- China

- /

- Real Estate

- /

- SZSE:000560

There's No Escaping 5i5j Holding Group Co., Ltd.'s (SZSE:000560) Muted Revenues Despite A 96% Share Price Rise

5i5j Holding Group Co., Ltd. (SZSE:000560) shareholders have had their patience rewarded with a 96% share price jump in the last month. Looking further back, the 18% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

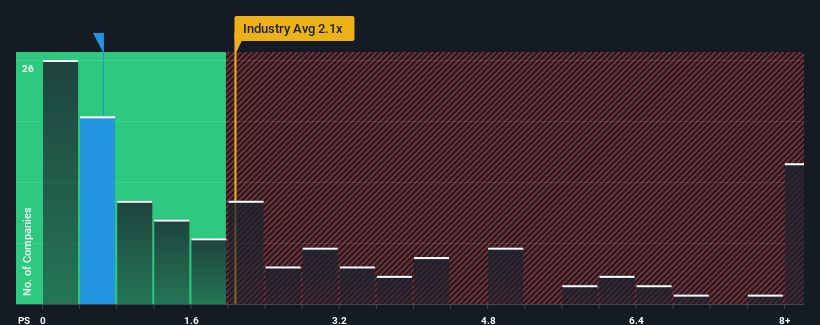

In spite of the firm bounce in price, 5i5j Holding Group's price-to-sales (or "P/S") ratio of 0.6x might still make it look like a buy right now compared to the Real Estate industry in China, where around half of the companies have P/S ratios above 2.1x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for 5i5j Holding Group

What Does 5i5j Holding Group's P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for 5i5j Holding Group, which is generally not a bad outcome. One possibility is that the P/S ratio is low because investors think this good revenue growth might actually underperform the broader industry in the near future. Those who are bullish on 5i5j Holding Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for 5i5j Holding Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, 5i5j Holding Group would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.1% last year. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 5.5% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why 5i5j Holding Group's P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

What Does 5i5j Holding Group's P/S Mean For Investors?

The latest share price surge wasn't enough to lift 5i5j Holding Group's P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

In line with expectations, 5i5j Holding Group maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

There are also other vital risk factors to consider and we've discovered 3 warning signs for 5i5j Holding Group (2 shouldn't be ignored!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000560

5i5j Holding Group

Provides real estate brokerage services in China and internationally.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives