- China

- /

- Real Estate

- /

- SZSE:000668

The Price Is Right For Rongfeng Holding Group Co.,Ltd. (SZSE:000668) Even After Diving 27%

To the annoyance of some shareholders, Rongfeng Holding Group Co.,Ltd. (SZSE:000668) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 34% in that time.

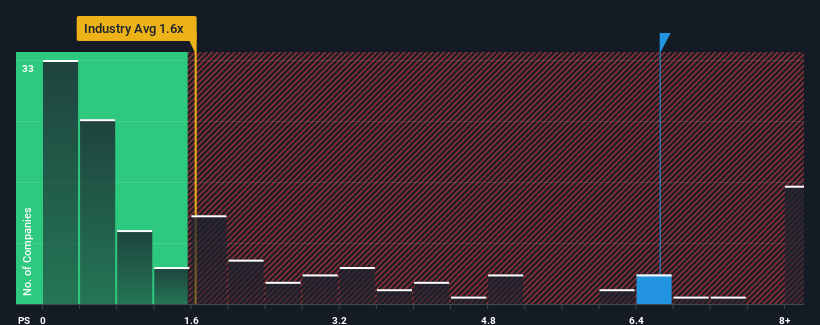

Even after such a large drop in price, when almost half of the companies in China's Real Estate industry have price-to-sales ratios (or "P/S") below 1.6x, you may still consider Rongfeng Holding GroupLtd as a stock not worth researching with its 6.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Rongfeng Holding GroupLtd

How Rongfeng Holding GroupLtd Has Been Performing

For instance, Rongfeng Holding GroupLtd's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Rongfeng Holding GroupLtd's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

Rongfeng Holding GroupLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 75%. Even so, admirably revenue has lifted 98% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is only predicted to deliver 9.0% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why Rongfeng Holding GroupLtd's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What Does Rongfeng Holding GroupLtd's P/S Mean For Investors?

Rongfeng Holding GroupLtd's shares may have suffered, but its P/S remains high. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Rongfeng Holding GroupLtd can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Plus, you should also learn about this 1 warning sign we've spotted with Rongfeng Holding GroupLtd.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000668

Rongfeng Holding GroupLtd

Engages in the medical devices distribution activities and provision of technical services in China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives