As global markets navigate a mix of economic indicators, including declining consumer confidence and fluctuating manufacturing data, small-cap stocks have shown resilience with moderate gains in key indices like the S&P 600. In this dynamic environment, identifying promising small-cap companies requires an eye for those with strong fundamentals and potential growth opportunities that can thrive amid broader market shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 9.82% | 7.91% | 12.42% | ★★★★★★ |

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Nanjing Well Pharmaceutical GroupLtd (SHSE:603351)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nanjing Well Pharmaceutical Group Co., Ltd. is a company engaged in the pharmaceutical industry with a market cap of CN¥3.24 billion.

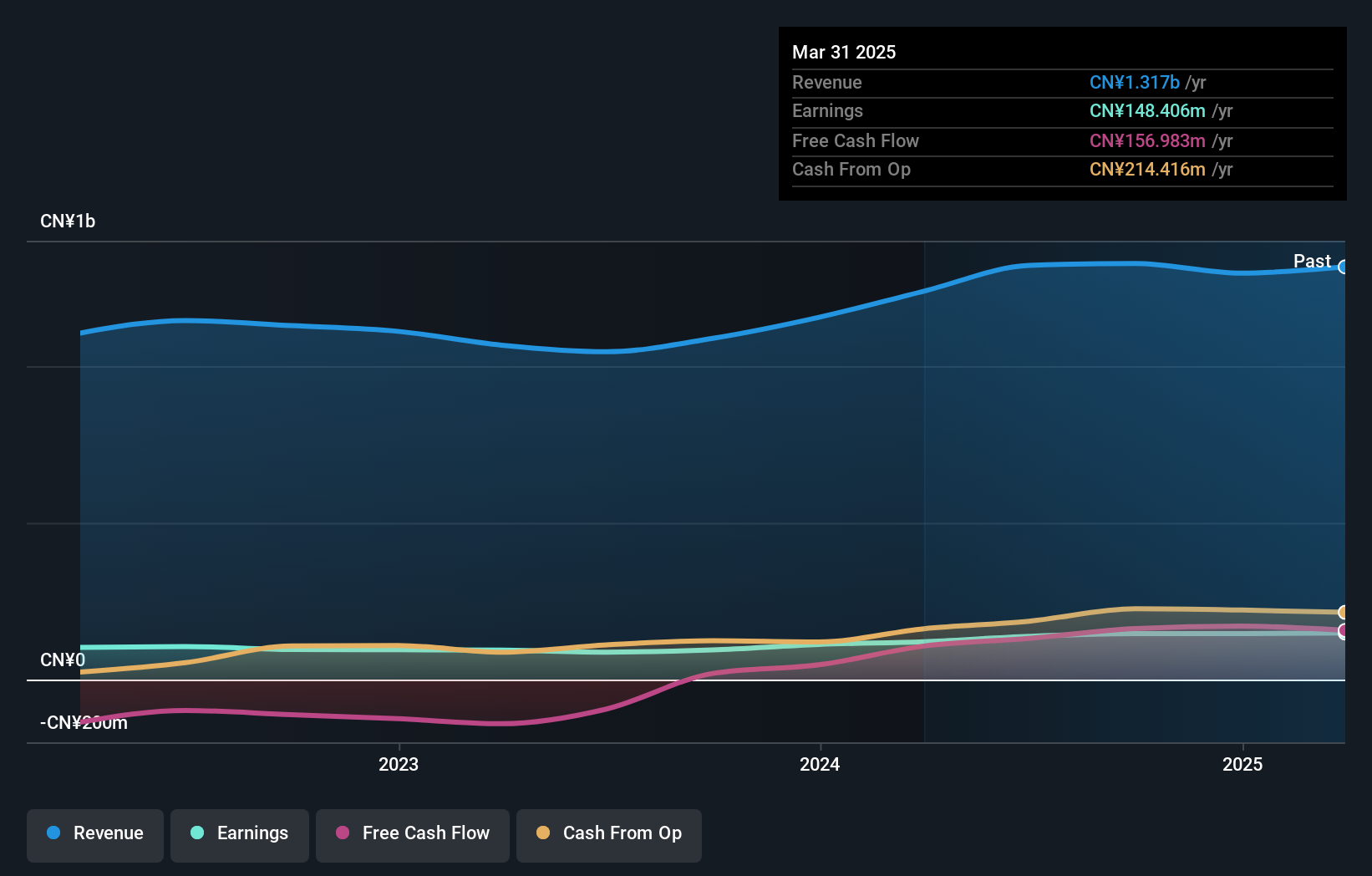

Operations: The company's primary revenue streams are derived from its pharmaceutical products. It reported a net profit margin of 15.2%, indicating efficient cost management relative to its revenue generation.

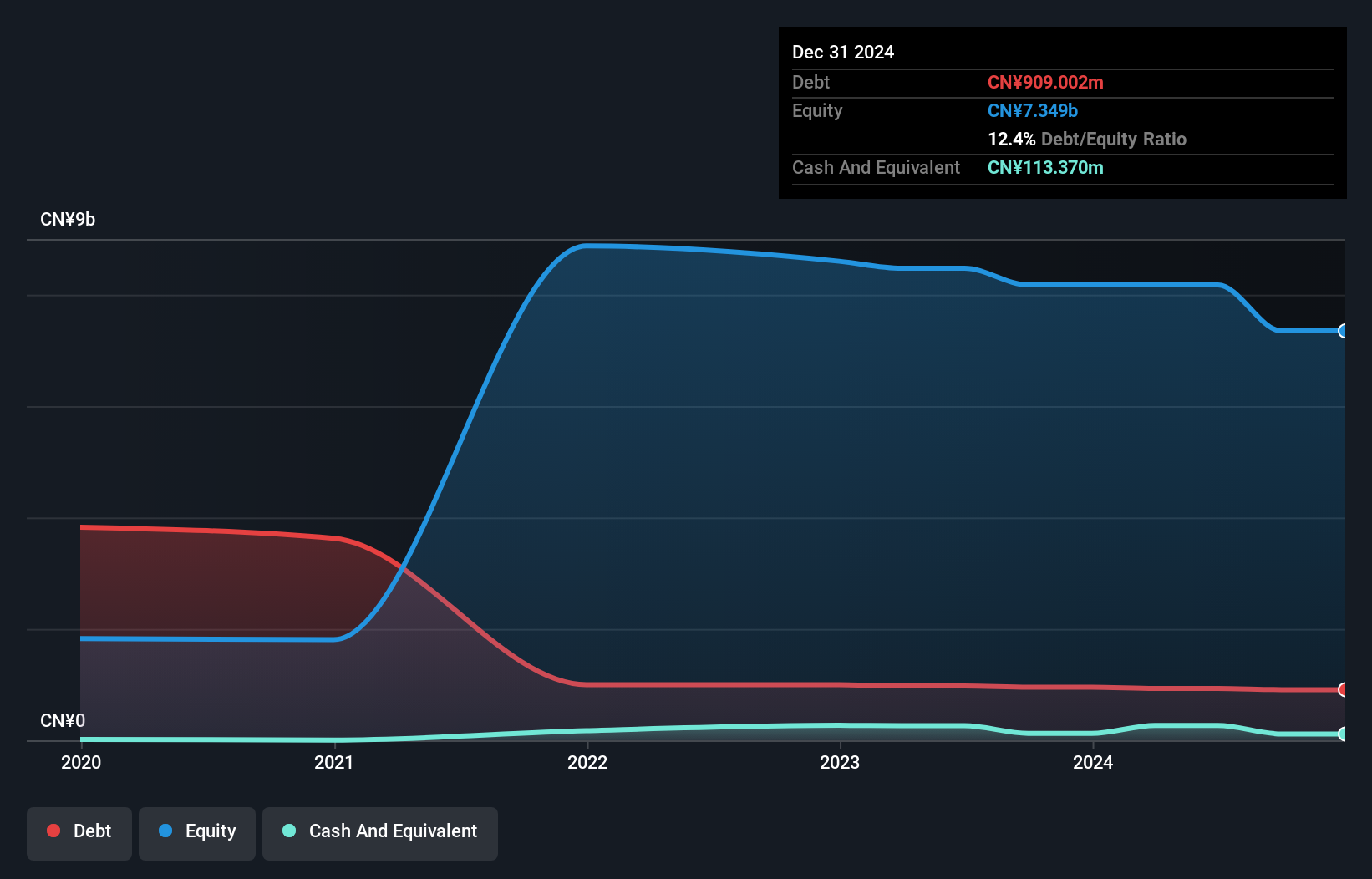

Nanjing Well Pharmaceutical Group seems to be an intriguing player in the pharmaceutical sector, showing a notable earnings growth of 55% over the past year, outpacing the broader chemicals industry. The company's debt to equity ratio has risen from 8.4% to 25.3% over five years, yet it remains satisfactory with interest payments well covered at 12 times by EBIT. Recent financials reveal sales of CNY 1 billion for nine months ended September 2024, up from CNY 828.68 million a year prior, and net income climbing to CNY 112.9 million from CNY 78.27 million previously, reflecting its robust performance in this period.

- Unlock comprehensive insights into our analysis of Nanjing Well Pharmaceutical GroupLtd stock in this health report.

Learn about Nanjing Well Pharmaceutical GroupLtd's historical performance.

Ping An Guangzhou Comm Invest Guanghe Expressway (SZSE:180201)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ping An Guangzhou Comm Invest Guanghe Expressway Close-end Infrastructure Fund operates as an infrastructure fund with a market capitalization of CN¥6.43 billion.

Operations: The fund generates revenue primarily from its transportation infrastructure segment, amounting to CN¥772.26 million.

Ping An Guangzhou Comm Invest Guanghe Expressway, a relatively smaller player in its sector, has shown impressive earnings growth of 76% over the past year, outpacing the Specialized REITs industry average of 8%. Trading at nearly 59% below estimated fair value suggests potential undervaluation. The company's net debt to equity ratio stands at a satisfactory 8%, indicating prudent financial management. Its interest payments are comfortably covered by EBIT at 8.8 times, reflecting strong operational performance. Additionally, it remains free cash flow positive and recently declared a cash dividend of CNY0.38 per share for December 2024.

Gloria Material Technology (TPEX:5009)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gloria Material Technology Corp. is a company that produces and sells alloy steel in Taiwan, the United States, China, and internationally, with a market capitalization of NT$27.14 billion.

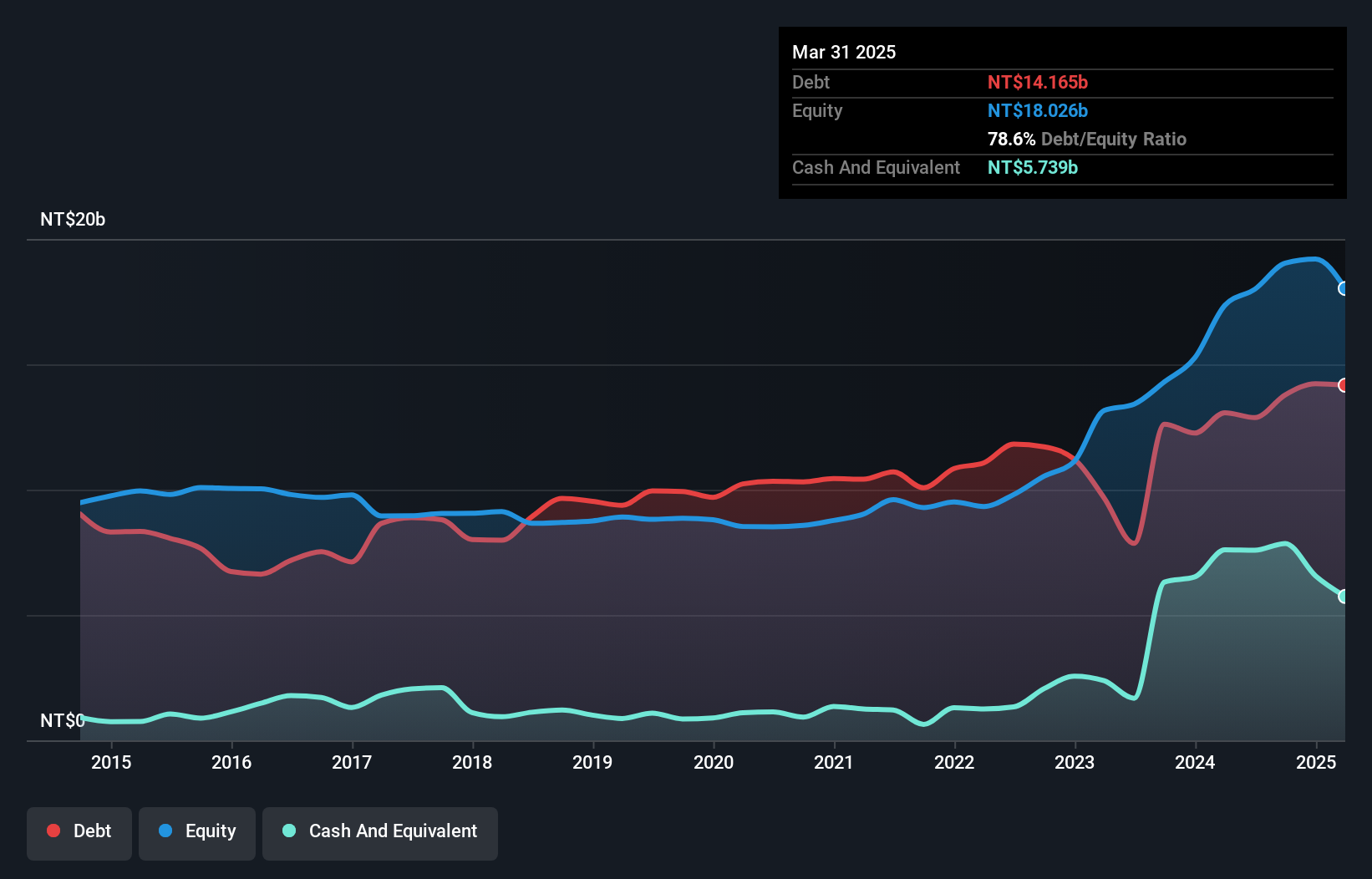

Operations: Gloria Material Technology generates revenue primarily through its main entity, contributing NT$12.04 billion, and its subsidiary Jinyun Iron and Steel Co., Ltd., which adds NT$1.11 billion. The company faces inter-division losses of NT$2.65 billion impacting overall financial performance.

Gloria Material Technology, a smaller player in the metals and mining sector, has shown promising financial results recently. Despite a slight dip in sales to NT$3.04 billion for Q3 2024 from NT$3.29 billion last year, net income surged to NT$990.97 million from NT$523.75 million, indicating improved profitability with basic earnings per share rising to TWD 1.67 from TWD 1 previously. Over the past five years, their debt-to-equity ratio impressively decreased from 112% to 72.4%, reflecting better financial management and stability in operations while trading at a notable discount of 65% below estimated fair value adds attractiveness for potential investors seeking undervalued opportunities.

Taking Advantage

- Investigate our full lineup of 4627 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Well Pharmaceutical GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603351

Nanjing Well Pharmaceutical GroupLtd

Nanjing Well Pharmaceutical Group Co.,Ltd.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives