- China

- /

- Real Estate

- /

- SZSE:000560

Further Upside For 5i5j Holding Group Co., Ltd. (SZSE:000560) Shares Could Introduce Price Risks After 30% Bounce

5i5j Holding Group Co., Ltd. (SZSE:000560) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 29% in the last twelve months.

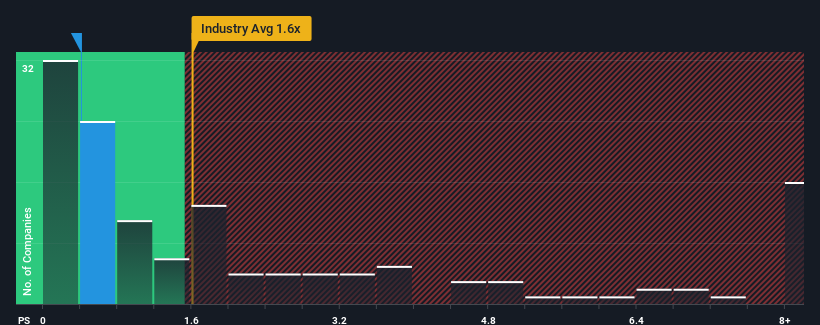

Even after such a large jump in price, 5i5j Holding Group may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Real Estate industry in China have P/S ratios greater than 1.6x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for 5i5j Holding Group

How Has 5i5j Holding Group Performed Recently?

While the industry has experienced revenue growth lately, 5i5j Holding Group's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think 5i5j Holding Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is 5i5j Holding Group's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like 5i5j Holding Group's to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Regardless, revenue has managed to lift by a handy 28% in aggregate from three years ago, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 16% as estimated by the only analyst watching the company. That's shaping up to be materially higher than the 10% growth forecast for the broader industry.

With this in consideration, we find it intriguing that 5i5j Holding Group's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From 5i5j Holding Group's P/S?

The latest share price surge wasn't enough to lift 5i5j Holding Group's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at 5i5j Holding Group's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you take the next step, you should know about the 1 warning sign for 5i5j Holding Group that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000560

5i5j Holding Group

Provides real estate brokerage services in China and internationally.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives