potential opportunities for investors seeking to navigate these challenging times.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alexander Marine (TWSE:8478) | NT$140.00 | NT$279.61 | 49.9% |

| RACCOON HOLDINGS (TSE:3031) | ¥858.00 | ¥1705.49 | 49.7% |

| Nishi-Nippon Financial Holdings (TSE:7189) | ¥1849.00 | ¥3655.43 | 49.4% |

| LPP (WSE:LPP) | PLN15300.00 | PLN30532.59 | 49.9% |

| Hyundai Rotem (KOSE:A064350) | ₩104900.00 | ₩209201.36 | 49.9% |

| People & Technology (KOSDAQ:A137400) | ₩39250.00 | ₩76934.18 | 49% |

| Micro-Star International (TWSE:2377) | NT$133.00 | NT$265.46 | 49.9% |

| Net Insight (OM:NETI B) | SEK4.58 | SEK9.05 | 49.4% |

| giftee (TSE:4449) | ¥1483.00 | ¥2946.17 | 49.7% |

| Wall to Wall Group (OM:WTW A) | SEK56.00 | SEK111.38 | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Hyundai Rotem (KOSE:A064350)

Overview: Hyundai Rotem Company manufactures and sells railway vehicles, defense systems, and plants and machinery both in South Korea and internationally, with a market cap of ₩11.12 billion.

Operations: The company's revenue is derived from three main segments: Rail Solution at ₩1.50 billion, Defense Solution at ₩2.37 billion, and Plant Segment at ₩515.79 million.

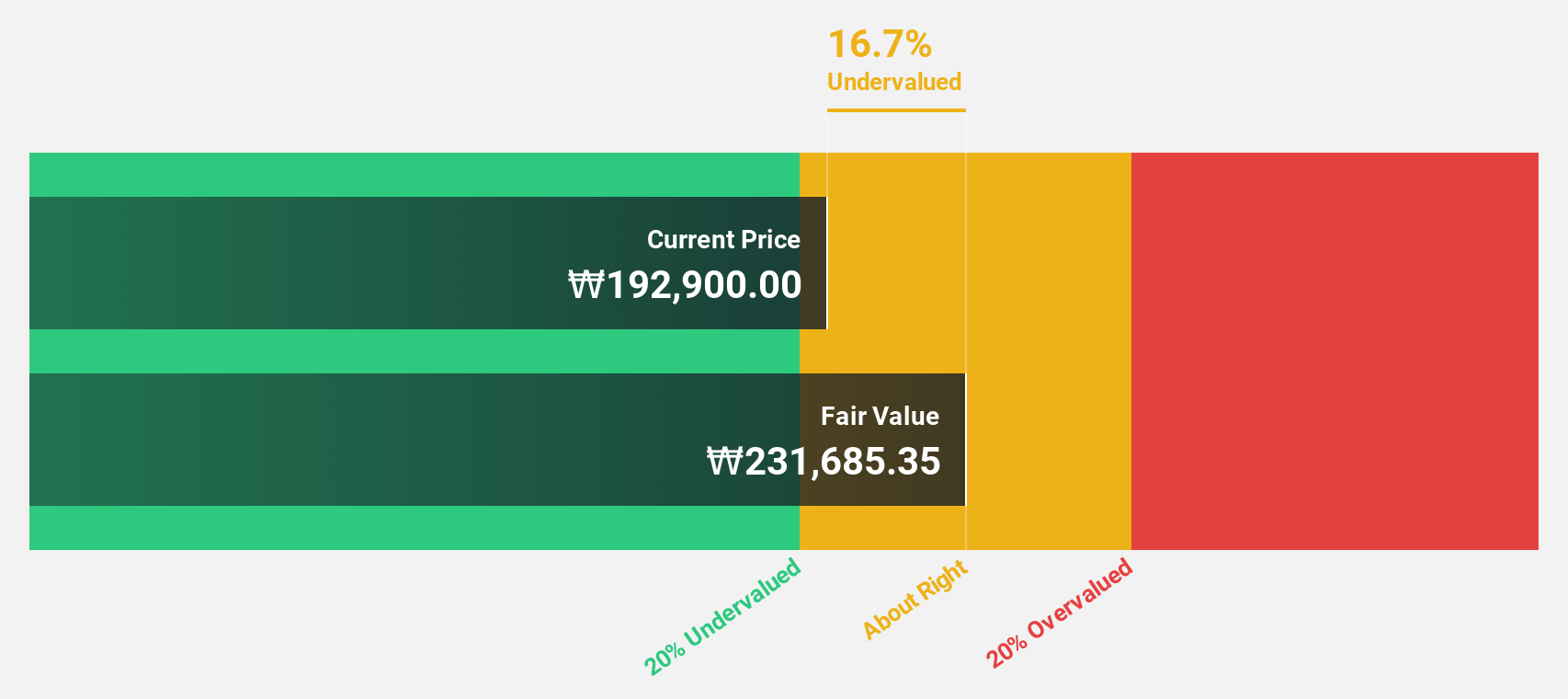

Estimated Discount To Fair Value: 49.9%

Hyundai Rotem is trading 49.9% below its estimated fair value of ₩209,201.36, making it significantly undervalued based on cash flows. The company reported robust earnings growth of 152.7% last year and forecasts indicate a continued annual profit growth rate of 25.6%, outpacing the KR market's expected growth. Despite high share price volatility, Hyundai Rotem's revenue is projected to grow at 13.5% annually, surpassing the broader market's rate of 7.5%.

- The growth report we've compiled suggests that Hyundai Rotem's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Hyundai Rotem stock in this financial health report.

Zhejiang China Commodities City Group (SHSE:600415)

Overview: Zhejiang China Commodities City Group Co., Ltd. operates an online trading platform in China, focusing on development and management services, with a market cap of CN¥78.91 billion.

Operations: The company generates revenue primarily through the development, management, and operation of an online trading platform in China.

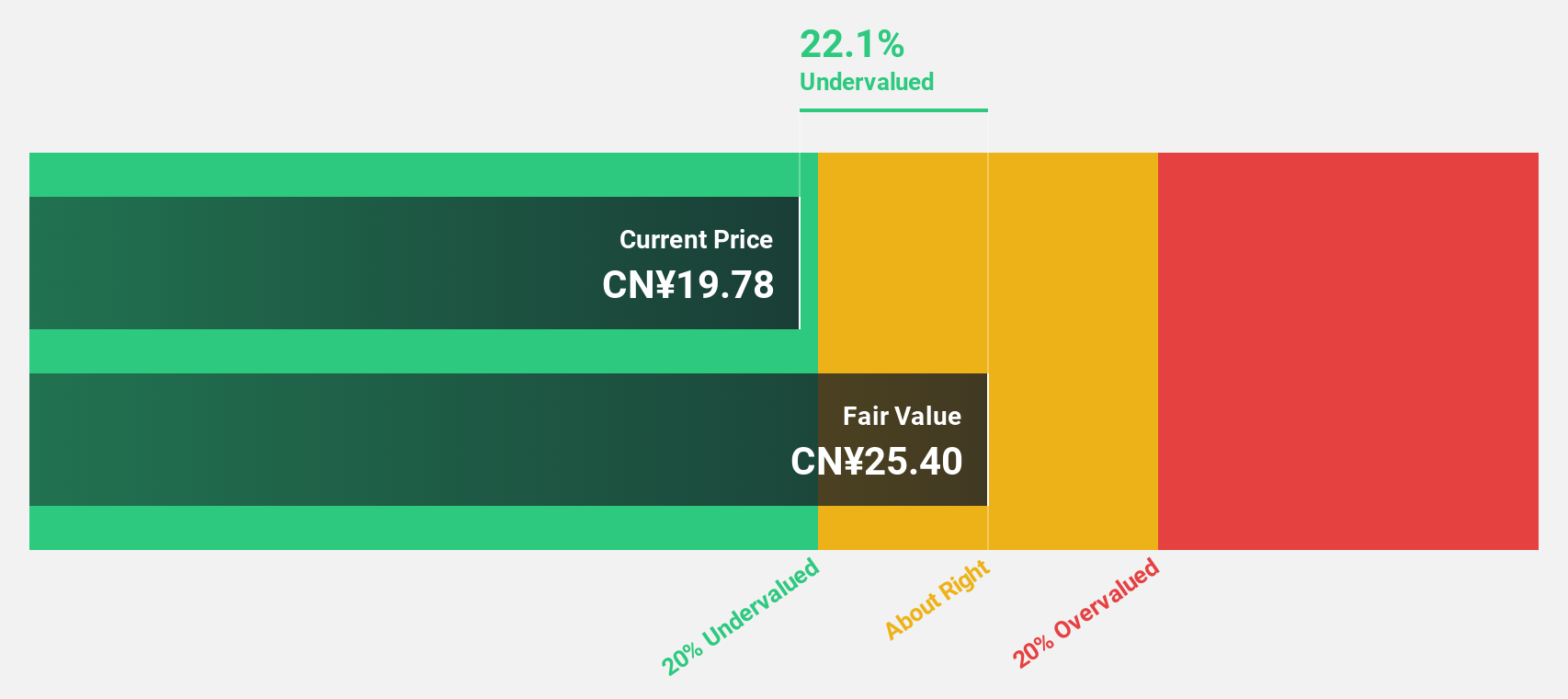

Estimated Discount To Fair Value: 38.5%

Zhejiang China Commodities City Group, trading at CN¥14.81, is undervalued against its fair value estimate of CN¥24.10, with a recent earnings growth of 46%. Analysts forecast continued strong earnings growth at 26.82% annually, outpacing the Chinese market's average. Despite an unstable dividend history, the company's revenue and net income have shown robust year-over-year increases in recent quarters, reinforcing its potential as an undervalued investment based on cash flows.

- Our expertly prepared growth report on Zhejiang China Commodities City Group implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Zhejiang China Commodities City Group with our comprehensive financial health report here.

HOYA (TSE:7741)

Overview: HOYA Corporation is a med-tech company that offers high-tech and medical products globally, with a market cap of ¥5.13 trillion.

Operations: The company's revenue is primarily generated from its Life Care segment, contributing ¥547.68 billion, and its Information Technology segment, contributing ¥294.89 billion.

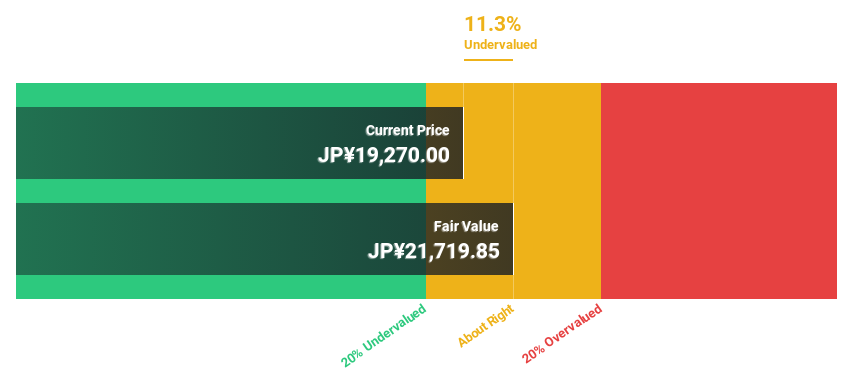

Estimated Discount To Fair Value: 25.8%

HOYA, trading at ¥15,235, is undervalued relative to its fair value estimate of ¥20,532.44. The company recently completed a share buyback program worth ¥49.99 billion to enhance shareholder returns and capital efficiency. With earnings growth projected at 10.9% annually and revenue growth surpassing the JP market average, HOYA's strong cash flow position makes it an attractive consideration for investors seeking undervalued opportunities based on cash flows.

- Our earnings growth report unveils the potential for significant increases in HOYA's future results.

- Click to explore a detailed breakdown of our findings in HOYA's balance sheet health report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 479 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hyundai Rotem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A064350

Hyundai Rotem

Manufactures and sells railway vehicles, defense systems, and plants and machinery in South Korea and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives