- China

- /

- Construction

- /

- SZSE:002060

3 Reliable Dividend Stocks Yielding Up To 6.5%

Reviewed by Simply Wall St

As global markets navigate the complexities of trade tensions and fluctuating economic indicators, investors are increasingly seeking stability amidst uncertainty. With U.S. stocks experiencing volatility due to tariff announcements and mixed economic data, dividend stocks have emerged as a potential source of reliable income. In this environment, selecting dividend stocks that offer consistent yields can provide a measure of financial security while capitalizing on their ability to generate income regardless of market turbulence.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.89% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.30% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.98% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

Click here to see the full list of 1956 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

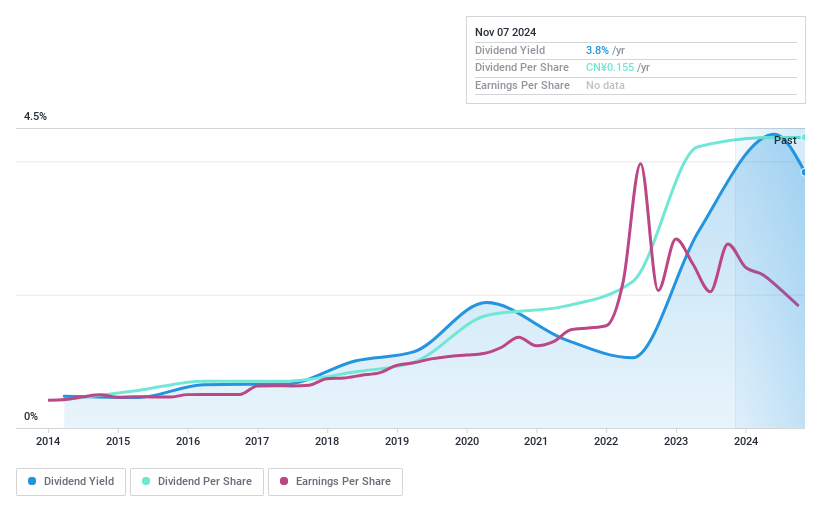

Guangdong Construction Engineering Group (SZSE:002060)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Guangdong Construction Engineering Group Co., Ltd. (SZSE:002060) operates in the construction industry, with a market cap of approximately CN¥13.40 billion.

Operations: Unfortunately, the revenue segment information provided is incomplete or missing. Please provide the necessary details to summarize Guangdong Construction Engineering Group's revenue segments accurately.

Dividend Yield: 4.3%

Guangdong Construction Engineering Group offers a dividend yield of 4.31%, placing it in the top quartile among Chinese dividend payers. The company's dividends have been stable and growing over the past decade, supported by a low payout ratio of 47.3%. However, dividends are not covered by free cash flows, indicating potential sustainability issues despite earnings growth forecasts of 17.25% annually. The stock trades at a favorable P/E ratio of 11x compared to the market average.

- Navigate through the intricacies of Guangdong Construction Engineering Group with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Guangdong Construction Engineering Group's current price could be quite moderate.

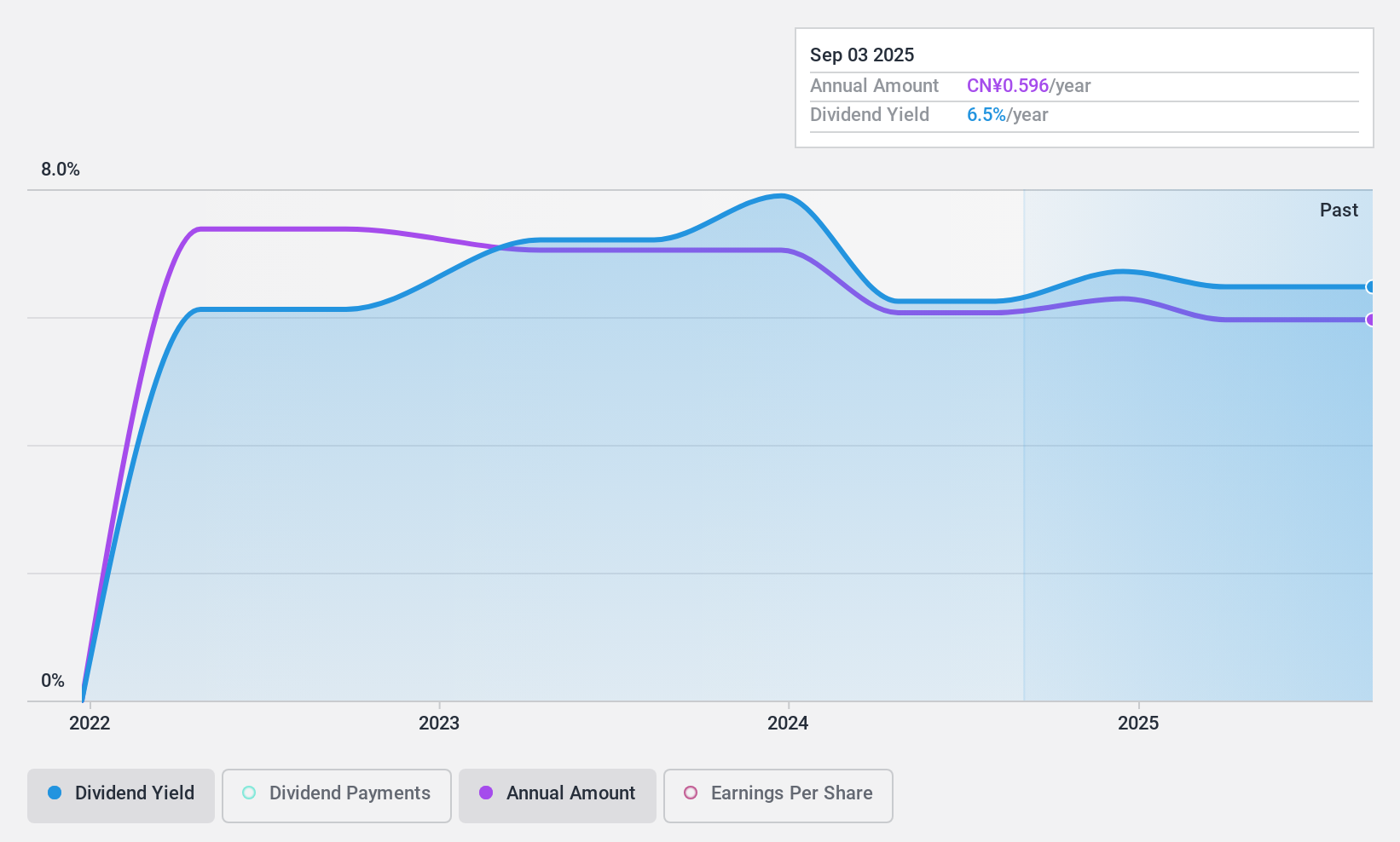

Ping An Guangzhou Comm Invest Guanghe Expressway (SZSE:180201)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ping An Guangzhou Comm Invest Guanghe Expressway Close-end Infrastructure Fund operates as an infrastructure fund with a market cap of CN¥6.57 billion.

Operations: The company's revenue segment includes Transportation Infrastructure, generating CN¥772.26 million.

Dividend Yield: 6.5%

Ping An Guangzhou Comm Invest Guanghe Expressway offers a dividend yield of 6.53%, ranking in the top 25% of Chinese dividend payers. Despite this attractive yield, dividends have been volatile and declining over the past three years, with an unstable track record. The payout ratio is 87.3%, indicating coverage by earnings, while a cash payout ratio of 70.6% suggests dividends are supported by cash flows. The stock trades at a significant discount to its estimated fair value.

- Click to explore a detailed breakdown of our findings in Ping An Guangzhou Comm Invest Guanghe Expressway's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Ping An Guangzhou Comm Invest Guanghe Expressway shares in the market.

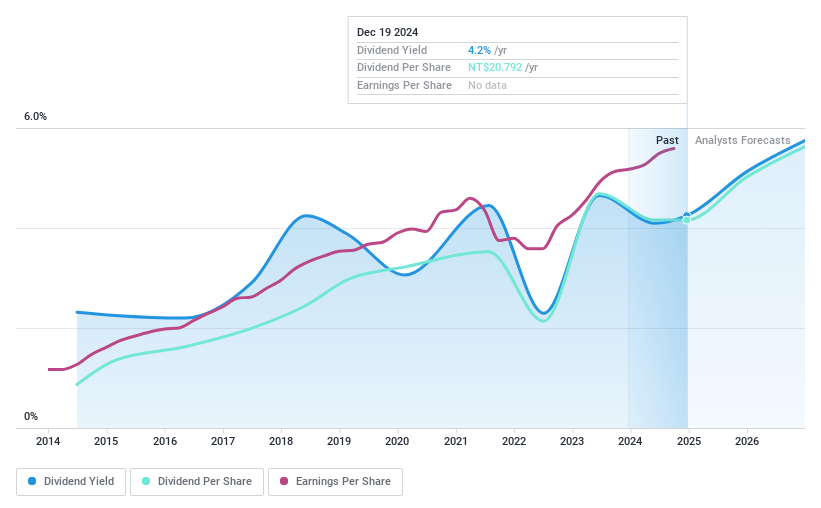

POYA International (TPEX:5904)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: POYA International Co., Ltd. operates a chain of retail stores in Taiwan and has a market cap of NT$50.37 billion.

Operations: POYA International Co., Ltd. generates revenue primarily through its General Merchandise Retail Sales Department, amounting to NT$23.26 billion.

Dividend Yield: 4.2%

POYA International's dividend yield of 4.21% is below the top 25% in Taiwan, with dividends historically volatile and unreliable over the past decade. Despite these inconsistencies, dividends are covered by earnings (payout ratio: 79.7%) and cash flows (cash payout ratio: 55.4%). The stock trades at a good value, significantly below its estimated fair value, while earnings have shown growth of 9.3% last year and are forecasted to continue growing annually by 10.94%.

- Get an in-depth perspective on POYA International's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that POYA International is priced lower than what may be justified by its financials.

Where To Now?

- Click here to access our complete index of 1956 Top Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002060

Guangdong Construction Engineering Group

Guangdong Construction Engineering Group Co., Ltd.

Established dividend payer with adequate balance sheet.

Market Insights

Community Narratives