- China

- /

- Real Estate

- /

- SZSE:000668

Rongfeng Holding Group Co.,Ltd. (SZSE:000668) Shares Slammed 25% But Getting In Cheap Might Be Difficult Regardless

Unfortunately for some shareholders, the Rongfeng Holding Group Co.,Ltd. (SZSE:000668) share price has dived 25% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 39% share price drop.

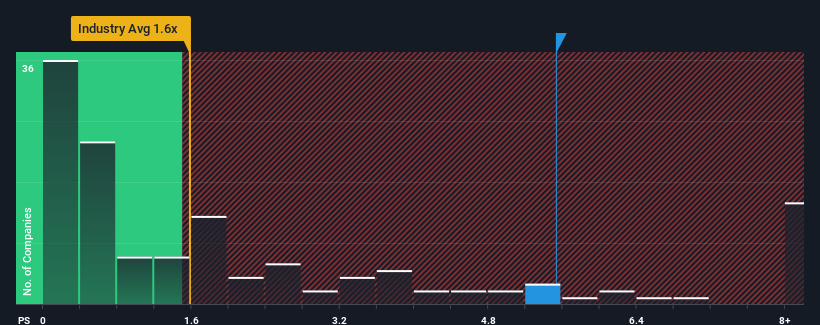

In spite of the heavy fall in price, when almost half of the companies in China's Real Estate industry have price-to-sales ratios (or "P/S") below 1.6x, you may still consider Rongfeng Holding GroupLtd as a stock not worth researching with its 5.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Rongfeng Holding GroupLtd

What Does Rongfeng Holding GroupLtd's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Rongfeng Holding GroupLtd over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Rongfeng Holding GroupLtd will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Rongfeng Holding GroupLtd?

In order to justify its P/S ratio, Rongfeng Holding GroupLtd would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 75% decrease to the company's top line. Even so, admirably revenue has lifted 98% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 2.9% shows it's noticeably more attractive.

With this in consideration, it's not hard to understand why Rongfeng Holding GroupLtd's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What We Can Learn From Rongfeng Holding GroupLtd's P/S?

A significant share price dive has done very little to deflate Rongfeng Holding GroupLtd's very lofty P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Rongfeng Holding GroupLtd revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Rongfeng Holding GroupLtd, and understanding should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000668

Rongfeng Holding GroupLtd

Engages in the medical devices distribution activities and provision of technical services in China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives