Exploring Gelsenwasser And Two Other Hidden Small Cap Opportunities

Reviewed by Simply Wall St

In recent weeks, global markets have experienced fluctuations due to tariff uncertainties and mixed economic indicators, with the S&P 500 Index experiencing a slight decline amid concerns over new tariffs on imports. Despite these challenges, small-cap stocks continue to present unique opportunities for investors seeking growth potential in an evolving economic landscape. Identifying promising small-cap stocks involves looking for companies with strong fundamentals and innovative strategies that can thrive even in uncertain market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Gelsenwasser (DB:WWG)

Simply Wall St Value Rating: ★★★★★☆

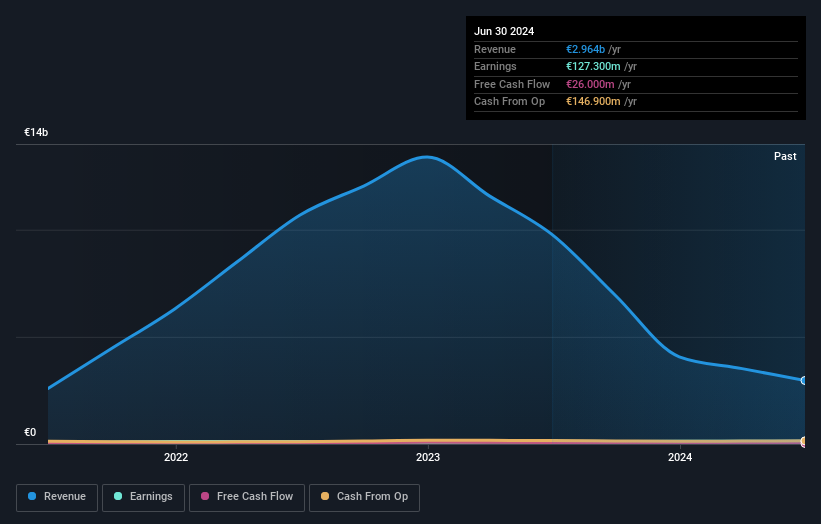

Overview: Gelsenwasser AG operates in the water, wastewater, gas supply, and electricity sectors across Germany, the Czech Republic, and Poland with a market capitalization of approximately €1.84 billion.

Operations: Revenue streams primarily include energy sales (€3.93 billion), energy grids (€271.20 million), and water services excluding wastewater (€286.30 million). The net profit margin shows an interesting trend, reflecting the company's ability to manage costs effectively within its diverse operations across multiple sectors and regions.

Gelsenwasser, a nimble player in the utilities sector, showcases impressive financial health with no debt on its books and high-quality earnings. Over the past year, its earnings surged by 32.9%, outpacing the industry's modest 2.6% growth rate. Trading at a significant discount of 85.6% below estimated fair value, it presents an intriguing valuation proposition for investors seeking potential upside. The company is free cash flow positive and maintains profitability without concerns over interest payments or cash runway issues due to its debt-free status, positioning it as a resilient contender in its industry landscape.

- Get an in-depth perspective on Gelsenwasser's performance by reading our health report here.

Gain insights into Gelsenwasser's past trends and performance with our Past report.

Shenzhen SDG ServiceLtd (SZSE:300917)

Simply Wall St Value Rating: ★★★★★★

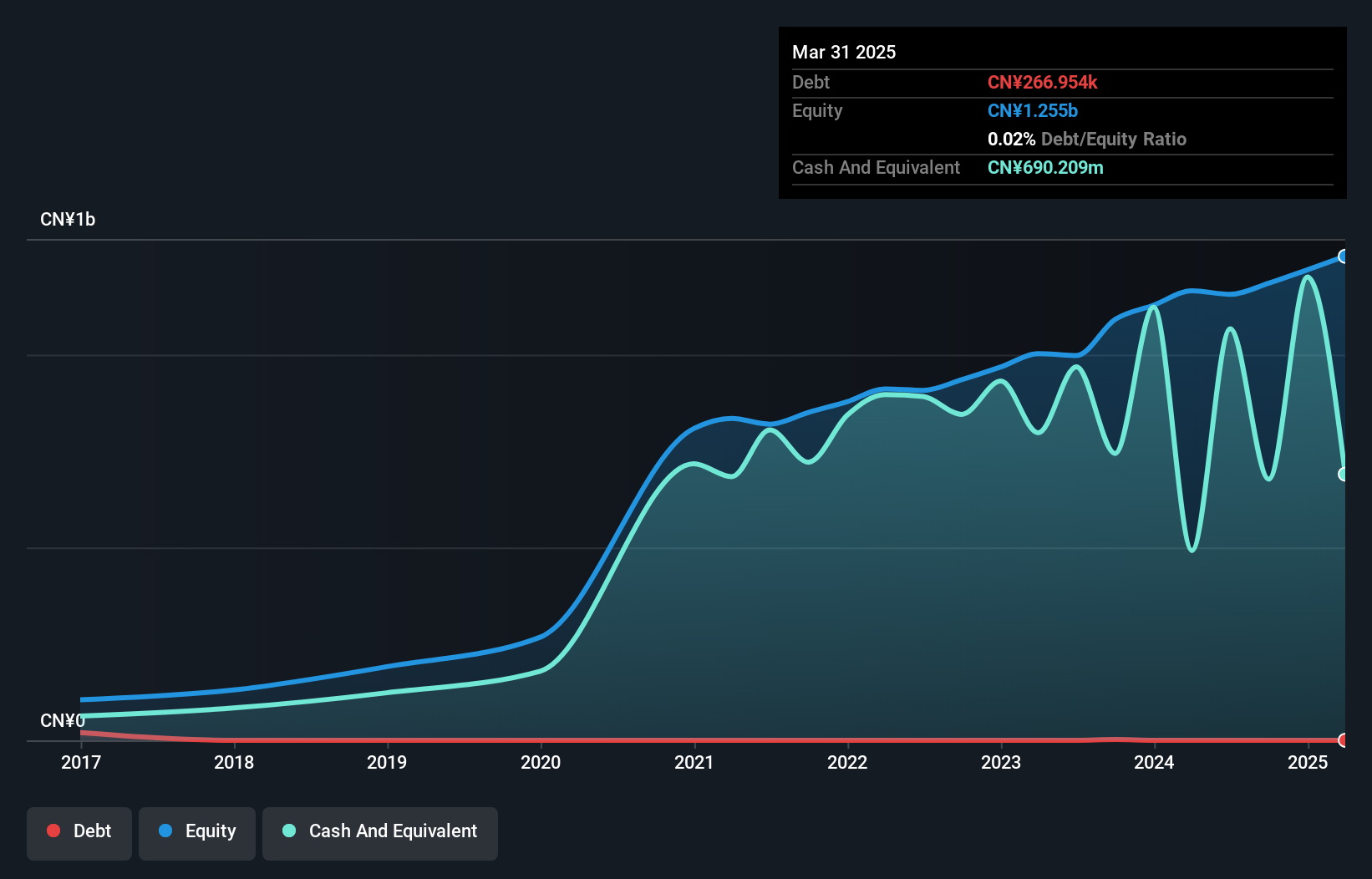

Overview: Shenzhen SDG Service Co., Ltd. offers property management services in China and has a market cap of CN¥8.10 billion.

Operations: Shenzhen SDG Service Co., Ltd. generates revenue primarily from property management services in China. The company's net profit margin has shown a notable trend, indicating efficiency in managing its operational costs relative to its revenue.

Shenzhen SDG Service, a smaller player in its field, presents a compelling profile with no debt and positive free cash flow of US$130.69 million as of late 2024. Its earnings growth of 3.3% last year outpaced the struggling real estate sector's -38.4%, indicating resilience and potential for further expansion. The company has high-quality past earnings, suggesting solid financial practices are in place. Recent board changes might signal strategic shifts aimed at enhancing governance and operational efficiency, potentially impacting future performance positively or negatively depending on execution and market conditions.

Mizuno (TSE:8022)

Simply Wall St Value Rating: ★★★★★★

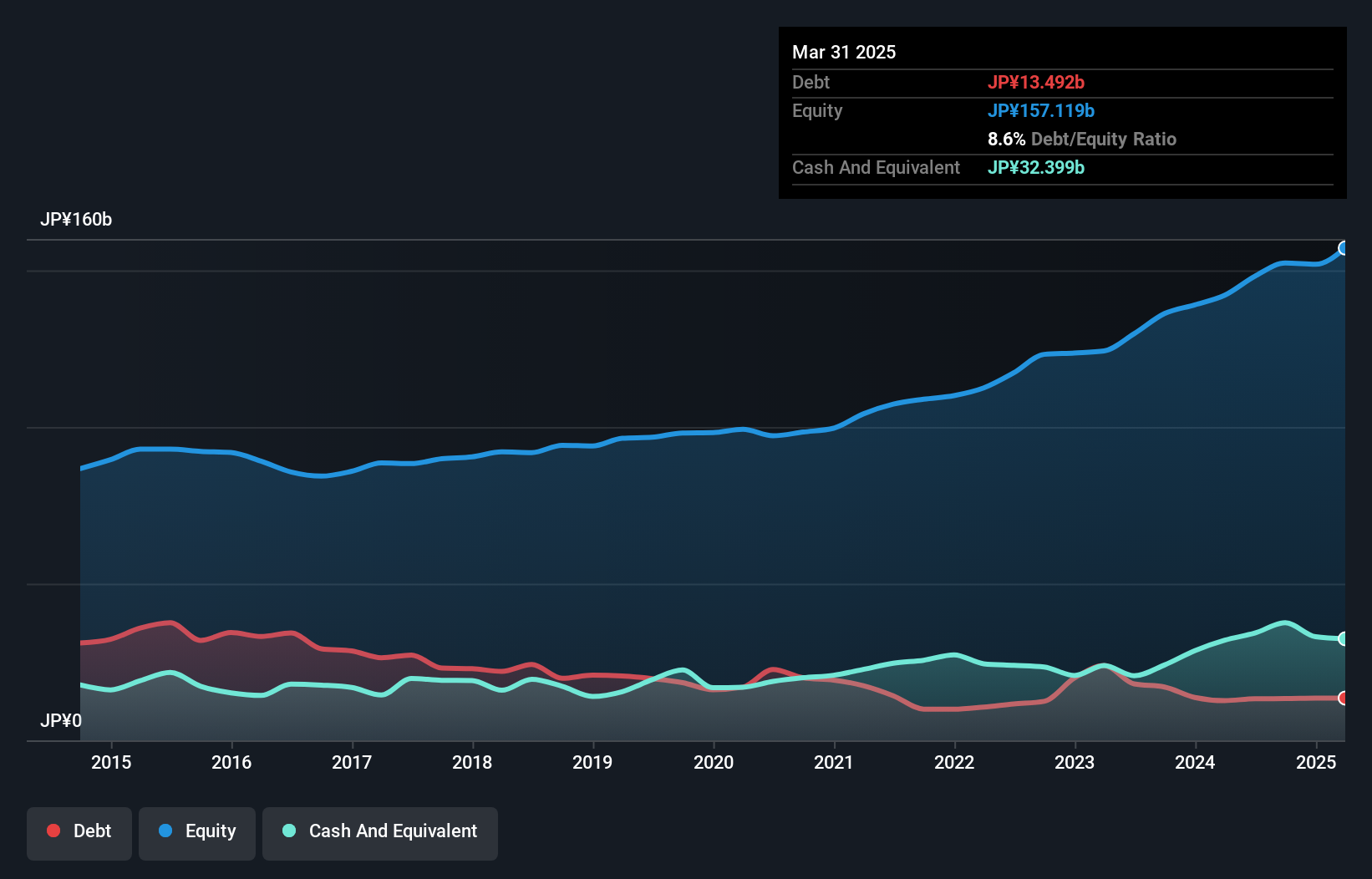

Overview: Mizuno Corporation is a global manufacturer and seller of sports products with operations spanning Japan, the rest of Asia, Europe, the Americas, and Oceania, and it has a market cap of ¥222.29 billion.

Operations: Mizuno generates revenue primarily from the sale of sports products across multiple regions, including Japan, Asia, Europe, the Americas, and Oceania. The company's financial performance is characterized by a focus on managing its cost structure to optimize profitability. Notably, Mizuno's gross profit margin reflects its ability to effectively manage production costs relative to sales revenue.

Mizuno, a notable player in the market, is trading at 35.8% below its fair value estimate, offering an attractive entry point for investors. The company has demonstrated strong financial health with earnings growth of 16.3% over the past year, outpacing the Leisure industry's -9.4%. Its debt-to-equity ratio has improved significantly from 16.4% to 8.9% over five years, underscoring prudent financial management. Mizuno's high-quality earnings and positive free cash flow further bolster its investment appeal, while interest coverage remains robust as it earns more than it pays on interest obligations.

- Click here to discover the nuances of Mizuno with our detailed analytical health report.

Review our historical performance report to gain insights into Mizuno's's past performance.

Summing It All Up

- Investigate our full lineup of 4697 Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8022

Mizuno

Manufactures and sells sports products in Japan, the rest of Asia, Europe, the Americas, and Oceania.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives