- China

- /

- Marine and Shipping

- /

- SHSE:600179

3 Asian Penny Stocks With Market Caps Over US$300M To Watch

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets, Asian equities continue to capture investor attention with their potential for growth and diversification. While the term "penny stock" might seem outdated, it still signifies an area of investment that can offer substantial opportunities when approached with careful analysis. By focusing on companies with strong financials and clear growth paths, investors can uncover promising prospects in this often-overlooked segment.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.94 | HK$2.39B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.50 | HK$927.78M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.61 | HK$2.17B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.21 | SGD490.4M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.72 | THB2.83B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.094 | SGD49.21M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.26 | SGD12.83B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.11 | HK$3B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.40 | THB8.89B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 951 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

Anton Oilfield Services Group (SEHK:3337)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anton Oilfield Services Group is an investment holding company that provides integrated oilfield technology services in the People’s Republic of China, Iraq, and internationally, with a market cap of HK$2.99 billion.

Operations: The company's revenue is primarily derived from Oilfield Technical Services (CN¥2.35 billion) and Oilfield Management Services (CN¥1.95 billion), with additional contributions from Inspection Services (CN¥457.55 million) and Drilling Rig Services (CN¥452.38 million).

Market Cap: HK$3B

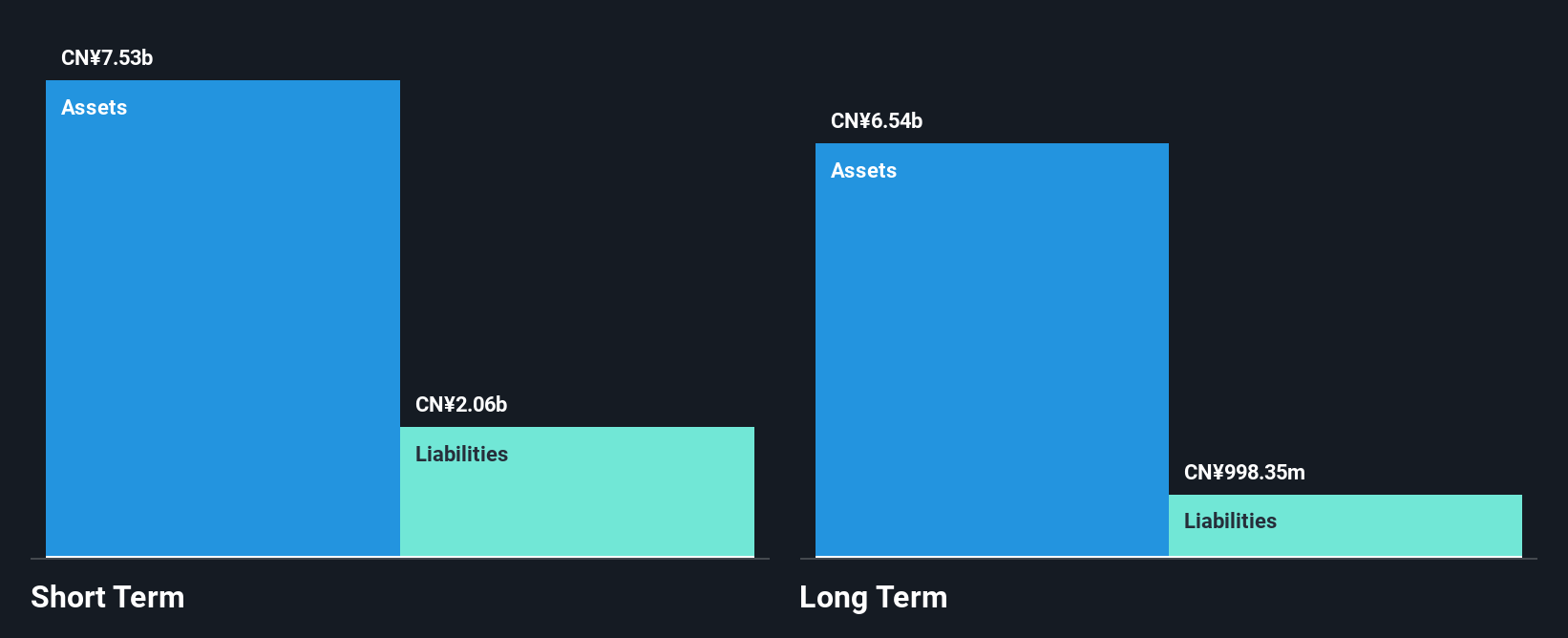

Anton Oilfield Services Group has demonstrated robust financial health, with short-term assets (CN¥7.4 billion) exceeding both short and long-term liabilities, and a debt-to-equity ratio reduced to 53.1%. The company’s earnings have grown significantly, with a recent half-year net income of CN¥165.14 million compared to CN¥105.87 million the previous year, partly due to lower finance costs following bond repayments. Despite low Return on Equity at 8.5%, the company is trading at good value relative to its peers and industry standards. Recent share buybacks are expected to enhance net asset value per share and earnings per share further.

- Click to explore a detailed breakdown of our findings in Anton Oilfield Services Group's financial health report.

- Understand Anton Oilfield Services Group's earnings outlook by examining our growth report.

Antong Holdings (SHSE:600179)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Antong Holdings Co., Ltd. operates in the container shipping and transport logistics sector in China, with a market cap of CN¥18.77 billion.

Operations: Antong Holdings Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥18.77B

