- China

- /

- Electronic Equipment and Components

- /

- SZSE:301280

Undiscovered Gems To Explore In January 2025

Reviewed by Simply Wall St

As we step into January 2025, global markets are navigating a complex landscape with mixed performances across major indices and economic indicators. Despite some setbacks in manufacturing data and GDP forecasts, the S&P 500 has capped off another strong year with significant gains, highlighting resilience amidst challenges. In this environment, identifying promising small-cap stocks requires a keen eye for companies that demonstrate robust fundamentals and potential for growth even when broader market sentiment is uncertain.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Suraj | 37.84% | 15.84% | 63.29% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Shandong Link Science and TechnologyLtd (SZSE:001207)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Link Science and Technology Co., Ltd. operates within the technology sector with a market capitalization of CN¥4.02 billion.

Operations: The company generates revenue primarily from its technology-related offerings, contributing significantly to its financial performance. Its gross profit margin is notable at 45%, indicating efficient cost management in producing goods or services.

Shandong Link Science and Technology, a small cap entity, has been making waves with its impressive financial performance. Over the past year, earnings surged by 66.9%, significantly outpacing the chemicals industry's -4.7%. The company has reduced its debt to equity ratio from 39.4% to a mere 4.6% over five years, indicating strong financial management. It trades at an attractive value, around 34.9% below estimated fair value compared to peers and industry standards. Recent reports show net income rose to CNY 199 million for nine months ending September 2024 from CNY 114 million previously, reflecting robust operational growth and profitability prospects ahead.

Bosera China Merchants Shekou Industrial Zone (SZSE:180101)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bosera China Merchants Shekou Industrial Zone Close-end Infrastructure Fund operates as a closed-end fund with a market cap of CN¥1.91 billion.

Operations: The fund's primary revenue stream is from real estate rentals, generating CN¥212.48 million.

Bosera China Merchants Shekou Industrial Zone, a smaller player in its sector, has shown impressive earnings growth of 119.9% over the past year, significantly outpacing the Industrial REITs industry average of 5.8%. Its net debt to equity ratio stands at a satisfactory 4.8%, having decreased from 60.9% five years ago, indicating prudent financial management. The company's price-to-earnings ratio is attractively positioned at 23.5x compared to the CN market's average of 33.2x, suggesting potential value for investors seeking quality earnings and robust debt coverage with EBIT covering interest payments by 6.4 times.

Zhejiang ZUCH Technology (SZSE:301280)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang ZUCH Technology Co., Ltd. specializes in providing electric connectors in China and has a market capitalization of CN¥4.01 billion.

Operations: ZUCH Technology's revenue is primarily derived from its electric connectors business in China, with a market capitalization of CN¥4.01 billion.

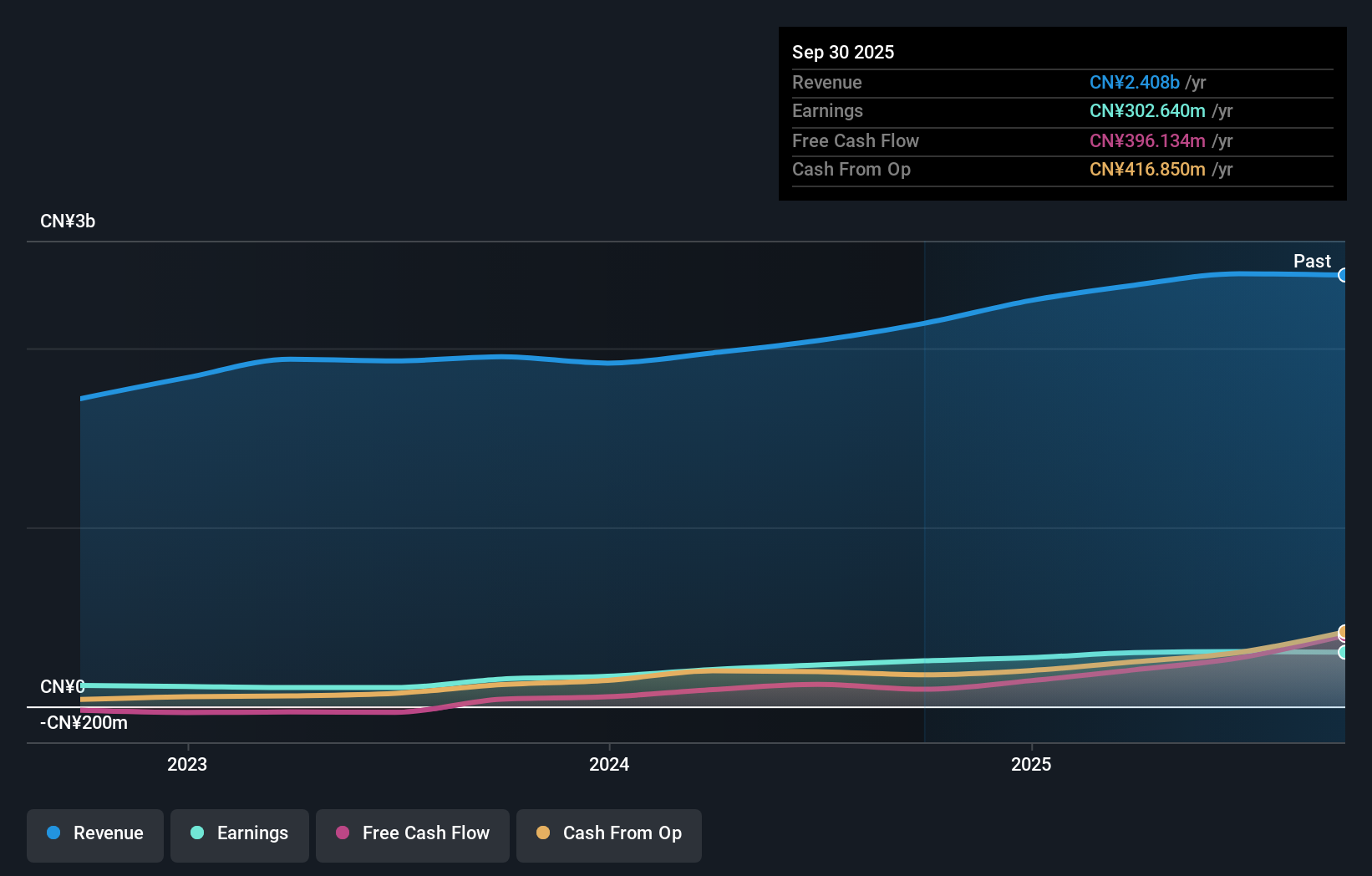

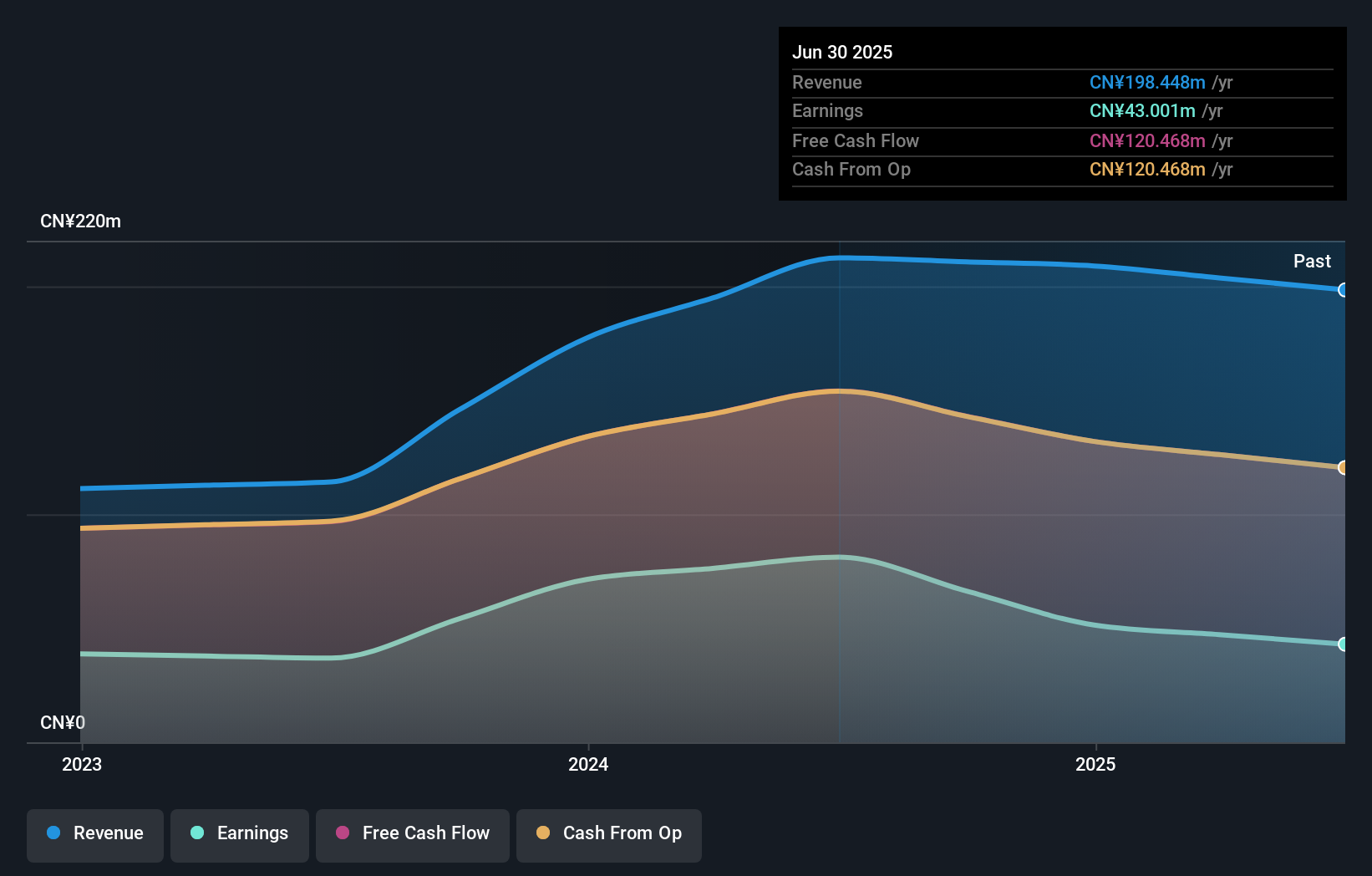

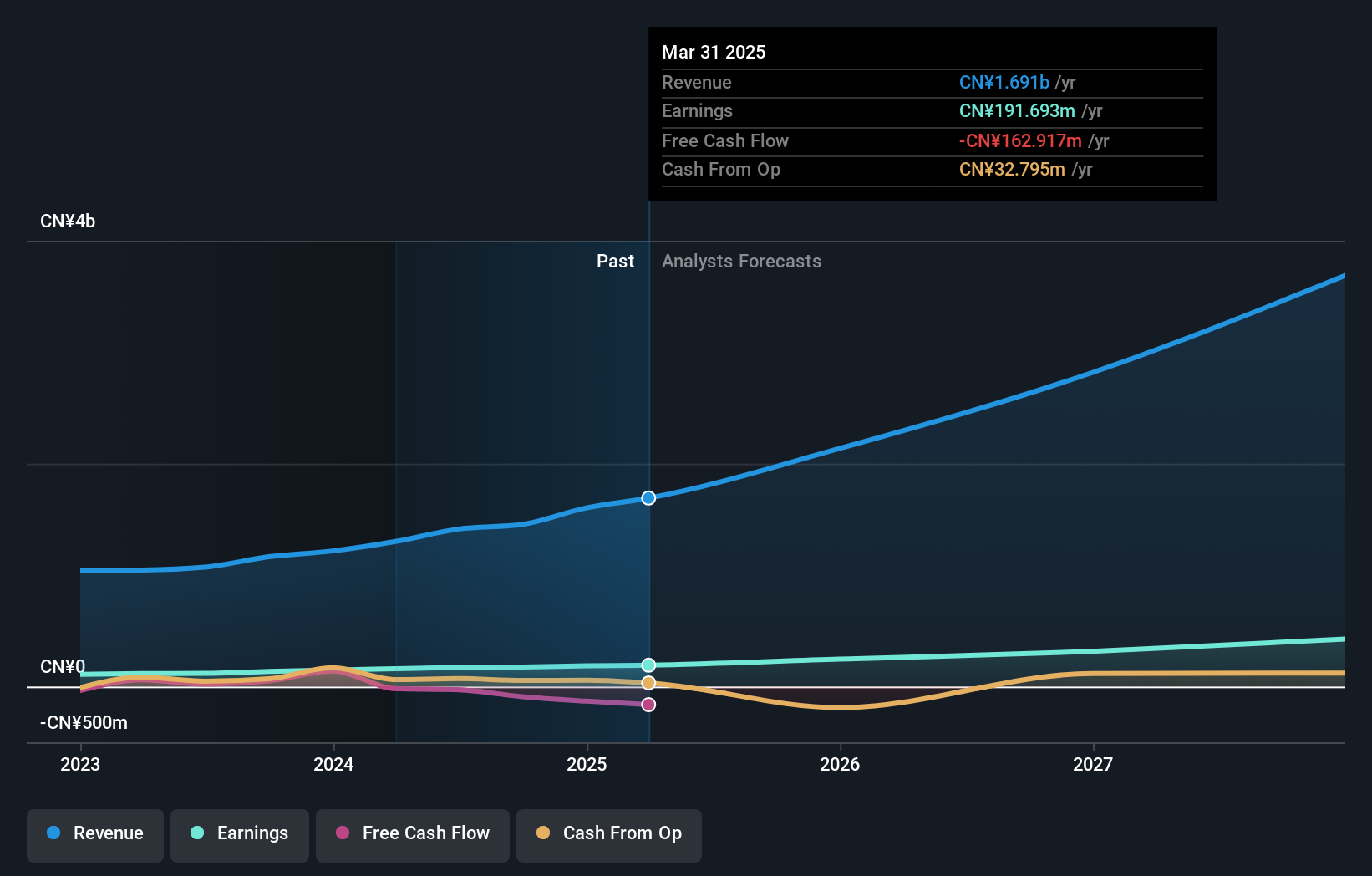

ZUCH Technology, a small player in the electronics sector, has shown impressive growth with earnings up 28.5% over the past year, surpassing industry averages. The company appears to be trading at an attractive price-to-earnings ratio of 23x compared to the broader CN market's 33.2x. Despite not being free cash flow positive recently, ZUCH's debt situation seems manageable with a significant reduction in its debt-to-equity ratio from 35.4% to 1.9% over five years and more cash than total debt on hand. Recent earnings reports highlight increased sales and net income for nine months ending September 2024, indicating potential for continued growth.

- Take a closer look at Zhejiang ZUCH Technology's potential here in our health report.

Learn about Zhejiang ZUCH Technology's historical performance.

Turning Ideas Into Actions

- Embark on your investment journey to our 4654 Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Zhejiang ZUCH Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang ZUCH Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301280

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives