As global markets react to rising U.S. Treasury yields, the S&P 500 has experienced a decline after six weeks of gains, while the Nasdaq Composite managed a slight increase. In these shifting market conditions, investors often seek opportunities in overlooked areas such as penny stocks. Though the term 'penny stock' might sound like a relic of past trading days, they can still offer significant potential for growth when backed by strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.575 | MYR2.86B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR337.78M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.78 | HK$495.14M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £176.31M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.69 | MYR119.52M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.53 | CN¥2.22B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.92 | MYR305.39M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.24 | £304.09M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.08 | £405.78M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

Click here to see the full list of 5,798 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Sanxiang Impression (SZSE:000863)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sanxiang Impression Co., Ltd. focuses on real estate development in China with a market cap of CN¥4.59 billion.

Operations: The company generates revenue primarily from its Real Estate Division, which accounts for CN¥1.30 billion, and its Cultural Performing Arts Division, contributing CN¥223.64 million.

Market Cap: CN¥4.59B

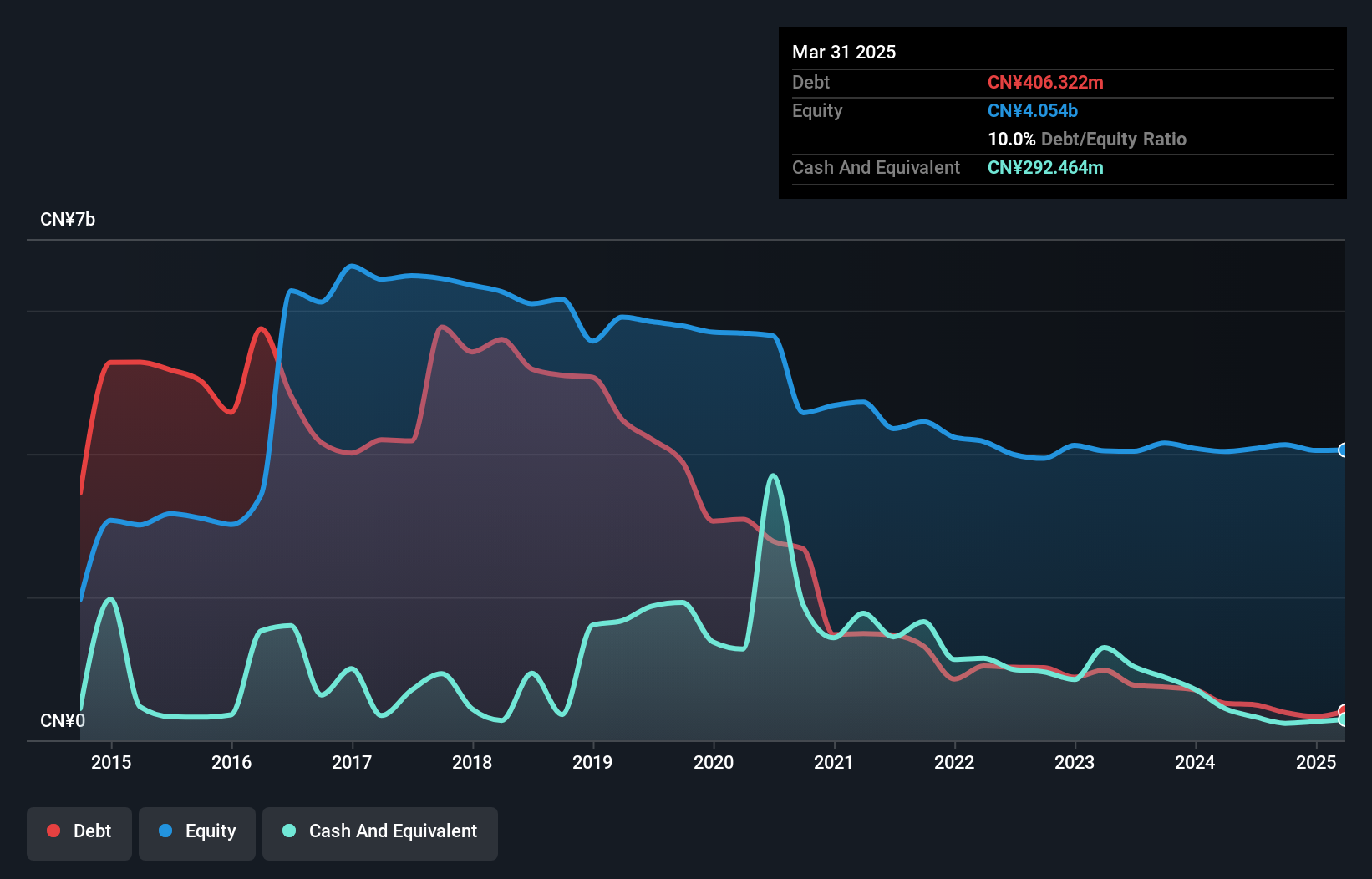

Sanxiang Impression Co., Ltd. has demonstrated modest financial stability, with a market cap of CN¥4.59 billion and diverse revenue streams from its Real Estate and Cultural Performing Arts divisions totaling CN¥1.52 billion. Recent earnings showed improvement, with nine-month sales reaching CN¥979.79 million, up from the previous year, and net income rising to CN¥65.27 million. The company's debt management is sound, evidenced by a reduced debt-to-equity ratio of 12.2% over five years and satisfactory interest coverage at 12.1 times EBIT, although operating cash flow coverage remains weak at 15.1%.

- Jump into the full analysis health report here for a deeper understanding of Sanxiang Impression.

- Assess Sanxiang Impression's previous results with our detailed historical performance reports.

Zhejiang Juli Culture DevelopmentLtd (SZSE:002247)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Juli Culture Development Co., Ltd. operates in the cultural and entertainment industry, with a market capitalization of CN¥1.92 billion.

Operations: The company generates revenue from the Building Materials Industry, amounting to CN¥926.37 million.

Market Cap: CN¥1.92B

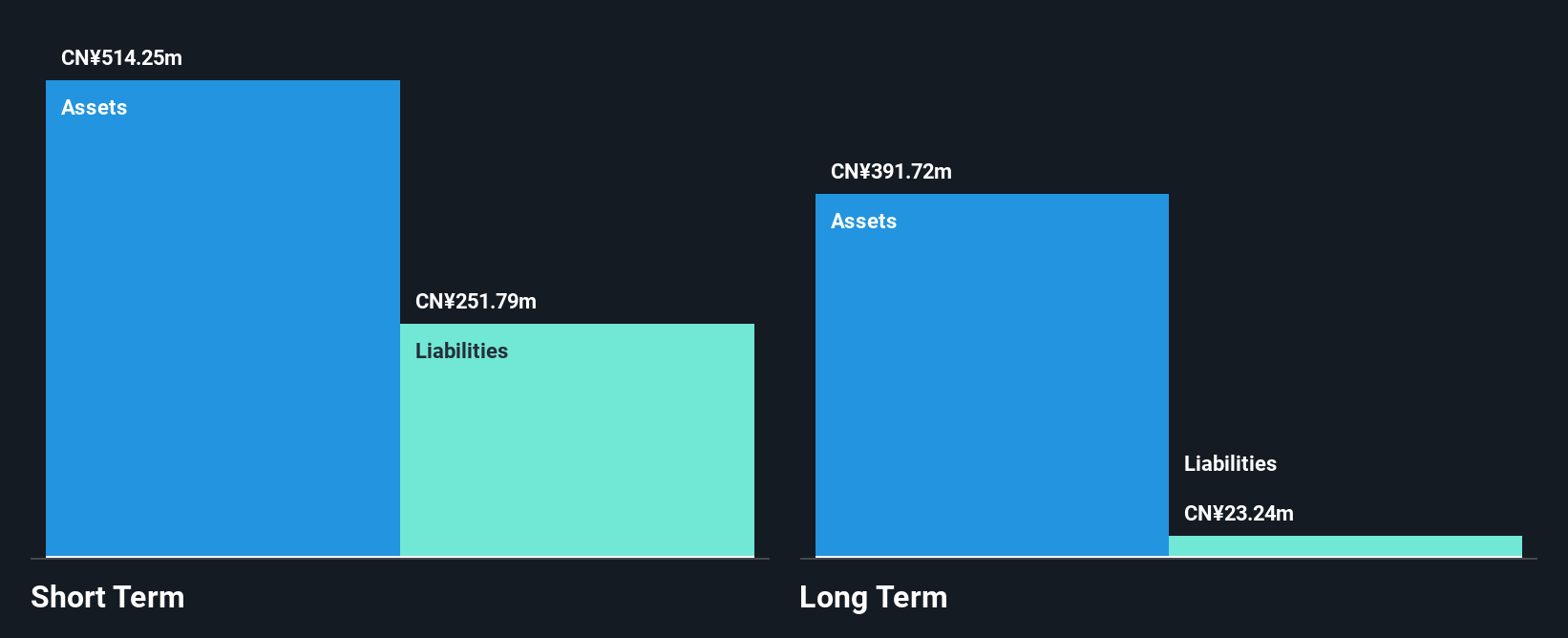

Zhejiang Juli Culture Development Co., Ltd. has shown significant financial improvement, transitioning to profitability this year with a net income of CN¥220.53 million for the nine months ending September 2024, compared to a net loss previously. The company's price-to-earnings ratio of 8x suggests it is undervalued relative to the broader Chinese market. Its short-term assets comfortably exceed both short and long-term liabilities, indicating strong liquidity. With no debt on its balance sheet, interest coverage isn't an issue, and the high return on equity at 37.9% reflects efficient use of shareholder funds without dilution over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of Zhejiang Juli Culture DevelopmentLtd.

- Examine Zhejiang Juli Culture DevelopmentLtd's past performance report to understand how it has performed in prior years.

Shenzhen Sunrise New Energy (SZSE:002256)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shenzhen Sunrise New Energy Co., Ltd. focuses on the research, development, manufacture, and marketing of new energy and fine chemicals both in China and internationally, with a market capitalization of CN¥5.04 billion.

Operations: The company generates revenue from its Fine Chemicals segment, contributing CN¥218.52 million, and its Photovoltaic Business, which accounts for CN¥109.99 million.

Market Cap: CN¥5.04B

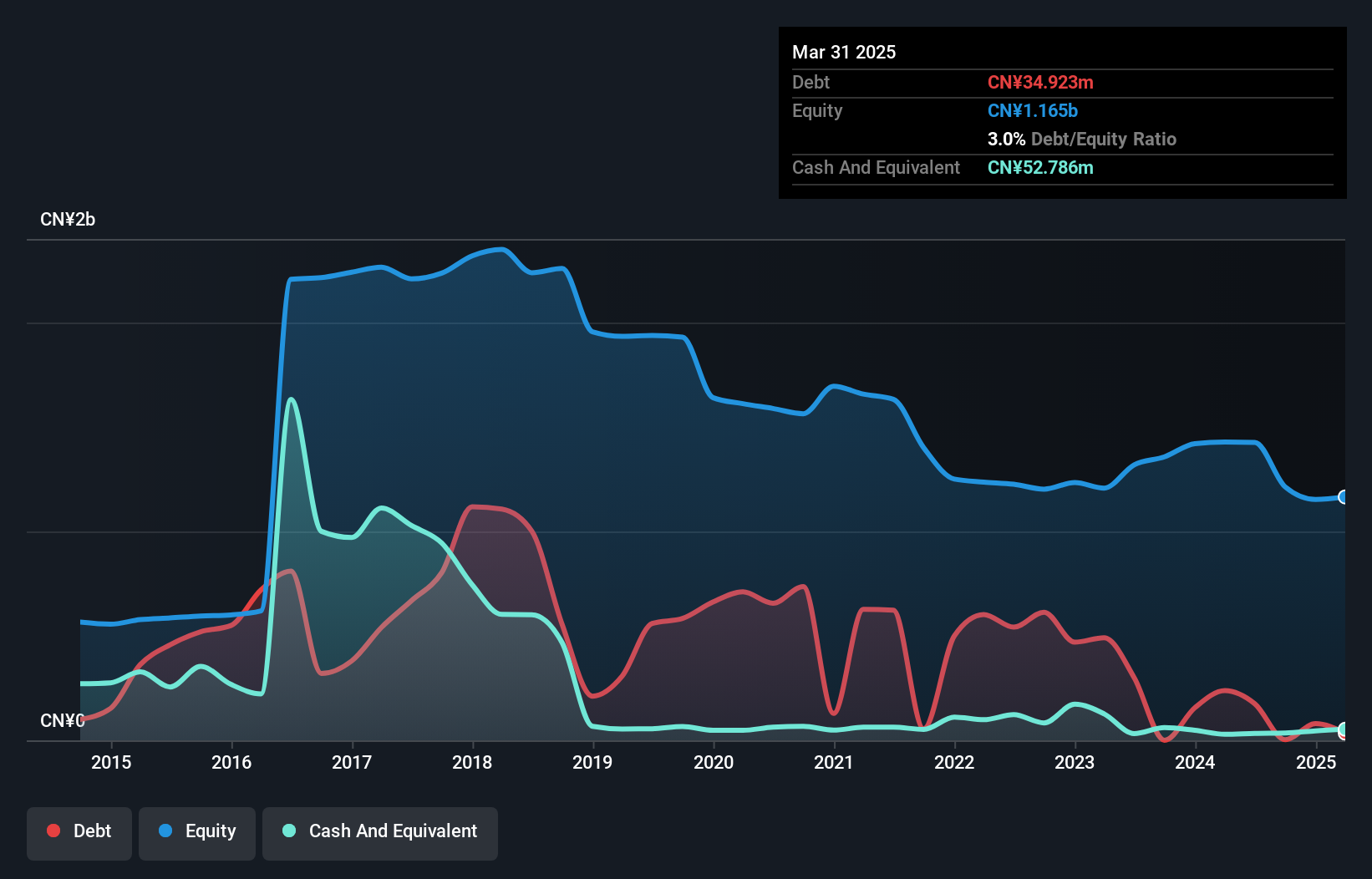

Shenzhen Sunrise New Energy Co., Ltd. has recently transitioned to profitability, reporting a net income of CN¥2.09 million for the half year ending June 2024, a significant improvement from the previous year's loss. The company's short-term assets of CN¥789.3 million comfortably cover both short and long-term liabilities, indicating solid financial stability despite its high share price volatility and low return on equity at 3.1%. However, earnings were significantly impacted by a one-off gain of CN¥16.8 million, and shareholders experienced dilution with shares outstanding increasing by 3.8% over the past year.

- Navigate through the intricacies of Shenzhen Sunrise New Energy with our comprehensive balance sheet health report here.

- Explore historical data to track Shenzhen Sunrise New Energy's performance over time in our past results report.

Turning Ideas Into Actions

- Click here to access our complete index of 5,798 Penny Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002256

Shenzhen Sunrise New Energy

Engages in the research and development, manufacture, and marketing of new energy and fine chemicals in China and internationally.

Excellent balance sheet minimal.

Market Insights

Community Narratives