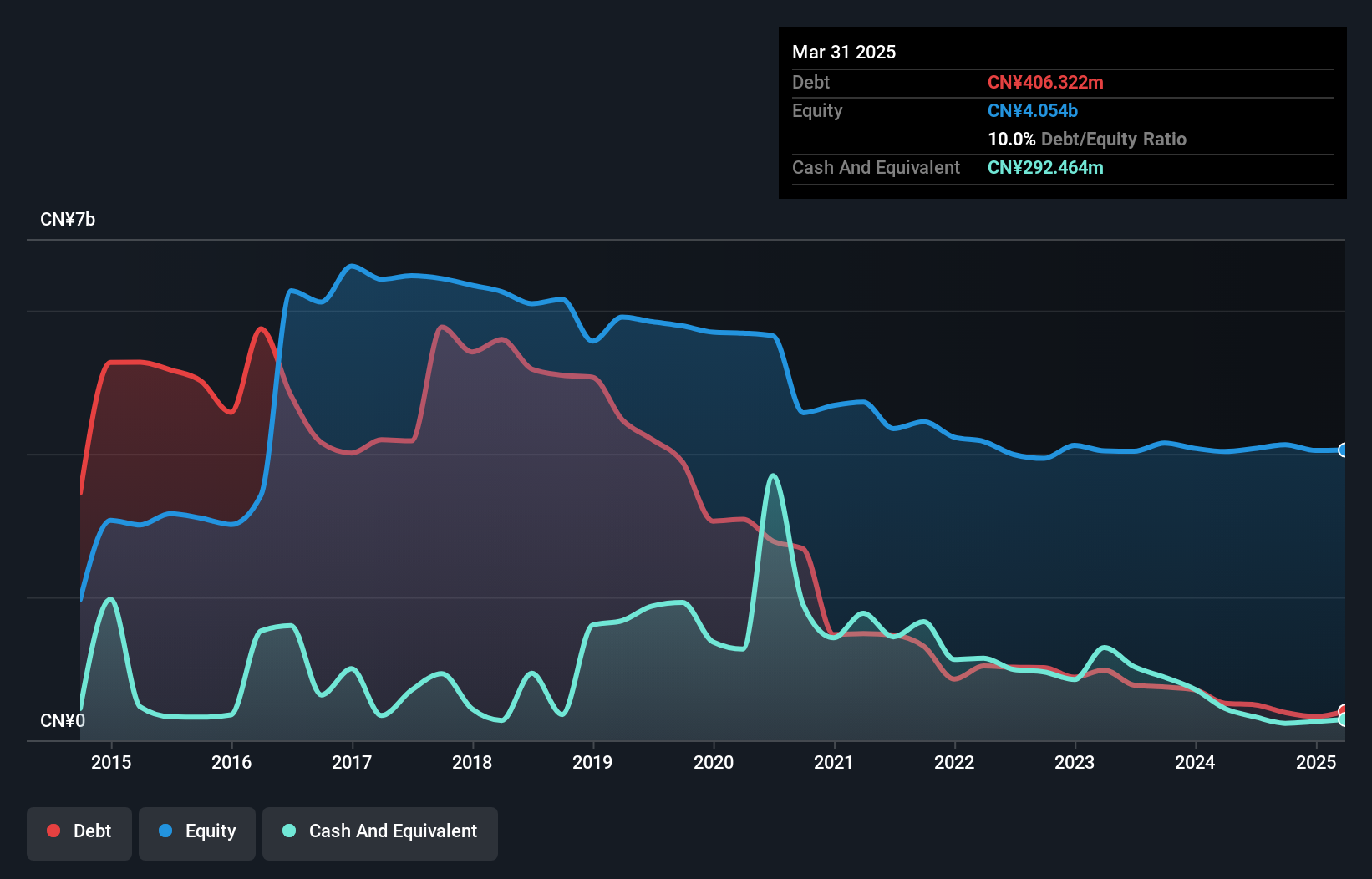

Antong Holdings Co., Ltd. has shown strong financial performance, with earnings growing by a very large margin over the past year and surpassing industry averages. The company’s revenue for the first half of 2025 was CN¥4.38 billion, reflecting significant growth from the previous year. Its debt is well-covered by operating cash flow, and short-term assets exceed both short- and long-term liabilities, indicating solid financial health. The recent acquisition interest from Sinotrans Limited highlights its market potential, although Return on Equity remains low at 8.6%. Antong's management and board are experienced, contributing to its stable operational outlook.

- Get an in-depth perspective on Antong Holdings' performance by reading our balance sheet health report here.

- Evaluate Antong Holdings' historical performance by accessing our past performance report.

Sanxiang Impression (SZSE:000863)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sanxiang Impression Co., Ltd. is involved in the development of real estate properties in China and has a market cap of CN¥4.44 billion.

Operations: The company's revenue is derived from two main segments: the Real Estate Segment, contributing CN¥857.20 million, and the Cultural Performing Arts Division, which accounts for CN¥127.69 million.

Market Cap: CN¥4.44B

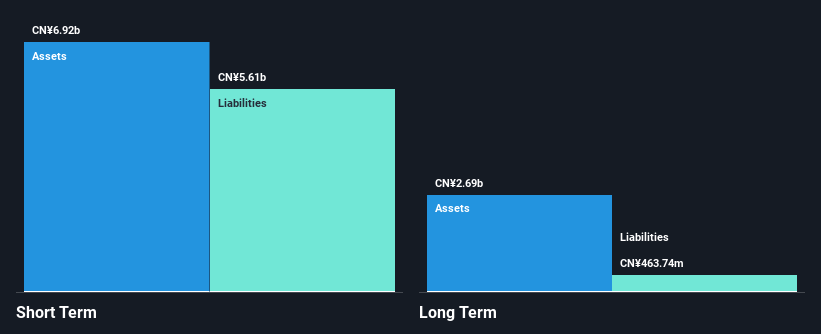

Sanxiang Impression Co., Ltd. faces challenges with declining earnings, reporting CN¥5.92 million net income for the first half of 2025, down from CN¥11.91 million a year prior. The company experienced a significant one-off loss of CN¥23.2 million impacting its recent financial results, contributing to negative earnings growth over the past year and lower profit margins at 1.3%. Despite these hurdles, Sanxiang maintains a strong balance sheet with short-term assets of CN¥4.5 billion exceeding liabilities and satisfactory debt levels with net debt to equity at 4.4%. Management's average tenure is seasoned at 5.4 years, providing stability amidst restructuring efforts reflected in recent bylaw amendments.

- Navigate through the intricacies of Sanxiang Impression with our comprehensive balance sheet health report here.

- Examine Sanxiang Impression's past performance report to understand how it has performed in prior years.

Seize The Opportunity

- Unlock more gems! Our Asian Penny Stocks screener has unearthed 948 more companies for you to explore.Click here to unveil our expertly curated list of 951 Asian Penny Stocks.

- Seeking Other Investments? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600179

Antong Holdings

Engages in the container shipping and transport logistics business in China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives