- China

- /

- Real Estate

- /

- SZSE:300917

Exploring Undiscovered Gems in China for October 2024

Reviewed by Simply Wall St

Amidst a backdrop of robust stimulus measures, Chinese stocks have experienced significant gains, with the Shanghai Composite Index and CSI 300 marking their largest weekly increases since 2008. As China implements these economic support mechanisms, investors are keenly exploring opportunities within the market, particularly focusing on small-cap companies that may benefit from renewed domestic consumption and industrial activity. Identifying promising stocks in this environment involves looking for those poised to capitalize on these macroeconomic shifts while maintaining strong fundamentals and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Xiangtan Electrochemical ScientificLtd | 50.35% | 14.78% | 38.33% | ★★★★★★ |

| Changsha Tongcheng HoldingsLtd | 8.27% | -12.36% | -6.10% | ★★★★★★ |

| Beijing WKW Automotive PartsLtd | 6.14% | -1.34% | 69.26% | ★★★★★★ |

| Hangzhou Biotest BiotechLtd | 0.02% | -46.81% | -19.87% | ★★★★★★ |

| Shenzhen Jdd Tech New Material | NA | 27.24% | 21.39% | ★★★★★★ |

| Tibet Development | 52.25% | -1.03% | 55.10% | ★★★★★★ |

| Guangzhou LBP Medicine Science & Technology | 0.65% | 5.07% | -21.27% | ★★★★★☆ |

| Jiangsu ChengXing Phosph-Chemicals | 74.90% | 2.41% | 20.41% | ★★★★★☆ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 22.46% | 0.77% | -3.26% | ★★★★☆☆ |

| Shenzhen Tongyi Industry | 72.24% | 13.41% | -16.34% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Nanjing LES Information Technology (SHSE:688631)

Simply Wall St Value Rating: ★★★★★★

Overview: Nanjing LES Information Technology Co., Ltd. operates in the information technology sector and has a market capitalization of CN¥11.90 billion.

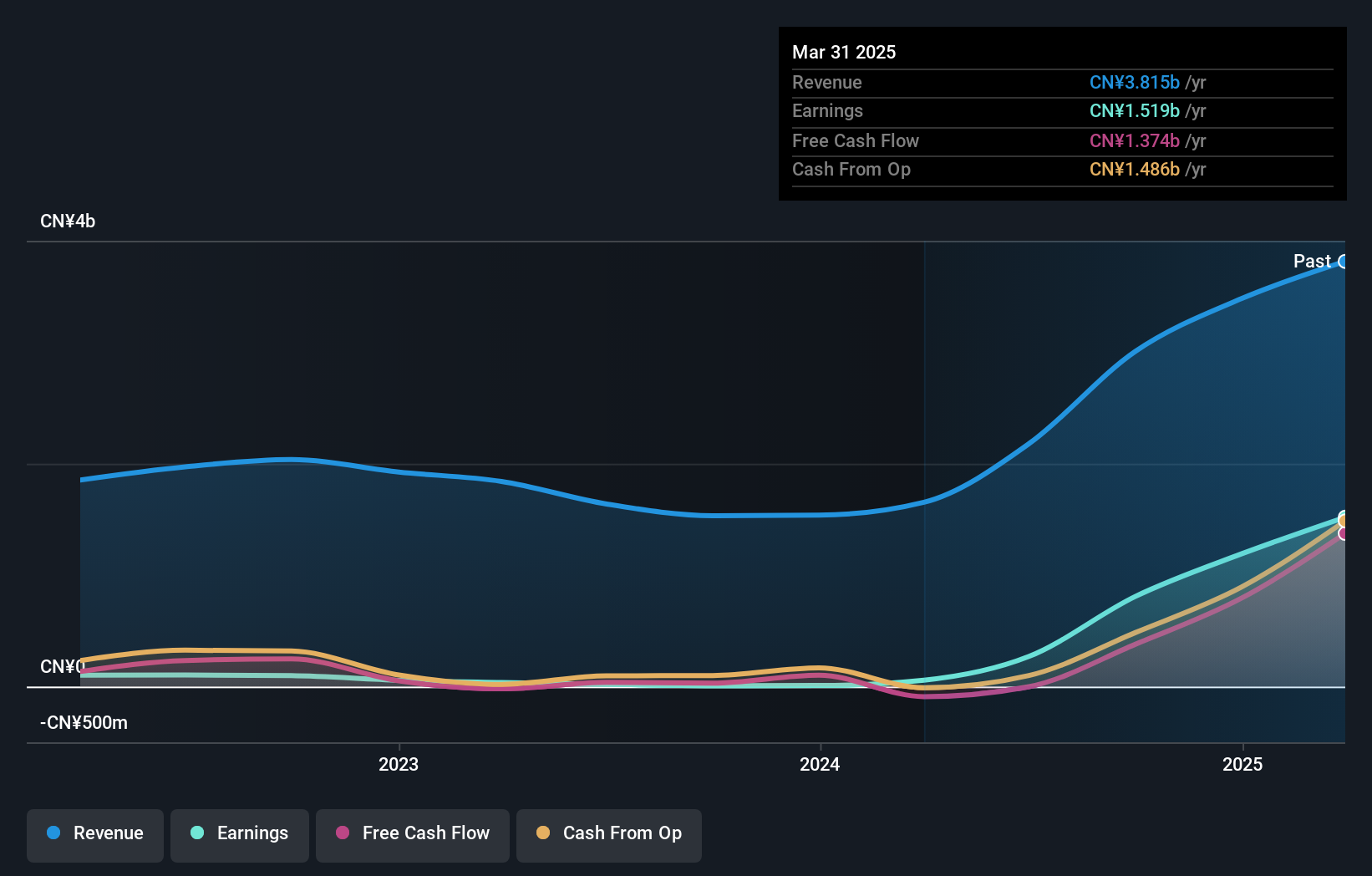

Operations: The company generates revenue primarily from its information technology services, with a focus on software development and system integration. It experiences a fluctuating gross profit margin, which was last reported at 45%.

Nanjing LES Information Technology, a small player in the Aerospace & Defense sector, has shown impressive earnings growth of 43% over the past year, outpacing industry averages. Despite its volatile share price recently, the company remains debt-free and boasts high-quality earnings. Recent financials reveal a net loss of CNY 5.45 million for H1 2024, an improvement from CNY 12.55 million last year. Notably, it was added to the S&P Global BMI Index in September 2024.

Jiangsu Zhengdan Chemical Industry (SZSE:300641)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Zhengdan Chemical Industry Co., Ltd. operates in the petrochemical industry and has a market capitalization of CN¥12.81 billion.

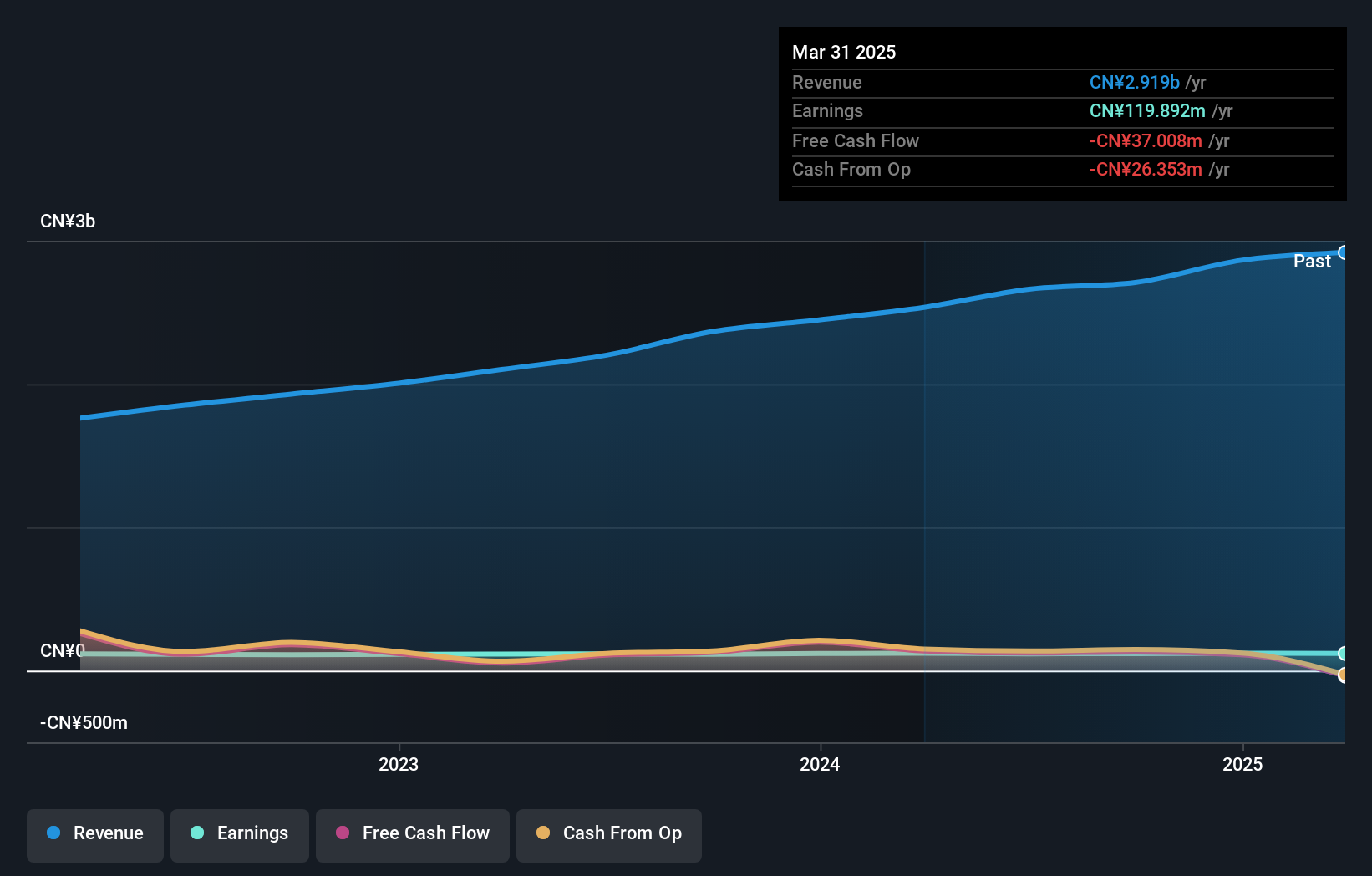

Operations: Jiangsu Zhengdan Chemical Industry derives its revenue primarily from the petrochemical industry, amounting to CN¥2.18 billion. The company's financial performance is highlighted by a focus on this sector, which forms the core of its business operations.

Jiangsu Zhengdan Chemical Industry, a small player in the chemical sector, has shown remarkable earnings growth of 1,255.5% over the past year, far outpacing the industry average of -4.7%. The company's debt to equity ratio improved significantly from 17.5% to 7.6% over five years, indicating better financial health. Despite recent shareholder dilution and volatile share prices, its net income surged to CNY 285.92 million for H1 2024 from CNY 25.63 million a year earlier, reflecting strong operational performance amidst strategic expansions like private placements worth CNY 428 million.

- Get an in-depth perspective on Jiangsu Zhengdan Chemical Industry's performance by reading our health report here.

Learn about Jiangsu Zhengdan Chemical Industry's historical performance.

Shenzhen SDG ServiceLtd (SZSE:300917)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen SDG Service Co., Ltd. offers property management services in China and has a market cap of CN¥10.35 billion.

Operations: Shenzhen SDG Service Co., Ltd. generates revenue primarily from property management services in China. The company has a market capitalization of CN¥10.35 billion, reflecting its scale within the industry.

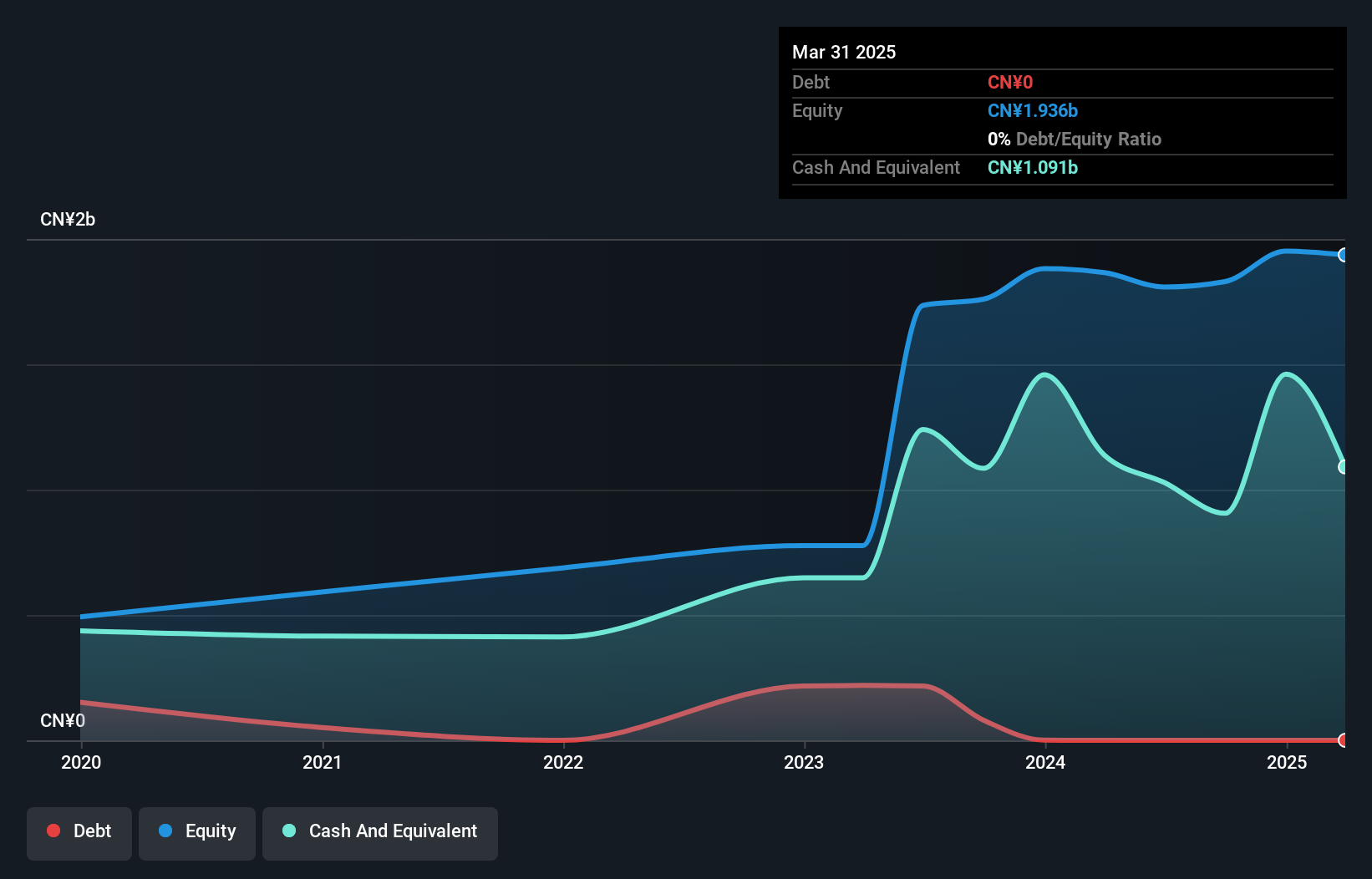

Shenzhen SDG Service Co., Ltd. has shown resilience with earnings growth of 1.1% over the past year, outpacing the Real Estate industry's -34.6%. The company reported first-half sales of CNY 1.34 billion, up from CNY 1.13 billion in the previous year, though net income slightly decreased to CNY 57.59 million from CNY 60.14 million. Despite a volatile share price recently, its debt-free status and high-quality earnings underscore its financial stability and potential for steady performance in a challenging market environment.

- Click here and access our complete health analysis report to understand the dynamics of Shenzhen SDG ServiceLtd.

Assess Shenzhen SDG ServiceLtd's past performance with our detailed historical performance reports.

Where To Now?

- Gain an insight into the universe of 898 Chinese Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300917

Adequate balance sheet low.

Market Insights

Community Narratives