- China

- /

- Real Estate

- /

- SZSE:300917

Discovering Three Undiscovered Gems in China with Strong Potential

Reviewed by Simply Wall St

China's recent announcement of robust stimulus measures has injected optimism into global markets, with the Shanghai Composite Index climbing 12.8% and the blue-chip CSI 300 soaring 15.7%. This surge in market sentiment presents a timely opportunity to explore some lesser-known Chinese stocks that could benefit from these economic tailwinds. In this article, we will highlight three undiscovered gems in China that show strong potential for growth amidst these favorable conditions. Identifying good stocks often involves looking at companies poised to capitalize on new economic policies and market trends, making now an opportune moment for investors to consider these promising options.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shandong Link Science and TechnologyLtd | 2.65% | 15.68% | 10.94% | ★★★★★★ |

| Tibet Weixinkang Medicine | NA | 15.57% | 36.17% | ★★★★★★ |

| Sublime China Information | NA | 6.24% | 1.49% | ★★★★★★ |

| Aeolus Tyre | 35.66% | -1.22% | 10.27% | ★★★★★☆ |

| Hubei Forbon TechnologyLtd | 22.99% | 15.04% | 2.15% | ★★★★★☆ |

| Wuxi Delinhai Environmental TechnologyLtd | 4.33% | -16.56% | -40.58% | ★★★★☆☆ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 22.46% | 0.77% | -3.26% | ★★★★☆☆ |

| Shanghai Ace Investment&DevelopmentLtd | 43.95% | 10.89% | 23.28% | ★★★★☆☆ |

| Huaiji Dengyun Auto-parts (Holding)Ltd | 67.58% | 11.72% | -34.21% | ★★★★☆☆ |

| Suzhou Chunqiu Electronic Technology | 52.50% | 9.15% | -17.36% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

XGD (SZSE:300130)

Simply Wall St Value Rating: ★★★★★★

Overview: XGD Inc. researches, develops, manufactures, sells, and services payment terminals in China and internationally with a market cap of CN¥12.76 billion.

Operations: XGD Inc. generates revenue primarily from the sale and servicing of payment terminals in China and internationally. The company has a market cap of CN¥12.76 billion.

XGD Inc. has shown impressive earnings growth of 376.1% over the past year, significantly outpacing the Electronic industry’s -3.7%. The company reported a net income of CNY 448.74 million for the first half of 2024, up from CNY 332.81 million last year, despite a drop in sales to CNY 1,574.99 million from CNY 1,957.48 million previously. Trading at good value compared to peers and with its debt-to-equity ratio reduced from 35.6% to 4.5% over five years, XGD remains an attractive prospect in its sector.

- Get an in-depth perspective on XGD's performance by reading our health report here.

Gain insights into XGD's historical performance by reviewing our past performance report.

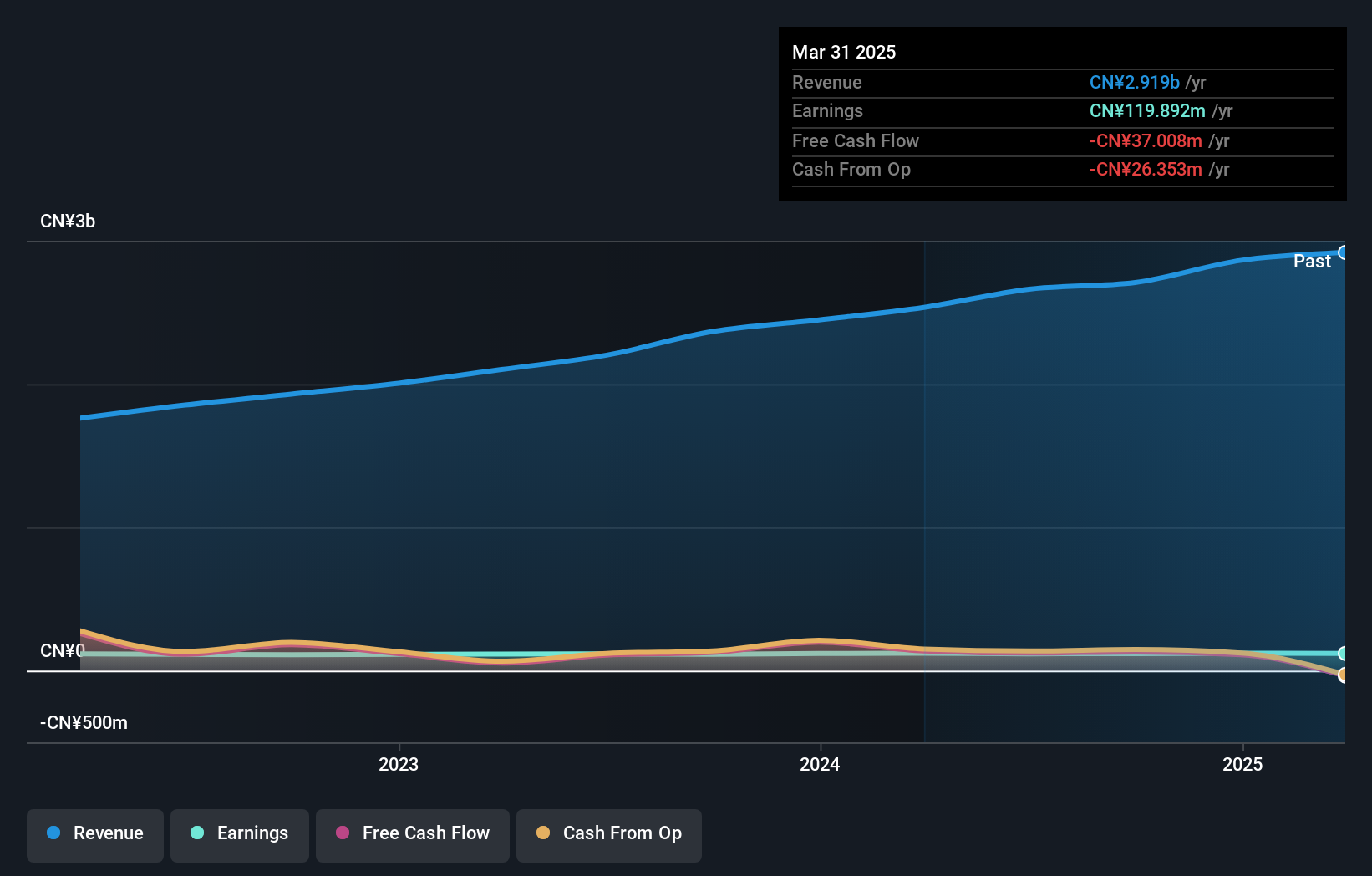

Jiangsu Zhengdan Chemical Industry (SZSE:300641)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Zhengdan Chemical Industry Co., Ltd. operates in the petrochemical industry and has a market cap of CN¥12.81 billion.

Operations: The company generates revenue primarily from its petrochemical industry segment, totaling CN¥2.18 billion.

Jiangsu Zhengdan Chemical Industry has shown remarkable growth, with earnings surging by 1255.5% over the past year, far outpacing the chemicals industry’s -4.7%. The company’s net income for the first half of 2024 was CNY 285.92 million, a significant increase from CNY 25.63 million in the same period last year. Notably, its debt-to-equity ratio improved from 17.5% to 7.6% over five years, indicating better financial health and lower leverage risks moving forward into new ventures like its planned production base in Malaysia.

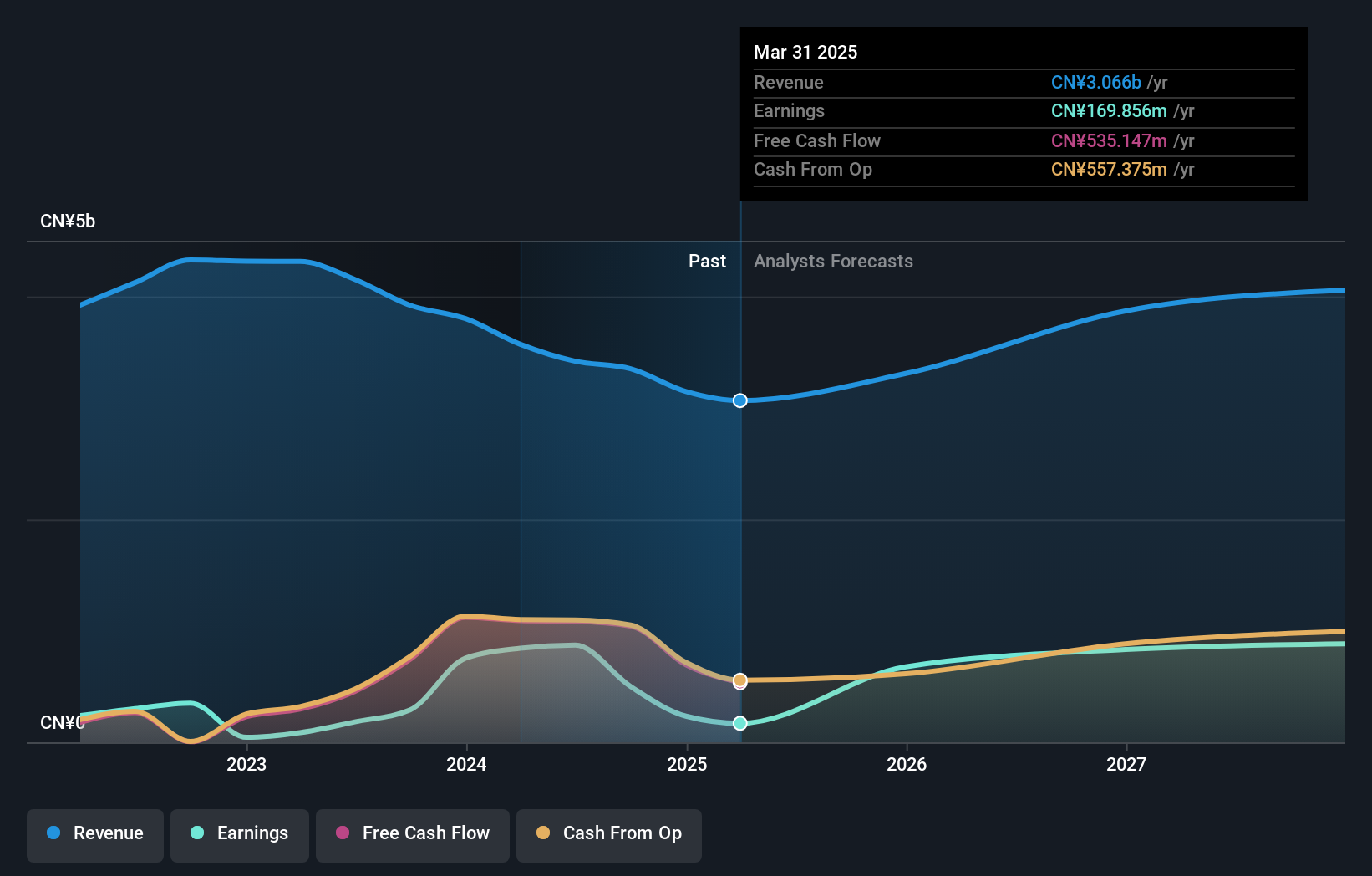

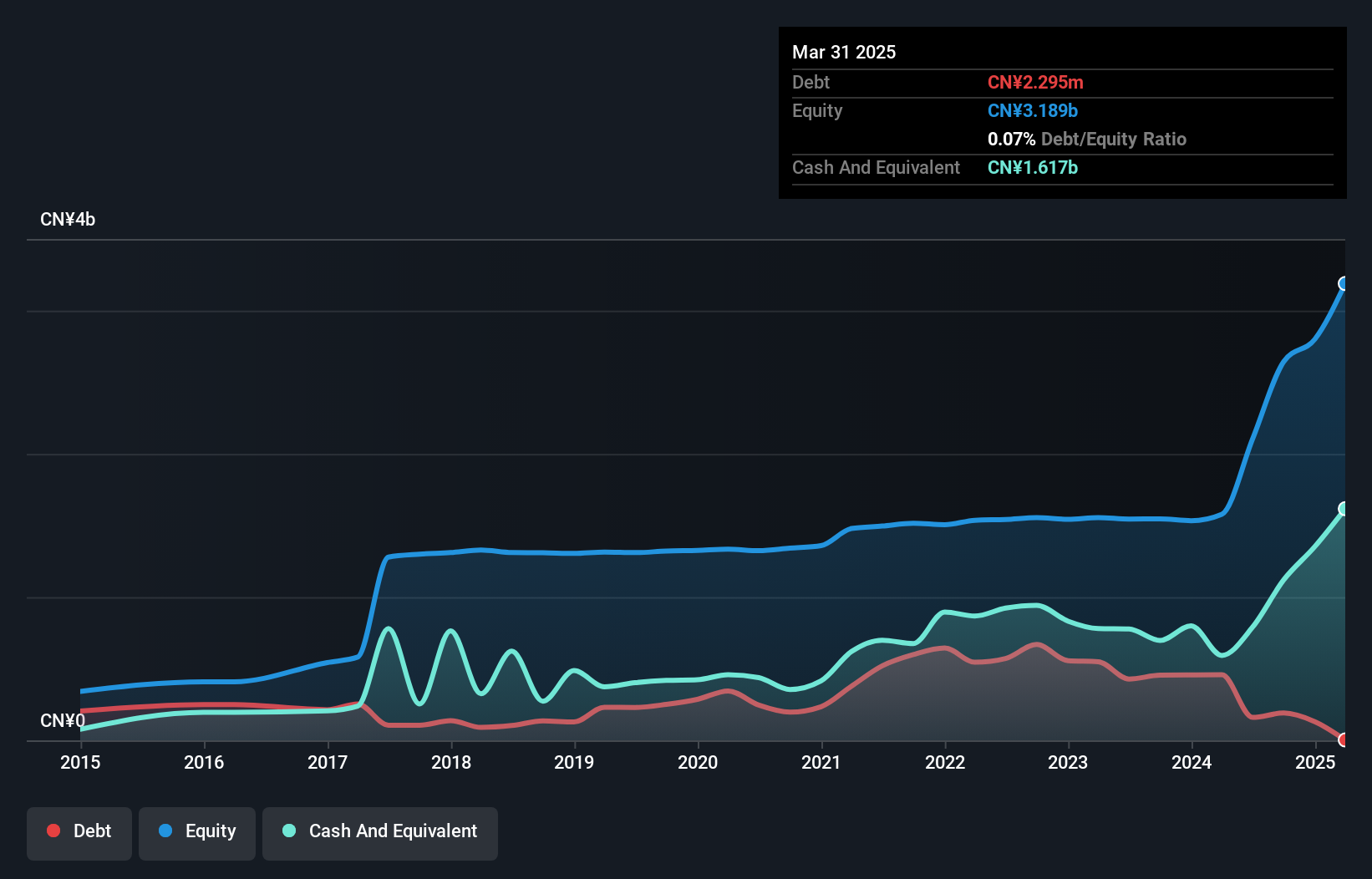

Shenzhen SDG ServiceLtd (SZSE:300917)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen SDG Service Co., Ltd. offers property management services in China and has a market cap of CN¥10.35 billion.

Operations: The company's revenue primarily comes from property management services. It has a market cap of CN¥10.35 billion.

Shenzhen SDG Service Ltd. reported half-year sales of CNY 1.34 billion, up from CNY 1.13 billion the previous year, while net income slightly dipped to CNY 57.59 million from CNY 60.14 million a year ago. Basic earnings per share held steady at CNY 0.34 compared to last year's CNY 0.36. The company has no debt and achieved a modest earnings growth of 1.1% over the past year, outperforming the Real Estate industry’s -34%.

- Navigate through the intricacies of Shenzhen SDG ServiceLtd with our comprehensive health report here.

Evaluate Shenzhen SDG ServiceLtd's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 896 Chinese Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300917

Flawless balance sheet with acceptable track record.